Table of content

-

Foreign Direct Investment (FDI) Approval Process in Nepal

1. Governing Laws of foreign direct investment in Nepal:

The article provides the general overview of procedure of establishment of Company through FDI (Foreign Direct Investment) in Nepal.

The major law governing foreign investment in Nepal are as mentioned:

- Foreign Investment and Technology Transfer Act 2019 (2075) ("FITTA"),

- Foreign Investment and Technology Transfer Rule, 2020 (2076),

- Industrial Enterprises Act, 2020 (2076) (“IEA”),

- Foreign Exchange Regulation Act, 1962 (2019) (“FERA”) and

- Public Private Partnership and Investment Act, 2019 (2075) (“PPP Act”).

2. Approval Authorities for Foreign Direct Investment (FDI) in Nepal:

Foreign investment is subject to approval. Following are the authorities that provides FDI approval based on the investment amount:

| Investment Amount | Approving Authority |

|---|---|

| For NPR 6 billion or Less | Department of Industry (“DOI”) |

| Above NPR 6 billion and Hydropower project more than 200 MW | Investment Board of Nepal (“IBN”) |

Note:Prior to NRB by Laws that came on 8 June 2021, NRB approval for foreign investment was required before injecting the investment amount in Nepal. Currently such approval is waived. However, the waiver is conditional, the NRB approval is required in case of investment through share purchase.

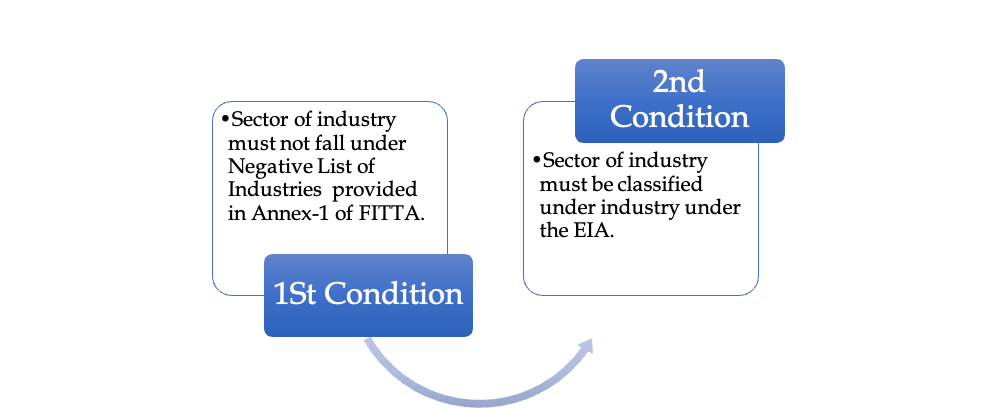

3. Permissibility of Foreign Direct Investment :

Foreign Investment is not permissible in every business. Following two conditions has to be fulfilled for the permissibility of FDI Companies in Nepal:

4. Industry where foreign investment is not permissible in Nepal :

Following are the industrial sector where foreign investment is not permissible:

- Poultry farming, fisheries, bee-keeping, fruits, vegetables, oil seeds, pulse seeds, milk industry and other sectors of primary agro-production;

- Cottage and small industries;

- Personal service business (hair cutting, tailoring, driving etc.);

- Industries manufacturing arms, ammunition, bullets and shell, gunpowder or explosives, and nuclear, biological and chemical (N.B.C.) weapons; industries producing atomic energy and radio-active materials;

- Real estate business (excluding construction industries), retail business, internal courier service, local catering service, moneychanger, remittance service

- Travel agency, guide involved in tourism, trekking and mountaineering guide, rural tourism including homestay;

- Business of mass communication media (newspaper, radio, television and online news) and motion picture of national language;

- Management, account, engineering, legal consultancy service and language training, music training, and computer training; and

- Consultancy services having foreign investment of more than fifty-one percent.

