Table of content

-

Procedure of Conducting Labor Audit in Nepal

1. Purpose of Labor audit:

The purpose of a labor audit is to uphold positive industrial relations by proficiently enforcing the prevailing legal framework within enterprises. This ensures safeguarding worker's rights and interests while fostering enhanced production and overall productivity.

Additionally, the objectives of the labor audit are as follows:

a) Enhancing adherence to labor regulations and legal mandates,

b) Mitigating worker grievances while fostering their commitment to the organization,

c) Easing the burden of governmental oversight, regulations, and inspections,

d) Establishing internal accountability and liability within the organization for policy and legal compliance.

2. Governing law related to Labor Audit in Nepal:

The governing laws for the labor audit in the context of Nepal are as follows:

i) Labor Act 2017 (2074) (“Labor Act”)

ii) Labor Rules 2018 (2075) (“Labor Rules”)

iii) Labor Audit Standard 2018 (2075) (“Labor Audit Standard”).

3. Mandatory requirement of labor audit:

Pursuant to Section 100 of Labor Act, each enterprise shall prepare a labor audit as prescribed as to whether or not acts and actions are being performed by the enterprise in accordance with the applicable labor law and prepare a report thereof.

4. Regulating Authority of Labor Audit in Nepal:

Labor audits are to be carried out by various entities such as banks, financial institutions, insurance companies, non-governmental organizations, corporations, firms, cooperatives, and other types of enterprises.

Rule 56 of Labor Rules has recognized different regulating authorities to submit the labor audit report which are as mentioned:

| Nature of Entities | Regulating Authority |

|---|---|

| Bank and Financial Institutions | Central Bank of Nepal (Nepal Rastra Bank) |

| Insurance Companies | Nepal Insurance Authority |

| Non-Government Organizations | Concerned District Administration Office |

| Other Enterprises | Authorities providing approval to establish or operate |

5. Procedure of Labor Audit in Nepal:

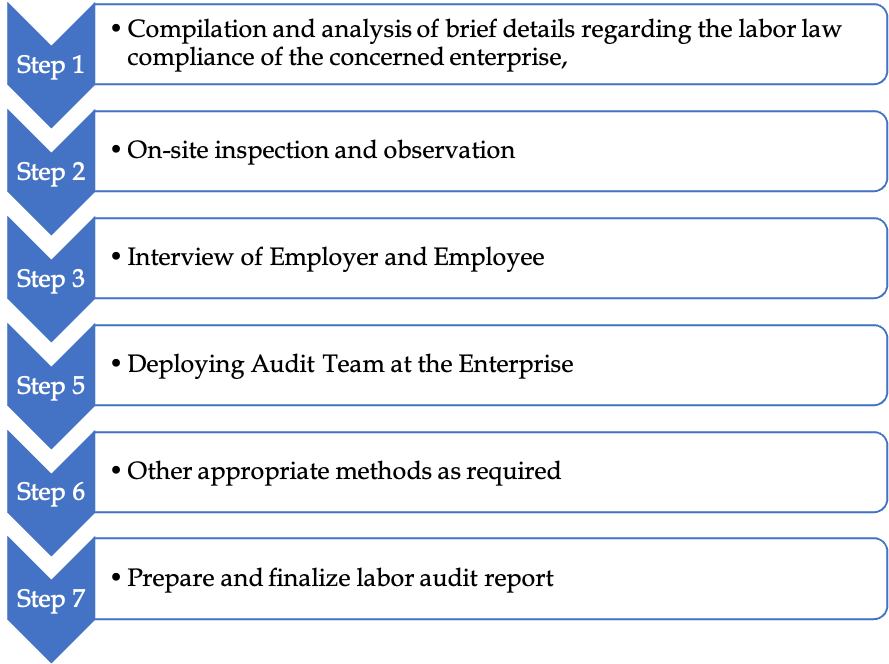

The Labor Audit Standard has defined the process for performing a Labor Audit in Nepal. As per No. 6 of Labor Audit Standard, the Labor Auditor must adhere to the following steps:

Please Note: The labor audit report is to be made in the format provided in Schedule 10 of the Labor Rules.

