Table of content

-

Registration of Non-Profit Institution in Nepal

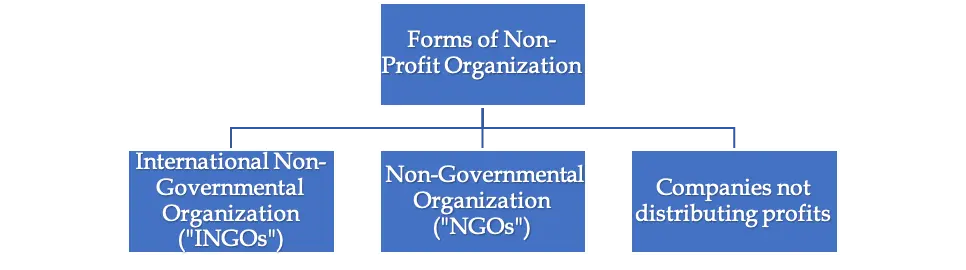

1. Forms of Non-Profit Organization in Nepal:

Nepali individuals desiring to undertake non-profit organization has two options:

i. Registration of Non-Governmental Organization (“NGOs”)

ii. Registration of Company not distributing profits.

For foreign nonprofit entities aspiring to conduct welfare activities in Nepal, there are two options: (i) setting up an International Non-Governmental Organization (“INGOs”) or (ii) directly funding Nepalese non-profit organization operating in Nepal. If a foreign non-profit organization chooses to provide funds to a Nepalese nonprofit organization, prior approval of the Social Welfare Council is necessary. On the other hand, if the aim is to directly carry out welfare activities, establishing an INGOs within Nepal is required.

2. Establishment of INGOs in Nepal

2.1 Governing Law of INGOs in Nepal:

Social Welfare Act, 1992 (2049) and Social Welfare Council Rules, 2049 (1992) are the main regulatory framework governing INGOs in Nepal.

Additionally, the Social Welfare Council has a series of guidelines that govern INGO activities, and these guidelines developed by the Social Welfare Council undergo periodic updates.

2.2 Governing Authority:

Social Welfare Council (“SWC”) is the primary governing authority to regulate INGOs in Nepal.

2.3 Requirement for Establishment of INGO:

Following are the basic requirement that needs to be fulfilled for establishment of INGO in Nepal :

· An entity seeking to establish as an INGO is required to possess prior registration as a non-profit organization within a foreign jurisdiction.

· The INGO is obligated to execute formal agreements, namely the General Agreement and the Project Agreement with SWC. These Agreement are prerequisites for the establishment of INGO.

· It is imperative for INGO to allocate a minimum of USD $200,000 annually for charitable contributions in Nepal.

· INGO is not authorized to directly undertake project implementation. Rather, the execution of projects is to be carried out in collaboration with nonprofit organizations as mentioned:

a) Non-Governmental Organization.

b) Company not distributing profits or

c) Any legally registered entity that has been established with the fundamental objective of non-profit distribution.

(For detailed information regarding the process of establishment of INGOs in Nepal , kindly refer to the following article published on our website of our law firm on the mentioned Link: Procedure for the registration of INGO in Nepal )

3. Registration of NGOs in Nepal

3.1 Governing law:

Associations Registration Act 1977 (2034) is the the primary regulatory framework governing NGOs in Nepal .

3.2 Regulating Authority:

NGOs undergo registration at the District Administration Office (DAO) situated in the pertinent district of establishment.

3.3 Requirement for registration of NGO:

· Number of Members of Board: The registration process mandates a minimum of 7 individuals holding Nepali citizenship: 1 President, 1 Vice-President, 1 Secretary, 1 Treasurer, and a minimum of 3 additional members.

· Within the composition of the Executive Committee, a representation of at least 33% comprising individuals of the female gender is a prerequisite.

(For detailed information regarding the process of NGOs registration, kindly refer to the following article published on our website of our law firm on the mentioned link:Procedure for the registration of Non-Governmental organizations (NGOs) in Nepal)

4. Company not distributing profits

As per the Companies Act 2006 (2063) (“Companies Act”), “Company not distributing profits” means company incorporated under Chapter 19 on conditions that it shall not be entitled to distribute or pay to its members any dividends or any other moneys out of the profits earned or savings made for the attainment of any objectives.

