Related Articles:

Table of content

-

in Nepal-1.jpg)

Registration of Non-Governmental Organizations (NGO) in Nepal

1. Governing laws of NGOs in Nepal:

This article provides the details regarding the registration processof NGO (Non- Govermental Organization) in Nepal.The regulatory framework governing the operations of NGO (Non- Govermental Organization) in Nepal comprises the following key legislations:

i) The Social Welfare Act 2049 (1992)

ii) The Associations Registration Act 2034 (1977)

iii) Applicable guidelines developed by the Social Welfare Council

2. Governing Authority

NGOs undergo registration at the District Administration Office (DAO) situated in the concerned district of establishment.

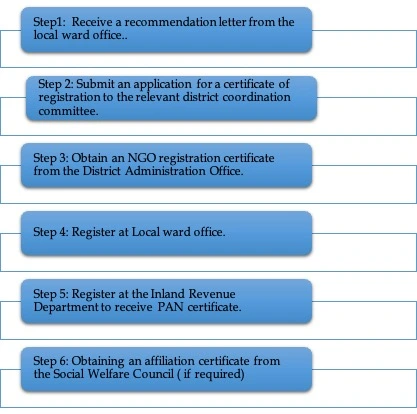

3. Registration process of NGO in Nepal:

The steps for the registration of NGO in Nepal are as follows;

Note: It is not compulsion to list NGO before Social Welfare Council, listing is only required when NGOs intends to receive foreign grants.

4. Time period Required for registration of NGOs in Nepal:

The registration process takes around 1(one) to 2(two) months after completing pre-requisite process.

5. Required documents:

The following documents are required for registration of NGO:

| SN. | Documents Required |

|---|---|

| 1. | Copy of the board members' resolution to establish the proposed NGO. |

| 2. | Certified copies of citizenship certificates for all board members. |

| 3. | Passport-sized photographs and copies of character reports from Nepal Police of all members from the relevant districts. |

| 4. | A draft of the NGO's memorandum (MOA) and articles of association (AOA). |

| 5. | Rent agreement for the NGO office location, including the house owner's citizenship certificate. |

| 6. | Receipt showing payment of 3 months' rent in advance, as per the agreement with the house owner. |

6. Board of Directors:

The registration process of NGO mandates a minimum of 7 individuals holding Nepali citizenship: 1 President, 1 Vice-President, 1 Secretary, 1 Treasurer, and a minimum of 3 additional members.

Within the composition of the Executive Committee, a representation of at least 33% comprising individuals of the female gender is a prerequisite.

7. Renewal of NGO Registration

To ensure the continued registration of NGO, it is necessary to undergo the annual renewal process, involving the submission of essential documents to the relevant authorities. Annually, this entails the tax office, ward office, and District Administrative Office (DAO); while with the Social Welfare Council, it is required every three years.

8. Tax exemption

NGOs are granted the privilege of income tax exemption for their operational income, contingent upon the acquisition of a tax-exempt certificate in adherence to the provision outlined in the Income Tax Act of 2022.

9. Similarities and differences between NGO and Company not distributing profits

Both nonprofit organizations, specifically NGOs and Company not distributing profits, have the capacity to be operated by Nepali individuals. Both of these organizational structures are eligible to seek funding, whether from domestic institutions or foreign sources. However, in instances where funding is procured from international sources, it is imperative for both types of organizations to obtain approval from the Social Welfare Council as a mandatory prerequisite.

The differences between NGO and Company not distributing profits on the following sub topic:

| SN. | Subject Matter | NGO | Company not Distributing Profits |

|---|---|---|---|

| a. | Registering Entities | District Administration Office (DAO) | Office of Company Registrar (OCR) |

| b. | Governing Laws | Association Registration Act of 2034 | Companies Act, 2063 |

| c. | Minimum Board Members while Registering | At least 7 | At least 5 |

| d. | Differences in Composition | Within the composition of the Executive Committee, a representation of at least 33% comprising individuals of the female gender is a prerequisite. | No such requirement. It is upon the discretion of the promoters to make composition of their own choice/need. |

| e. | Renewal | Renewal must be done annually. | Annual compliance not required for renewal. |

Note: The process of registering and renewing an NGO is complex and time-consuming, whereas the procedure for Company not distributing profits is comparatively simpler. Given the available options and taking into account the aspect of flexibility, clients tend to favor the registration of Company not distributing profits.

10. Related Article Link:

You can find more information on the following topics:

- Registration Of Non-Profit Institution In Nepal

- INGO Registration In Nepal : INGO Law In Nepal

- Registration Of Company Not Distributing Profits In Nepal

Date of Publication: 18 August 2023

Disclaimer: Bhandari Law and Partners is one of the leading law firm in Nepal with team of best professional lawyers in Nepal . This article published on website of the law firm is just for information purpose only. It shall not be taken as the legal advice, advertisement, personal communication, solicitation or inducement. Bhandari Law and Partners or any of the team members of the firm shall not be liable for the consequence arising of the information provided. As the factual situation may be different on your case, thereof if you need further legal advice on the subject matter, please Contact Us.

Related Professionals:

Frequently Asked Question

For quick legal assistance:

You can directly call to our legal expert: +977-9808811027

Even can call or drop a text through What’s app , Viber, Telegram and We Chat at the same number.

Also can do email on : info@lawbhandari.com

contact us

Phone :,

,Connect with our professional lawyers in Nepal :

Follow Our Law Firm on Social Media :