Table of content

-

Repatriation of foreign investment and returns In Nepal

01. Introduction

Foreign Investor may repatriate its investment, dividends and royalties etc. upon obtaining the approval of (i) Investment Board of Nepal (“IBN”) or the Department of Industry (“DOI”) and (ii) approval of Nepal Rastra Bank (“NRB”) after the paying all the applicable taxes in accordance with the Prevailing law of Nepal. This article has outlined the requirements and procedures governing such repatriations.

02. Governing law applicable for the Repatriation in Nepal

The repatriation of the FDI in Nepal is primarily governed by the (i) Foreign Investment and Technology Transfer Act, 2019 (“FITTA”) and (ii) Foreign Exchange (Regulation) Act, 2019 (“FERA”).

03. Governing authority

| Authority | Details |

|---|---|

| Investment Board of Nepal (“IBN”) or Department of Industry (“DOI”) | Provides the approval to repatriate |

| Nepal Rastra Bank (“NRB”) | Provides the final approval to repatriate |

04. Permissible repatriation of Investment and Return:

Foreign investors are permitted to repatriate the following:

| S.N. | Repatriation |

|---|---|

| 1. | Amount from the sale of shares |

| 2. | Profit or dividend received from foreign investment |

| 3. | Amount remaining after paying all liabilities following the liquidation or winding up |

| 4. | Amount of royalty received under the technology transfer agreement |

| 5. | Amount of lease rent under the lease investment |

| 6. | Damages or compensation, received from the final settlement of a law suit, arbitration or any other legal process in Nepal |

| 7. | Amount that can be repatriated in accordance with the prevailing laws |

Kindly Note:

Investors may repatriate funds at the prevailing exchange rate. Repatriation can occur in a) the same foreign currency originally invested, or b) in a different foreign currency, for which approval from NRB will be required.

05. Procedure of repatriation in Nepal

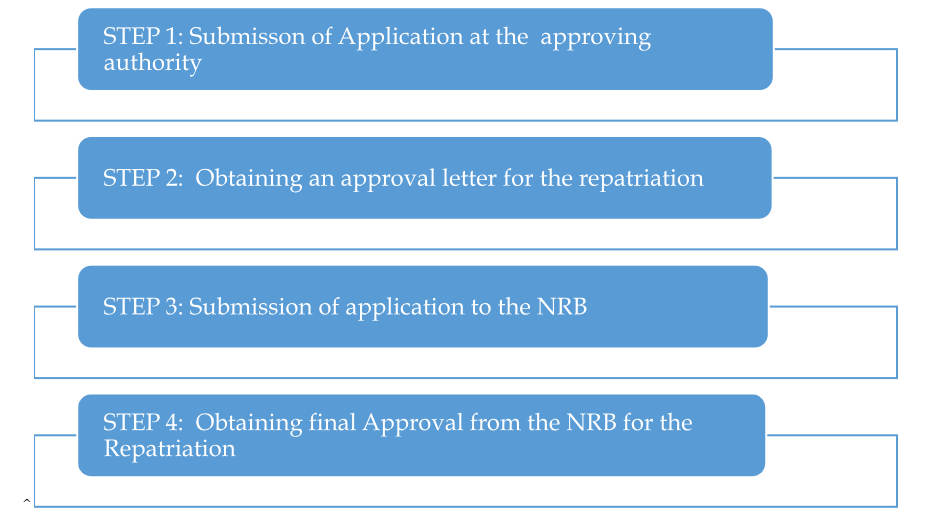

Following steps are followed to repatriate the foreign investment and returns in Nepal.

Steps followed to repatriate the foreign investment and returns in Nepal:

-

STEP 1: Submission of Application at the approving authority

-

STEP 2: Obtaining an approval letter for the repatriation

-

STEP 3: Submission of application to the NRB

-

STEP 4: Obtaining final Approval from the NRB for the Repatriation

06. Tentative Timeline for Repatriation

It shall take tentative 1 to 2 months’ time to repatriate the amount from Nepal to foreign jurisdiction.

