Table of content

-

Establishment of Business in Nepal By Foreign Investors

1. INTRODUCTION ON BUSINESS ESTABLISHMENT OF NEPAL:

This article gives a quick overview of the key issues regarding (i) establishment/registration of business in Nepal by the foreign investors, (ii) forms of business vehicles, (iii) concession and facilities provide, (iv) protection of investment and (v) restrictions and the exit procedure for foreign investors.

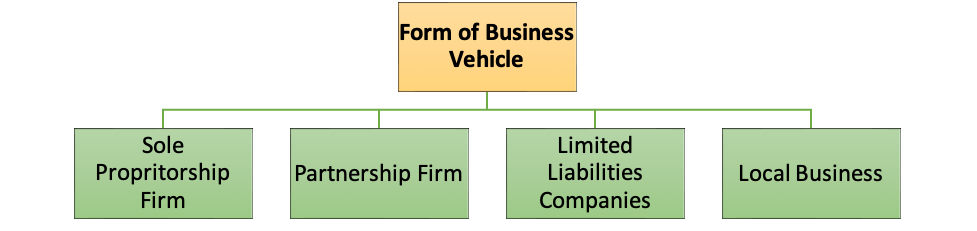

2. MAJOR FORMS OF BUSINESS VEHICLES IN NEPAL:

There are different forms of business vehicles through which business can be established in Nepal. The major forms of business vehicles are as mentioned:

2.1. Sole Proprietorship Firms:

The Private Firm Registration Act, 1958 (2014) is the governing law to register the sole proprietorship firm in Nepal. Individuals can register the sole proprietorship firm either in Department of Commerce and Supply Management (in case of commerce related firm), Department of Cottage and Rural Industry (in the case of cottage and rural industry), and Department of Industry (“DOI”) for any other industry.

The sole proprietorship firms do not have a separate legal personality, and the liability of the individual is unlimited. It is mostly used by individuals undertaking trading activities, operating small retailer shops, restaurants, etc., and professional service providers such as accountants and lawyers.

The advantages and drawbacks of sole proprietorship firms are as mentioned:

| Advantages | Drawbacks |

|---|---|

| Easy to establish, control, and dissolve | Unlimited liability |

| Prompt and flexible in decision making | Requires periodical renewal |

| Comparatively fewer corporate compliances | No separate legal personality |

2.2. Partnership Firms:

Another major form of business vehicle is a partnership firm that can be established under the Partnership Act, 1964(2020). Similar to the private firm, a partnership firm does not have a separate corporate personality, and the liability of partners is unlimited. Partnership firms are mostly used for trading activities and professional services. The minimum number of individuals required to open a partnership form is two, and the maximum is unlimited. Nepalese law has not made any restriction on the maximum number of partners in this type of business vehicle.

One can register the partnership firm either in Department of Commerce and Supply Management (in case of commerce related firm), Department of Cottage and Rural Industry (in the case of cottage and rural industry) and DOI for any other industry.

The advantages and drawbacks of partnership firm are as mentioned:

| Advantages | Drawbacks |

|---|---|

| Easy to establish, control, and dissolve | Liability is unlimited |

| Comparatively fewer corporate compliances | Requires periodical renewal |

| Flexibility in decision making as compared to limited companies | No separate legal personality |

2.3. Limited Liability Companies:

Limited liability company are the most common form of business vehicle that investor incorporates in Nepal. The same is applicable for the foreign investors who want to register the business in Nepal. Limited liability and separate personality are the main features of this business vehicle.

