Table of content

-

Branch Office Registration Process in Nepal

1. Governing law of branch office registration in Nepal :

The registration of a branch office of a foreign company in Nepal is governed by the Companies Act, 2006 (2063) (“Companies Act”). Section 154 (1) of Companies act incorporates the provision related to the registration of branch office of a foreign company in Nepal.

2. Governing authority :

Office of Company Register (‘OCR”) is the governing authority to register a Branch Office in Nepal.

3. Condition for registration of branch office in Nepal :

The Companies Act requires registration of a branch office, if a foreign company is undertaking business activity in Nepal for a continuous period of one month or more through an office established in Nepal or used therefor or appoints any person for regular contact or avails its service.

As a matter of practice, registration of branch office in Nepal requires either of these approvals:

- Approval from government authority (Approval of the government authority is required. The government authority shall be the government authority related with the nature of business that the branch office will be operating in Nepal eg: approval from Ministry of Information, Communication and Technology is required for IT related business) or

- Agreement of foreign company with any government authority of Nepal, executed for purpose of doing the business in Nepal.

4. Act that does not constitute as establishment of branch office:

Establishment of business through equity investment and its management, engaging the agent or distributor in Nepal would not be construed to have established a branch office in Nepal.

Branch office establishment does not provide the legal status of separate legal personality. It shall be considered as the part of foreign company operating in Nepal.

5. Business activities of branch office:

The branch office should carry out the business activities that are permissible in Nepal. However, the business activities carried by the branch office should be similar to the business activities that is carried by the foreign company.

6. Minimum capital requirement :

There is no minimum capital threshold for the investment of branch office, Companies Act is silent in this regard. Generally, the foreign companies inject the investment amount for branch office considering their operation cost. There is no minimum capital threshold for the investment of branch office, Companies Act is silent in this regard. Generally, the foreign companies inject the investment amount for branch office considering their operation cost.

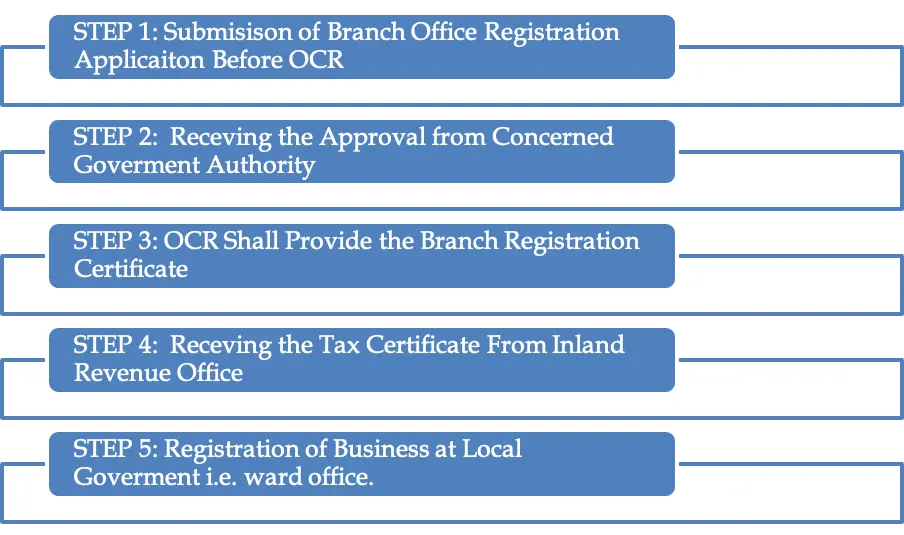

7. Branch office registration process in Nepal

Following steps are followed for branch office registration:

-

STEP 1: Submission of Branch Office Registration Application Before OCR

-

STEP 2: Receiving the Approval of Concerned Goverment Authority

-

STEP 3: OCR Shall Provide the Branch Registration Certificate

-

STEP 4: Receiving the Tax Certificate From Inland Revenue Office

-

STEP 5: Registration of Business at Local government i.e. ward office.

Kindly Note: Separate approval shall not be required if the foreign company have already executed the agreement with government authority.

8. Timeline

The timeline for registration of a branch office in Nepal is usually 30 to 45 days. Sometimes it may require additional days to receive the approval from concerned government authority.