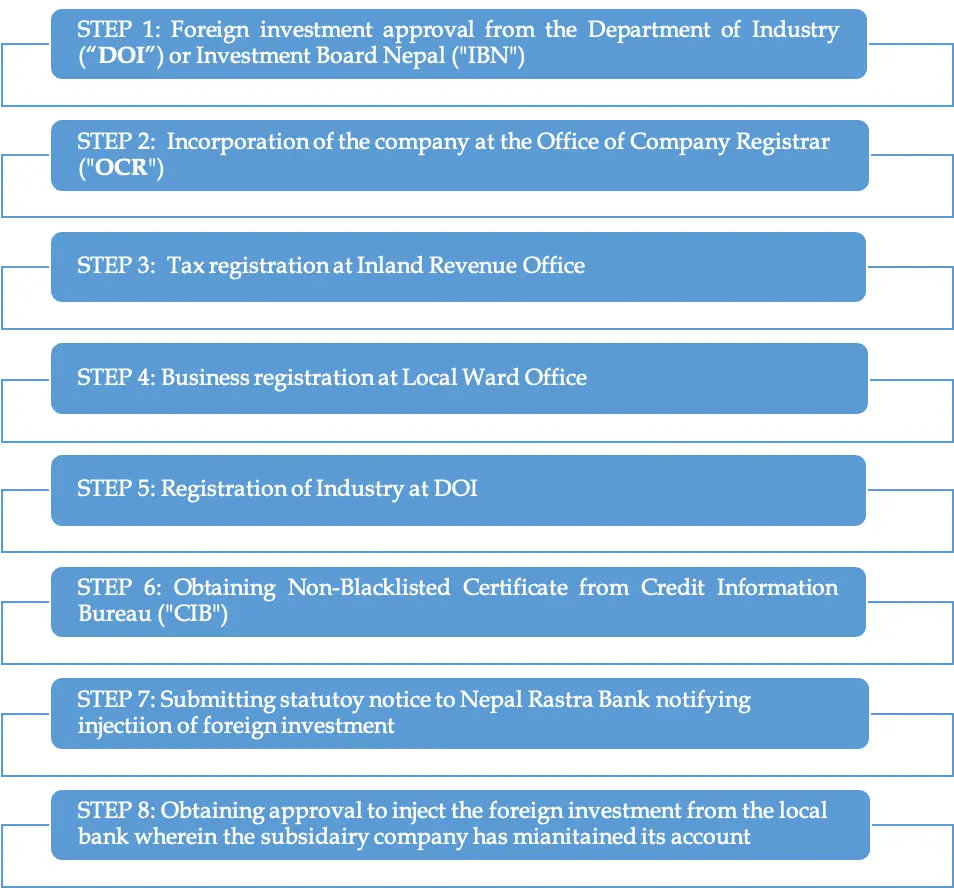

5. Procedure of foreign direct investment (FDI) approval in Nepal:

The procedure of foreign investment approval is mentioned herein:

-

Step 1: Obtaining the Foreign Investment Approval from DOI or IBN

-

Step 2: Registration of company at Office of the Company Register

-

Step 3: Tax Registration at Inland Revenue Office

-

Step 4: Business Registration at Local Ward Office

-

Step 5: Obtaining the recommendation letter from the Local Ward Office for Industry Registration

-

Step 6: Registration of industry before the Department of Industry.

-

Step 7: Obtaining the "non-black certificate" from the Credit Information Bureau

-

Step 8: Opening the local bank account of the company

-

Step 9: Recording the investment amount before NRB

The graphical represenation of the above steps is outlined as below:

6. Minimum Capital Requirement for Foreign Investment in Nepal :

The minimum capital required for obtaining foreign investment approval has been fixed as NPR 20 million (Approx. USD 153846) except IT Company. For IT Company there is no minimum investment amount.