Limited liability companies are incorporated under the Company Act 2006(2063) and it is registered by Office of Company Registrar (“OCR”). For detail regarding the registration of company in Nepal, please go through article published at the website of our law firm on the mentioned link: Company Registration Process In Nepal

The advantages and drawbacks of limited liability Companies are as mentioned:

| Advantages | Drawbacks |

|---|---|

| Limited Liability | Expensive to manage and difficult to establish, control, and dissolve |

| Separate Legal Personality | Fulfillment of a high level of legal compliance |

| Perpetual Succession |

The Company Act provides for the incorporation of three types of companies which are:

a. Private Limited Companies:

The minimum number of shareholders required in a private company is one (1) and may not exceed to one hundred one (101). For the registration of a private limited company required documents need to be submitted at the office of company registrar (“OCR”). Unlike the Public Limited Company, the Private Limited Company (i) cannot sell their shares publicly, (ii) less than seven (7) shareholders can operate the company and (iii) can commence the business immediately after incorporation.

b. Public Limited Companies

The minimum number of shareholders in a public company is seven (7) and can exceed any number. Public company should have paid up capital of Nepalese Rupees One Crore (Ten Million Nepalese Rupees) and the compliance requirement of the public limited company is higher in comparison to private company.

c. Company Not Distributing Profit:

Company Not Distributing Profit is incorporated with the objective of public welfare rather than profit motive. They are incorporated with the condition not to distribute profit to its members.

As per the Companies Directives of Nepal one can established Company Not Distributing Profit with following objectives:

- a. development and promotion of any profession,

- b. protection of collective rights and interests of the persons engaged in a specific profession or occupation and

- c. for the attainment of any scientific, academic, social, benevolent or public utility or welfare objective on the condition of not distributing dividends.

For detail regarding the registration of company not distributing profit in Nepal, please go through article published at the website of our law firm on the mentioned link: Registration Of Company Not Distributing Profits In Nepal .

2.4. Local Business:

Individuals also can operate business by registering the business at the local level government that is ward office. Small business such as retail shop, grocery stores, tea shop etc. are directly registered on as the local business and are governed by local municipality law.

3. OPTIONS FOR FOREIGN INVESTORS FOR CARRYING OUT BUSINESS ACTIVITIES IN NEPAL:

The following options are available for foreign investors to register/establish a business in Nepal:

3.1 REGISTRATION OF LIMITED LIABILITY COMPANIES IN NEPAL:

Limited Liability Company is the common business vehicle on which the foreign Investor invest in Nepal. A foreign investor can invest or operate a business in Nepal by either incorporating a limited liability company or by acquiring shares of a company that is already in existence (equity investment). Pursuant to Foreign Investment and Technology Transfer Act, 2019 (2075) (“FITTA”) foreign investment can be done through the followings methods:

3.1.1 Permissibility of Foreign Investment

A foreign investor desirous to invest in Nepal must invest in a permitted sector of ‘industry’ in Nepal. Thus, the permissibility of foreign investment is subject to the fulfillment of two conditions:

a. First Condition: The sector of industry must not fall under “Negative List of Industries” provided in Annex-1 of FITTA and

b. Second Condition: The sector of industry must be classified under “Positive List” under the Industrial Enterprise Act, 2020 (2076)

3.1.2 Capital Requirement

The minimum capital required for establishment of FDI Company is 20 million Nepalese Rupees.

For further information regarding the approval of foreign direct investment in Nepal, please go through article published at the website of our law firm on the mentioned link: FDI (Foreign Direct Investment) Approval Process In Nepal .

3.2 REGISTRATION OF BRANCH OFFICE IN NEPAL

The second option for a foreign company to conduct business in Nepal is by establishing a branch office in Nepal under the Companies Act, 2006 (2063) (“Companies Act”). The Companies Act requires registration of a branch office if a foreign company is undertaking business activity in Nepal for a continuous period of one month or more through an office established in Nepal or used therefor or appoints any person for regular contact or avails its service. The branch office should carry out the same business activities that the foreign company carries out in the country of its incorporation.

As a matter of practice, the branch office are registered by OCR, however the registration of branch office requires either of this approvals:

a. Approval from government authority (Approval is granted from government authority, related with the nature of business that the branch office will be operating in Nepal eg: approval from Ministry of Information, Communication and Technology for IT related business) and

b. Agreement with any government authority of Nepal for purpose of doing the business in Nepal.