Company Not Distributing Profits is incorporated with the objective of public welfare rather than profit motive. They are incorporated with the condition not to distribute profit to its members.

As per the Companies Directives of Nepal one can established Company Not Distributing Profit in Nepal with following objectives:

· development and promotion of any profession,

· protection of collective rights and interests of the persons engaged in a specific profession or occupation and

· for the attainment of any scientific, academic, social, benevolent or public utility or welfare objective on the condition of not distributing dividends.

4.1 Governing Law:

Companies Act 2007 (2063) is the regulatory framework governing Company not distributing profits.

4.2 Regulating Authority

Office of Company Registrar (“OCR”) is regulating authority of Company not distributing profits.

4.3 Requirement for registration of Company not distributing profits in Nepal:

The requisite number of promoters involved in the registration of company not distributing profits must be a minimum of five, with the upper limit being unrestricted.

At least five promoters are needed for the registration of a company not distributing profits, in accordance with the Companies Act . The Act places no restrictions on the maximum number of promoters. Membership remains non-transferable and terminates solely upon occurrences such as death, registration cancellation, dissolution, voluntary resignation, or merger with another company. It is possible for any individual, trustee of a public trust, or corporate entity to establish a Company not distributing profits.

(For detailed information regarding the process of Company not distributing profits registration, kindly refer to the following article published on our website of our law firm on the mentioned link: : Procedures for the registration of Company not distributing profits in Nepal)

5. Similarities and differences between NGO and Company not distributing profits

Both nonprofit organizations, specifically NGOs and Company not distributing profits, have the capacity to be operated by Nepali individuals. Both of these organizational structures are eligible to seek funding, whether from domestic institutions or foreign sources. However, in instances where funding is procured from international sources, it is imperative for both types of organizations to obtain approval from the SWC as a mandatory prerequisite.

The differences between NGO and Company not distributing profits on the following sub topic

(i) Separate governing laws apply to these entities: an NGO, registered under the Association Registration Act of 2034, and a Company not distributing profits, which is registered under the Companies Act of 2063.

(ii) Registered at different institution:

| Organization Type | Associated Office |

|---|---|

| NGO | District Administration Office (DAO) |

| Company not distributing profits | Office of Company Registrar (OCR) |

(iii) Minimum Members:

NGOs require a minimum of 7 members, whereas Profit not distributing Companies need at least 5 members to establish themselves.

(iv) Annual Compliance:

NGOs must renew their certificates of incorporation annually, while Company not distributing profits do not require renewal but must fulfill annual compliance requirements pursuant to Companies Act.

Note:

The process of registering and renewing an NGO is complex and time-consuming, whereas the procedure for Company not distributing profits is comparatively simpler. Given the available options and taking into account the aspect of flexibility, clients tend to favor the registration of Company not distributing profits.

Date of Publication: 18 August 2023

Related Article Link:

Please click the article published at our law firm website, which are related to the above article topic:

INGO Registration In Nepal : INGO Law In Nepal

Registration of Non Governmental Organization (NGO) in Nepal

Registration Of Company Not Distributing Profits In Nepal

Disclaimer: Bhandari Law and Partners is one of the leading law firm in Nepal with team of best professional lawyers in Nepal.This article published on website of the law firm is just for information purpose only. It shall not be taken as the legal advice, advertisement, personal communication, solicitation or inducement. Bhandari Law and Partners or any of the team members of the firm shall not be liable for the consequence arising of the information provided. As the factual situation may be different on your case, thereof if you need further legal advice on the subject matter, please Contact Us.

Related Professionals:

Frequently Asked Question

For quick legal assistance:

You can directly call to our legal expert: +977-9808811027

Even can call or drop a text through What’s app , Viber, Telegram and We Chat at the same number.

Also can do email on : info@lawbhandari.com

contact us

Phone :,

,Connect with our professional lawyers in Nepal :

Follow Our Law Firm on Social Media :