6. Timeline to submit Labor Audit Report:

In accordance with Rule 56 of the Labor Rules, enterprise must perform and present a Labor Audit by the conclusion of the Nepali month of Poush (around mid-January) on an annual basis. The labor audit should be carried out the standards established by the Ministry of Labor, Employment, and Social Security.

7. Qualification for conducting Labor Audit in Nepal:

The company has the option to carry out a labor audit on its internal managerial staff or by engaging an individual or organization external to the company, as per the Number 5 of Labor Audit Standard, one must meet the following qualifications:

1. For Individuals

| SN. | Qualification |

|---|---|

| 1. | Must be a Nepali citizen. |

| 2. | Should hold a minimum of a bachelor's degree. |

| 3. | Must have a minimum of two years of managerial experience within an enterprise. |

2. For Organizations:

| SN. | Qualification |

|---|---|

| 1. | Must be registered in compliance with relevant laws. |

| 2. | Must align with the labor-related objectives of the organization. |

| 3. | When appointing an auditor, the organization must ensure that the selected individual possesses all the aforementioned qualifications. |

8. Scope of Labor Audit

As per the Number 4 of Labor Audit Standard, the scope of labor audit involves examining the employer's compliance with the following legislation to ensure adherence:

i. Labor Act 2017 (2074) and Labor Rules 2017 (2075)

ii. Contribution based Social Security Act 2017 (2074) and Social Security Rules 2018 (2075)

iii. Bonus Act 1973 (2030) and Bonus Rule 1982 (2039)

iv. Trade union Act 1992 (2049) and Trade Union Rules 1993 (2050)

v. Matters included under Audit Report pursuant to Schedule 10 of Labor Rule, 2017 (2075)

vi. Internal Rules and By-laws of the Enterprise

vii. Other relevant issues.

9. Responsibility of Enterprise

Since the primary responsibility for conducting a labor audit rest with each individual enterprise, it is imperative that the labor audit be executed within the designated timeframe, and the labor audit report be submitted to the regulating authority in accordance with the laws. So as per the No. 7 of Labor Audit Standard, during the process of conducting the audit, enterprises are required to fulfill the subsequent obligations:

(a) Providing the auditor with comprehensive details pertaining to the current status of the undertaken work by the enterprise.

(b) Ensuring that the auditor is well-informed about the wages to be dispensed and other available service facilities.

(c) Providing any necessary support required for the smooth execution of the auditor's tasks during the audit process.

(d) Providing a copy of the Labor Audit report to the pertinent Labor and Employment office, the labor relations committee, and the regulatory body affiliated with respective entities as mentioned in point no 4. (Regulating authority) of this article.

10. Responsibility of Labor Auditor

No. 8 of Labor Audit Standard has additionally outlined the responsibilities of the Labor Auditor. The Labor Auditor holds accountability for the following:

a) Preparing the Labor Audit Report based on accurate information about the enterprise and presenting it to the company.

b) Conducting the audit within the specified timeframe, free from any external influences.

c) Ensuring the confidentiality of any sensitive information acquired during the audit process, refraining from sharing it with any third parties or individuals.

11. Penalty for providing false information on labor audit.

In accordance with Rule 56 of the Labor Rules and Section 163(2)(b) of the Labor Act, should any inaccurate information be identified in the Labor Audit Report, the Department of Labor holds the authority to levy fines of up to NRs 20,000 (Twenty Thousand Nepalese Rupees) on either the individual responsible for the false details or the management of the Entity responsible for conducting the Labor Audit.

Date of Publication: 11 September 2023

Disclaimer: Bhandari Law and Partners is one of the leading law firm in Nepal with team of best professional lawyers in Nepal.This article published on website of the law firm is just for information purpose only. It shall not be taken as the legal advice, advertisement, personal communication, solicitation or inducement. Bhandari Law and Partners or any of the team members of the firm shall not be liable for the consequence arising of the information provided. As the factual situation may be different on your case, thereof if you need further legal advice on the subject matter, please Contact Us.

Related Professionals:

Frequently Asked Question

For quick legal assistance:

You can directly call to our legal expert: +977-9808811027

Even can call or drop a text through What’s app , Viber, Telegram and We Chat at the same number.

Also can do email on : info@lawbhandari.com

contact us

Phone :,

,Connect with our professional lawyers in Nepal :

Follow Our Law Firm on Social Media :