There is no minimum capital threshold for the investment of branch office. For more information regarding the registration of branch office in Nepal, please go through article published at the website of our law firm on the mentioned link: Branch Office Registration Process In Nepal .

3.3 REGISTRATION OF THE LIASION(CONTACT) OFFICE IN NEPAL:

The Company Act, 2006 (2063) also provides for registration of liaison offices of a foreign company in Nepal. Specific government approvals are not required to establish a liaison office. The liaison office is not allowed to undertake any income generating or advertisement activities. The office can only be used as a contact point for the foreign company and other local parties to communicate, coordinate and regulate the relationship.

The foreign company are allowed to:

a. To work as the point of contact and maintain liaison on behalf of foreign company,

b. Assist individuals to import and use of foreign companies’ products without taking any remunerations and

c. Coordinate with Nepalese Agent if appointed by the foreign company.

For more information regarding the registration process of liaison office in Nepal, please go through article published at the website of our law firm on the mentioned link: Liaison Office Registration Process In Nepal .

4. TRADING ACTIVITIES FOR FOREIGN COMPANIES IN NEPAL:

Foreign company cannot invest in the trading business so they are not allowed to open the local subsidiary company in Nepal. Foreign investor can appoint a local agent to distribute its products in Nepal by executing the agency/ distributorship agreement.

5. BUSINESS ACTIVITIES OF FOREIGN COMPANY THROUGH FRANCHISE ARRANGEMENT:

Foreign companies also have the option of entering into a franchise arrangement in Nepal governed by the terms and conditions of a franchise agreement. There are no permissibility restrictions on franchise arrangements. The procedures for franchising foreign brand in Nepal are;

a. Registration of Trademark (Foreign Brand) before DOI,

b. Execution of Franchise Agreement with Foreign Company and Local Company and

c. Approval of Franchise Agreement and Related Agreement from DOI.

6. RESTRICTED BUSINESS FOR FOREIGN INVESTMENT:

Foreign investment is restricted for sectors of industry that fall under the “Negative List of Industries” provided in Annex-1 of the FITTA. The Negative List comprises of the following industries:

- a. Poultry farming, fisheries, bee-keeping, fruits, vegetables, oil seeds, pulse seeds, milk industry, and other sectors of primary agro-production;

- b. Cottage and small industries;

- c. Personal service business (hair cutting, tailoring, driving, etc.);

- d. Industries manufacturing arms, ammunition, bullets and shell, gunpowder or explosives, and nuclear, biological and chemical (N.B.C.) weapons; industries producing atomic energy and radioactive materials;

- e. Real estate business (excluding construction industries), retail business, internal courier service, local catering service, moneychanger, remittance service;

- f. Travel agency, guide involved in tourism, trekking and mountaineering guide, rural tourism including homestay;

- g. Business of mass communication media (newspaper, radio, television, and online news) and motion picture of the national language;

- h. Management, account, engineering, legal consultancy service and language training, music training, and computer training;

- i. Consultancy services having foreign investment of more than fifty-one percent.

7. FACILITIES PROVIDED TO FOREIGN INVESTORS IN NEPAL:

The following facilities are provided under for the foreign investor in Nepal:

- a. Companies having foreign investment are considered local companies and can own private land in Nepal.

- b. In case the foreign investor is an individual, the investor is allowed to obtain a business visa until the investment is retained in Nepal.

- c. In case the foreign investor is a company, representatives from the company are allowed to obtain a business visa until the investment is retained in Nepal. The family members of the foreign investor or the company representatives are also allowed to obtain a business visa until the investment is retained in Nepal.

- d. Residential visas are provided to foreign investors and their family members who have invested an amount equal to or more than one million United States dollars or above at once until the investment is retained in Nepal.