9. Documents required for registration :

Following are the documents required for branch office registration:

| S.N. | Documents | Notarization |

|---|---|---|

| 1 | Certificate of Registration, Memorandum of Association, Article of Association of the Foreign Company and its Nepalese Translation. | Yes |

| 2 | Application for Branch Office Registration | Not Applicable |

| 3 | Board Resolution of the Foreign Company to set up a branch office. | No |

| 4 | Signed Copy of Company Profile | No |

| 5 | Copy of passport of all directors of Company | Yes |

| 6 | Copy of citizenship certificate of Nepal Representative authorized to receive notices (Notarization should be done from Nepalese Notary Officer) | Yes |

| 7 | Letter of appointment of Authorized Representative | No |

| 8 | Proposed Plan of Branch Office | No |

| 9 | Power of Attorney. | Yes |

| 10 | Declaration of director or their representative of Company that the information submitted is correct and accurate | No |

| 11 | Approval letter from concerned government authority of Nepal (if available) | No |

| 12 | Agreement executed by the foreign company with the government authority of Nepal (if available) | No |

10. Government Fee :

Government Fee of the branch office depends on capital that foreign company want to inject in Nepal:

| Investment Amount (Amount in NPR) | Registration Fee (Amount in NPR) |

|---|---|

| Up to 10,000,000 | 15,000 |

| From 10,000,001 to 100,000,000 | 40,000 |

| From 100,000,001 to 200,000,000 | 70,000 |

| From 200,000,001 to 300,000,000 | 100,000 |

| From 300,000,001 to 400,000,000 | 130,000 |

| From 400,000,001 to 500,000,000 | 160,000 |

| Above 500,000,000 | 3,000 plus for each additional 10,000,000 |

11. Compliance Requirement :

Following are the post compliance requirement of branch office in Nepal:

- Submit 3-month compliance document before OCR;

- Appoint Auditor to prepare annual financial statement (audit report) of branch office;

- Submit the financial statement at OCR within 6 months of completion of each fiscal year;

- Submit the financial statement to its head office within 3 months from its preparation date and

- Update document at OCR in case there is change in name and address of the foreign company.

Note: Branch Office has obligation to do compliance applicable pursuant to other prevailing Nepalese law including Labor Law, Social Security Law, Tax Law etc. during the process of its operation in Nepal.

12. Branch Office different from a liaison Office :

- Unlike branch office, liaison office are not allowed to do any income earning activities in Nepal. The liaison office can only be used as a contact point for the foreign company and other local parties to communicate, coordinate and regulate the relationship;

- As a matter of practice unlike branch office liaison office are not required to take any approval from the concerned authority for establishment;

- Activities such as entering into a contract for transaction and marketing and advertisement of product of the company is restricted for Liaison Office.

For more details regarding the registration of the liaison office in Nepal please visit the article published at our law firm website. Link; Liaison Office Registration in Nepal

13. Branch Office different from local subsidiary company (foreign investment company) :

- a. Local subsidiary company has an entirely separate legal personality from its parent company, whereas branch office does not have separate personality from its parent company;

- b.Unlike branch office, parent company is not automatically liable for activities carried out by the local subsidiary company.

For more details regarding the registration of the local subsidiary company in Nepal please visit the article published at our law firm website. Link: Company Registration Process in Nepal .

Related Article Link:

Please click the article published at our law firm website, which are related to the above article topic:

Establishment of Business in Nepal by the Foreign Investor

Company Registration Process in Nepal

FDI (Foreign Direct Investment) Approval Process In Nepal

Liaison Office Registration in Nepal

Disclaimer: Bhandari Law and Partners is one of the leading law firm in Nepal with team of best professional lawyers in Nepal.This article published on website of the law firm is just for information purpose only. It shall not be taken as the legal advice, advertisement, personal communication, solicitation or inducement. Bhandari Law and Partners or any of the team members of the firm shall not be liable for the consequence arising of the information provided. As the factual situation may be different on your case, thereof if you need further legal advice on the subject matter, please Contact Us.

Related Professionals:

Frequently Asked Question

For quick legal assistance:

You can directly call to our legal expert: +977-9808811027

Even can call or drop a text through What’s app , Viber, Telegram and We Chat at the same number.

Also can do email on : info@lawbhandari.com

contact us

Phone :,

,Connect with our professional lawyers in Nepal :

Follow Our Law Firm on Social Media :