Table of content

-

Company Registration Process in Nepal | Latest 2026 Guide

Background

There is different of business vehicles through which the business can be operated in Nepal. Sole proprietorship firm, Partnership firm, Limited liabilities Companies and Local Business (registered at local government i.e., ward office), among these business vehicle limited companies are most common form of business vehicle registered in Nepal.

This article explains detail procedure regarding the registration of limited liabilities company in Nepal.

1. Governing law for company registration in Nepal

Companies Act, 2006 (2063) is the law governing company registration process in Nepal .

2. Governing Authority

The office of Company Registrar ("OCR") is the governing authority for the company registration process in Nepal .

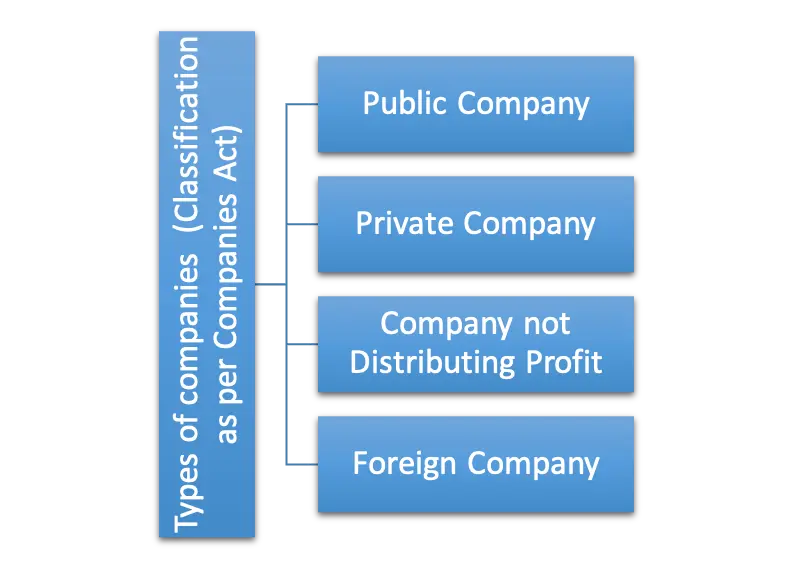

3. Classification of Companies in Nepal under Companies Act

Companies Act has classified companies into following categories:

4. Company Registration Process in Nepal

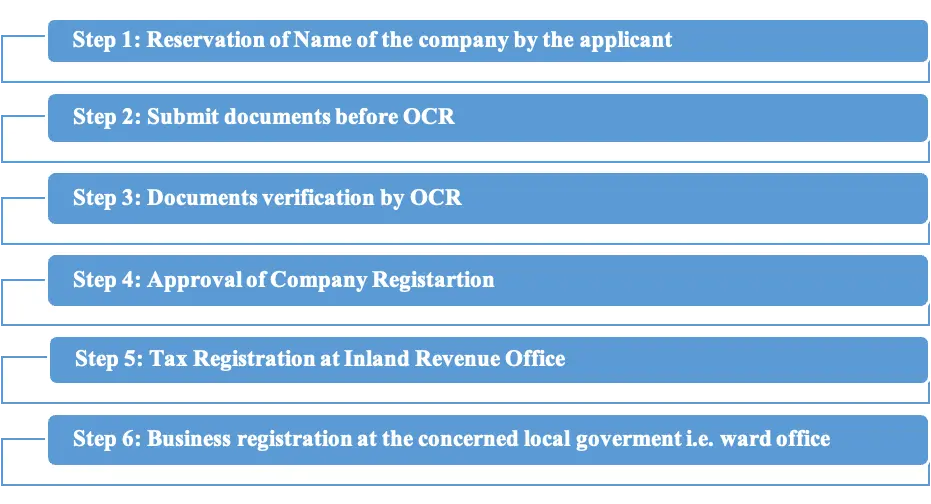

The company registration process in Nepal is mentioned below:

-

Step 1: Reservation of Name of the company by the applicant

-

Step 2: Submit documents before OCR

-

Step 3: Documents verification by OCR

-

Step 4: Approval of Company Registartion

-

Step 5: Tax Registration at Inland Revenue Office

-

Step 6: Business registration at the concerned local goverment i.e. ward office

Figure: Steps Explaining the Company Registration Processs in Nepal

5. Timeline for registration

It will require 7 to 10 days for company registration process in Nepal .