07. Documents required for repatriation of FDI and returns:

7.1 Documents required to obtain the approval from the approval authorities are as follows:

| S.N. | Documents Details |

|---|---|

| 1. | Application in the prescribed format |

| 2. | Copy of Industry Registration Certificate and Industry Registration Certificate |

| 3. | Copy of approval of foreign investment |

| 4. | Copy of resolution of the Board of Directors |

| 5. | Decision of Annual General Meeting (“AGM”) on paying dividend (in case of repatriation of dividend) |

| 6. | Copy of current Audit Report, Tax Clearance Certificate and notarized copy of letter being not-blacklisted |

| 7. | Letter of FDI recording in NRB |

| 8. | Approved Share Purchase Agreement or Share Subscription Agreement (if any) |

| 9. | Document showing the amount received from the sale of shares (in case of sale of shares) |

| 10. | Copy of the document showing the amount paid as the principal or interest on foreign investment |

| 11. | Copy of approved agreement of Technology Transfer and lease investment (in case of TT Agreement or lease investment) |

| 12. | Royalty Calculation Certified by Chartered Accountant (in case of repatriation of royalty) |

| 13. | Copy of the list of the promoters and shareholders verified by the OCR |

7.2 Documents required to obtain the approval from the NRB are as follows:

| S.N. | Documents Details |

|---|---|

| 1. | Repatriation approval from DOI/IBN |

| 2. | Copy of General meeting and board meeting regarding repatriation |

| 3. | Copy of letter regarding recording the foreign investment at NRB |

| 4. | Copy of latest audited financial statements and audit report |

| 5. | Copy of latest tax clearance certificate |

| 6. | Copy of the non-blacklist certificate issued from CIB |

| 7. | Self-declaration by the foreign investor certifying that:

|

| 8. | In case of royalty, invoice raised by the foreign investor and royalty amount verified by certified auditor |

| 9. | In case of share sale, due diligence audit report stating the rate of share price |

| 10. | Copy of evidence of taxes paid on the repatriation amount |

08. Payment of Tax

Foreign investors allowed to return the amount of their investment upon paying the following applicable taxes.

| Applicable Tax | |

|---|---|

| Category | Tax Rate |

| Aircraft Lease | 10% |

| Dividends | 5% |

| Share Sale Proceeds | 5% |

| Service Fees | 15% |

In regards to Royalty Repatriation

The FITTR established specific repatriation limits for royalties under two categories: (a) technology transfer agreement that does not involve the use of a trademark, and (b) technology transfer agreements entered for usage of trademarks.

(i).Technology transfer agreement that does not involve the use of a trademark.

| Royalty | For Local Sales | For Export |

|---|---|---|

| Lump sum or gross sales revenue | Up to 5% of gross sales revenue excluding taxes | Up to 10% of gross sales revenue excluding taxes |

| Net profit | Up to 15% of net profit | Up to 20% of net profit |

(ii). Technology transfer agreements entered for usage of trademarks.

| Industry | For Local Sales | For Export |

|---|---|---|

| Alcohol and tobacco industries | Up to 2% of gross sales revenue excluding taxes | Up to 5% of gross sales revenue excluding taxes |

| Other industries | Up to 3% of gross sales revenue excluding taxes | Up to 6% of gross sales revenue excluding taxes |

09. Restriction on repatriation

Foreign investor are not allowed to repatriate there investment amount during the 1st year of investment. NRB sets out the condition at the of granting its approval.

Date of Publication: 04 May 2025.

Disclaimer: This article published at our website is just for information purpose only. It shall not be taken as the legal advice, advertisement, personal communication, solicitation or inducement. Bhandari Law and Partners or any of the team members of the firm shall not be liable for the consequence arising of the information provided. As the factual situation may be different on your case, thereof if you need further legal advice on the subject matter, please Contact Us.

Related Professionals:

Frequently Asked Question

For quick legal assistance:

You can directly call to our legal expert: +977-9808811027

Even can call or drop a text through What’s app , Viber, Telegram and We Chat at the same number.

Also can do email on : info@lawbhandari.com

contact us

Phone :,

,Connect with our professional lawyers in Nepal :

Follow Our Law Firm on Social Media :