7. Required Documents for FDI :

Following are the documents required for registration of FDI Company in Nepal:

| S.N. | Documents |

|---|---|

| 1. | Company incorporation certificate, Memorandum of Association, and Article of Association of Investor (Notarized) |

| 2. | Copy of Passport in case of Individual Investor (Notarized) |

| 3. | Company profile of the investing company (Bio Data in case of an individual investor) |

| 4. | Copy of Passports of all the Directors and shareholders of the Investor (Notarized) |

| 5. | Copy of passport/citizenship of Investor’s authorized representative (Notarized) |

| 6. | Project report for the operation of a local subsidiary company |

| 7. | Schedule for investment in the industry |

| 8. | Financial Credibility Certificate (FCC) of Investor issued by a local bank in the home country |

| 9. | Latest audit report of Investor (Notarized) |

| 10. | Resolution of Investor for investing in Nepal |

| 11. | Signed company profile of the Investor |

| 12. | Power of attorney authorizing individuals to complete the approval and registration process |

| 13. | Joint Venture Agreement in case of two or more than two investors |

8. Timeline for FDI approval process:

The overall time period for the registration of foreign direction investment in Nepal takes about three to five (3 to 5) months.

9. Government Fee Applicable for FDI Approval Process:

Government fee applicable for FDI approval in Nepal

| S.N. | Particulars | Government Fee |

|---|---|---|

| 1. | Guarantee amount to be deposited at DOI | NPR 20,000 (Approx. USD 155) |

| 2. | Government fee for Company Registration | Depends on the authorized capital of the company which is mintoined in below table ( For both public and private company) |

| 3. | Business Registration at Ward Office | NPR 5,000 to 15,000 per year (Approx. USD 38 to 115). Note: The business registration fees are specific to each local level. |

| 4. | House Rent Tax | 10% of the house rent amount per month. (Please note house rent rates depend on each local level and are subject to change every fiscal year). |

Government Fee for Private Company Registration

The government fee that is required to be paid for registration of private company at Office of Company Registrar is as mentioned:

| S.N. | Amount of Authorized Capital (in NRs.) | Registration Fee (in NRs.) |

|---|---|---|

| 1 | 5,00,001 to 25,00,000 | 9,500 |

| 2 | 25,00,001 to 1,00,00,000 | 16,000 |

| 3 | 1,00,00,001 to 2,00,00,000 | 19,000 |

| 4 | 2,00,00,001 to 3,00,00,000 | 22,000 |

| 5 | 3,00,00,001 to 4,00,00,000 | 25,000 |

| 6 | 4,00,00,001 to 5,00,00,000 | 28,000 |

| 7 | 5,00,00,001 to 6,00,00,000 | 31,000 |

| 8 | 6,00,00,001 to 7,00,00,000 | 34,000 |

| 9 | 7,00,00,001 to 8,00,00,000 | 37,000 |

| 10 | 8,00,00,001 to 9,00,00,000 | 40,000 |

| 11 | 9,00,00,001 to 10,00,00,000 | 43,000 |

| 12 | 10,00,00,000 | 30 Per Lakh |

Government Fee for Public Company Registration

The government fee that is required to be paid for registration of public company at Office of Company Registrar is as mentioned:

| S.N. | Amount of Authorized Capital (in NRs.) | Registration Fee (in NRs.) |

|---|---|---|

| 1 | Up to 1,00,00,000 | 15,000 |

| 2 | 1,00,00,001 to 10,00,00,000 | 40,000 |

| 3 | 10,00,00,001 to 20,00,00,000 | 70,000 |

| 4 | 20,00,00,001 to 30,00,00,000 | 1,00,000 |

| 5 | 30,00,00,001 to 40,00,00,000 | 1,30,000 |

| 6 | 40,00,00,001 to 50,00,00,000 | 1,60,000 |

| 7 | Above 50,00,00,000 | 3000 Per Lakh |

10. Timeline for injecting the foreign investment amount in Nepal

FERA has categories 3 stages of timeline to inject the foreign investment amount. The schedule of investment as mentioned:

| Stages | Details | Percentage of Injection of Investment |

|---|---|---|

| Stage I | Within 1 year of receiving the investment approval: | Depends on the amount of investment |

| Minimum investment amount i.e. NPR 20 Million | 25% | |

| 20 to 250 million NPR | 15% | |

| 250 million NPR to 1000 Million | 10% | |

| Stage 2 | When the company starts production or does start the commercial transaction | Up to 70% of the investment amount |

| Stage 3 | After 2 years of production or commencement of transaction | Remaining 30% of the investment amount |