- e. Foreign investment companies and foreign investors can open foreign currency accounts and conduct foreign currency transactions.

- f. Foreign investment companies can employ foreign nationals in highly technical or managerial positions if such positions cannot be fulfilled by a Nepali citizen.

- g. Foreign investors have the right to repatriate their investment and returns in convertible foreign currency.

8. TAXES APPLICABLE TO FOREIGN INVESTMENT COMPANIES:

The tax system of Nepal is a self-assessment system whereby the taxpayers themselves assess their income and pay the applicable taxes. The main taxes that businesses are subject to in Nepal under Income Tax Act 2002 (2058), Value Added Tax Act 1996 (2052) and Excise Duty Act 2002 (2058) are as follows:

8.1. Income tax:

- a. General corporate tax rate is 25%.

- b. Certain sectors like manufacturing and hydropower sector are taxed at concessional rate of 20%.

- c. Sectors like agriculture, forestry and mining industries are taxed at a concessional rate of 20%.

- d. Certain sectors like banking and financial institutions are subject to 30%.

- e. Dividends are subject to 5%.

8.2. Value Added Tax (VAT):

The VAT Act defines goods and services that are subject to VAT. The VAT Act prescribes a uniform rate of 13% VAT for all types of transactions of goods and services as prescribed under the VAT Act.

8.3. Withholding tax/tax deducted at source (TDS):

Certain payments are subject to withholding tax such as royalties (15%), rent (10%) and Services Fees 15%.

9. REPATRIATION OF INVESTMENT AND OTHER RETURNS FROM NEPAL:

A foreign investor is allowed to repatriate the following:

- a. earnings through dividend or through sale proceeds against investment in shares,

- b. Compensation and Indemnity,

- c. Sale Proceeds upon Share Transfer,

- d. Returns of Capital at the Time of Liquidation,

- e. Technology transfer fees, royalty and license fees that have been earned through technology transfer and

- f. Lease rent under lease financing.

The investor has obligation to show that all local subsidiary company have complied all the laws, obtained all the necessary approval, pay tax and compiled with all the obligation before repatriation. Approval from DOI or IBN and NRB approval is required before repatriation. Investor can repatriate the investment and earning in the same currency or in other convertible foreign currency.

10. PROTECTION OF FOREIGN INVESTMENT IN NEPAL

Nepal has signed six bilateral investment treaties (BIT) with the India, Finland, Mauritius, United Kingdom, Germany and France. Among which only four BITs are already in implementation. Nepal's BIT with India and Mauritius have not yet come into force.

BITs have incorporated the following principles:

(i) National Treatment,

(ii) MFN Treatment and

(iii) Fair and Equitable Treatment for the protection of foreign investment. Same principle has also been recognized by FITTA.

Related Article Link:

Please click the article published at our law firm website, which are related to the above article topic:

Company Registration Process In Nepal

FDI (Foreign Direct Investment) Approval Process In Nepal

Branch Office Registration Process In Nepal

Liaison Office Registration Process In Nepal

Registration Of Company Not Distributing Profits In Nepal

Date of Publication:18 August 2023

Disclaimer: Bhandari Law and Partners is one of the leading law firm in Nepal with team of best professional lawyers in Nepal.This article published on website of the law firm is just for information purpose only. It shall not be taken as the legal advice, advertisement, personal communication, solicitation or inducement. Bhandari Law and Partners or any of the team members of the firm shall not be liable for the consequence arising of the information provided. As the factual situation may be different on your case, thereof if you need further legal advice on the subject matter, please Contact Us.

Related Professionals:

Frequently Asked Question

For quick legal assistance:

You can directly call to our legal expert: +977-9808811027

Even can call or drop a text through What’s app , Viber, Telegram and We Chat at the same number.

Also can do email on : info@lawbhandari.com

contact us

Phone :,

,Connect with our professional lawyers in Nepal :

Follow Our Law Firm on Social Media :