6. Documents list required for registration of Company in Nepal

The following documents are required for company registration process in Nepal .

| S.N. | Documents |

|---|---|

| 1 | Application for registration in the standard format |

| 2 | Memorandum of Association and Article of Association of Nepalese Entity |

| 3 | Shareholder agreement if any |

| 4 | Citizenship Certificate/Passport of investor in case of an individual |

| 5 | Copy of certificate of registration and other registration documents (memorandum of association, articles of association) of corporate entity in case a corporate entity wants to invest in the company |

| 6 | Resolution of the corporate entity for incorporating entity in case a corporate entity wants to invest in the company |

| 7 | Copy of prior approval of the Department of Industry ("DOI") in case of investment through a foreign investor |

7. Differences between the Public & Private Company

The differences between the Public and Private companies are as mentioned:

| S.N. | Subject | Public Company | Private Company |

|---|---|---|---|

| 1 | Number of Shareholders | Minimum 7 and maximum any number of shares | Minimum 1 and maximum up to 101 |

| 2 | Number of Director | Minimum 3 to maximum 11 | As provided by Article of Association |

| 3 | Requirement of Independent Director | At least 1 director in case of directors not exceeding 7 At least 2 directors in case of directors exceeding 7 | No requirement of Independent Director |

| 4 | Transfer of share | No consensus required among shareholders for transfer of share | Consensus between shareholders is required for transfer of share |

| 5 | Invitation to Public | Can invite the public to subscribe to shares and debentures | Cannot issue such an invitation |

| 6 | Name of Company | Name of the company ends with Ltd. | Name of the company ends with Pvt. Ltd. |

| 7 | Company Secretary | Public Company must appoint a Company Secretary | Not compulsory to appoint the Company Secretary |

| 8 | Approval while starting business | Need to take approval from OCR while starting business | No approval is required |

| 9 | Minimum Paid-up Capital | Minimum paid-up capital of the company should be Ten Million Nepalese Rupees should be maintained. | Not specified by law. In practice, the minimum amount should be NPR 1,00,000. |

| 10 | Undertaking type of business | Banking transaction, financial transaction, insurance business, stock exchange business, pension fund, or mutual fund business are allowed to be undertaken by public company only. | No compulsion requirement on undertaking type of business |

8. Fee/Tax Required for Company Registration

8.1. Government Fee for Private Company Registration

The government fee that is required to be paid for registration of private company at Office of Company Registrar is as mentioned:

| S.N. | Amount of Authorized Capital (in NRs.) | Registration Fee (in NRs.) |

|---|---|---|

| 1 | 5,00,001 to 25,00,000 | 9,500 |

| 2 | 25,00,001 to 1,00,00,000 | 16,000 |

| 3 | 1,00,00,001 to 2,00,00,000 | 19,000 |

| 4 | 2,00,00,001 to 3,00,00,000 | 22,000 |

| 5 | 3,00,00,001 to 4,00,00,000 | 25,000 |

| 6 | 4,00,00,001 to 5,00,00,000 | 28,000 |

| 7 | 5,00,00,001 to 6,00,00,000 | 31,000 |

| 8 | 6,00,00,001 to 7,00,00,000 | 34,000 |

| 9 | 7,00,00,001 to 8,00,00,000 | 37,000 |

| 10 | 8,00,00,001 to 9,00,00,000 | 40,000 |

| 11 | 9,00,00,001 to 10,00,00,000 | 43,000 |

| 12 | 10,00,00,000 | 30 Per Lakh |

8.2. Government Fee for Public Company Registration

The government fee that is required to be paid for registration of public company at Office of Company Registrar is as mentioned:

| S.N. | Amount of Authorized Capital (in NRs.) | Registration Fee (in NRs.) |

|---|---|---|

| 1 | Up to 1,00,00,000 | 15,000 |

| 2 | 1,00,00,001 to 10,00,00,000 | 40,000 |

| 3 | 10,00,00,001 to 20,00,00,000 | 70,000 |

| 4 | 20,00,00,001 to 30,00,00,000 | 1,00,000 |

| 5 | 30,00,00,001 to 40,00,00,000 | 1,30,000 |

| 6 | 40,00,00,001 to 50,00,00,000 | 1,60,000 |

| 7 | Above 50,00,00,000 | 3000 Per Lakh |

8.3. Additional Fee Required for Company Registration

Except the registration fee at OCR there are few additional fee that need to be paid for registration of company in Nepal is as mentioned:

| S.N. | Particulars | Government Fee |

|---|---|---|

| 1 | Guarantee amount to be deposited at DOI (In case of investment in Company through foreign investor) | NPR 20,000 (Approx. USD 155) |

| 2 | Business Registration at Ward Office | NPR 5,000 to 15,000 per year (Approx. USD 38 to 115) |

| 3 | House Rent Tax | 10% of house rent amount per month (Please note house rent rate tax depends on each local level and subject to change every fiscal year. As a matter of practice the local government takes 4 to 6 month advance house rent tax during the business registration) |

Important 2026 Update: While the tiered fee structure below remains the statutory standard, the Nepal government frequently introduces waivers or simplified 0.1% calculations through the annual Finance Act. Always verify the current month's "Gazette" notification before filing.

9. Post registration compliance

Following are the post registration compliances that a company should do after registration of company in Nepal:

- Receiving the specific license from concerned department (if necessary). Kindly go through para 11 of this article.

- Submission of 3 months compliance document before OCR,

- Recording of investment at NRB (in case of FDI Company)

- Submit Annual Compliance Document at OCR,

- Compliance with Companies Act, Labor Act, Tax Law and other applicable law of Nepal during the operation of the local subsidiary company.

10. Specific business approval

There are some nature of business which need additional approval from the concerned department prescribed by the law even after incorporation of company before their operation.

| S.N. | Nature of Business | Institution to grant License/Approval |

|---|---|---|

| 1 | Colleges | Affiliated University |

| 2 | Insurance Company | Insurance Board |

| 3 | Bank and Financial Institution | Nepal Rastra Bank |

| 4 | Hydro Power | Electricity Development Board |

| 5 | Travels and Trek | Ministry of Tourism, Culture and Civil Aviation |

| 6 | Food Industries | Department of Food Technology and Quality Control |

| 7 | Business related to telecommunication | Nepal Telecommunication Authority |

Date of Publication:18 August 2023

Related Article Link:

Please click the article published at our law firm website, which are related to the above article topic:

FDI (Foreign Direct Investment) Approval Process In Nepal

Branch Office Registration Process In Nepal

Liaison Office Registration Process In Nepal

Registration Of Company Not Distributing Profits In Nepal

Disclaimer: This article on Company Registration Process in Nepal is published on our website is just for information purpose only. It shall not be taken as the legal advice, advertisement, personal communication, solicitation or inducement. Bhandari Law and Partners is one of the leading law firm in Nepal and any of the team members ( Lawyers of Nepal) of the firm shall not be liable for the consequence arising of the information provided. As the factual situation may be different on your case, thereof if you need further legal advice on the subject matter, please Contact Us.

Related Professionals:

Frequently Asked Question

For quick legal assistance:

You can directly call to our legal expert: +977-9808811027

Even can call or drop a text through What’s app , Viber, Telegram and We Chat at the same number.

Also can do email on : info@lawbhandari.com

contact us

Phone :,

,Connect with our professional lawyers in Nepal :

Follow Our Law Firm on Social Media :