11. Sector Approval

Certain regulated businesses are also subject to additional business specific approvals or licenses for the commencement of their business activities even after getting FDI approval. Licensing/Approval requirement depends on the nature of business of company. Following are some business which requires additional specific approval before commencement of business activities:

| S.N. | Nature of Business | Institution to Grant License/Approval |

|---|---|---|

| 1. | Colleges | Affiliated University |

| 2. | Insurance Company | Nepal Insurance Authority |

| 3. | Bank and Financial Institution | Nepal Rastra Bank |

| 4. | Hydropower | Department of Electricity Development |

| 5. | Travels and Trek | Ministry of Tourism, Culture and Civil Aviation |

| 6. | Food Industries | Department of Food, Technology and Quality Control |

| 7. | Business related to telecommunication | Nepal Telecommunication Authority |

12. Capping of Foreign Investment:

Foreign investors can invest 100% of ownership in local subsidiary companies. However, for few sectors the domestic law restrict investment through investment capping which are as mentioned:

| Sector | Investment Percentage Ratio |

|---|---|

| Telecommunication | 80% |

| Banking and Financial Institution | Minimum 20% and Maximum 85% |

| Insurance Companies | 80% |

| Consultancy Business | 51% |

13. Post investment compliances for FDI Company in Nepal :

Following are the main compliances that FDI company has to do after the FDI approval process:

- Submission of 3 months compliance document before OCR,

- Recording of investment at NRB,

- Submit Annual Compliance Document at OCR,

- Compliance with Companies Act, Labor Act, Tax Law and other applicable law of Nepal during the operation of the local subsidiary company.

14. Repatriation of foreign investment in Nepal :

A foreign investor is allowed to repatriate the following:

- Earnings through dividend or through sale proceeds against investment in shares,

- Compensation and Indemnity,

- Sale Proceeds upon Share Transfer,

- Returns of Capital at the Time of Liquidation,

- Technology transfer fees, royalty and license fees that have been earned through technology transfer and

- Lease rent under lease financing.

The investor has obligation to show that all local subsidiary company have complied all the laws, obtained all the necessary approval, pay tax and compiled with all the obligation before repatriation. Approval from DOI or IBN and NRB approval is required before repatriation. Investor can repatriate the investment and earning in the same currency or in other convertible foreign currency.

Related Article Link:

Please click the article published at our law firm website, which are related to the above article topic:

Registration of Company in Nepal

Branch Office Registration Process In Nepal

Liaison Office Registration Process in Nepal

Registration of Company Not Distributing Profit in Nepal

Date of Publication:18 August 2023

Disclaimer: Bhandari Law and Partners is one of the leading law firm in Nepal with team of best professional lawyers in Nepal.This article published on website of the law firm is just for information purpose only. It shall not be taken as the legal advice, advertisement, personal communication, solicitation or inducement. Bhandari Law and Partners or any of the team members of the firm shall not be liable for the consequence arising of the information provided. As the factual situation may be different on your case, thereof if you need further legal advice on the subject matter, please Contact Us.

Related Professionals:

Frequently Asked Question

For quick legal assistance:

You can directly call to our legal expert: +977-9808811027

Even can call or drop a text through What’s app , Viber, Telegram and We Chat at the same number.

Also can do email on : info@lawbhandari.com

contact us

Phone :,

,Connect with our professional lawyers in Nepal :

Follow Our Law Firm on Social Media :