Table of content

-

Cheque Bounce in Nepal : Applicable Legal Remedy

Overview:

This article covers detail regarding the process of the legal remedy against cheque bounce in Nepal.

1. Introduction of Cheque Bounce in Nepal

Cheque related crimes has increased in Nepal due to increase in the number of cheque transactions.

Dishonor of cheque occurs when the bank refuse to accept or pay the drawn amount due to (i) insufficient fund in bank account, (ii) mismatch of signature, (iii) overwriting of cheque, (iv) problem with cheque date etc.

Cheque bounce is one of the types of dishonor of cheque that occur when the bank refuses to pay the drawn amount on the ground that the bank accounts does not hold the sufficient fund.

2. Legal Remedy Against Cheque Bounce in Nepal

The prevailing law of Nepal provides two distinct remedy against the cheque bounce in Nepal which is illustrated in below mentioned figure:

Parties can seek either of the remedies mentioned above for offences related to cheque bounce.

3. Remedy under Banking Offence and Punishment Act

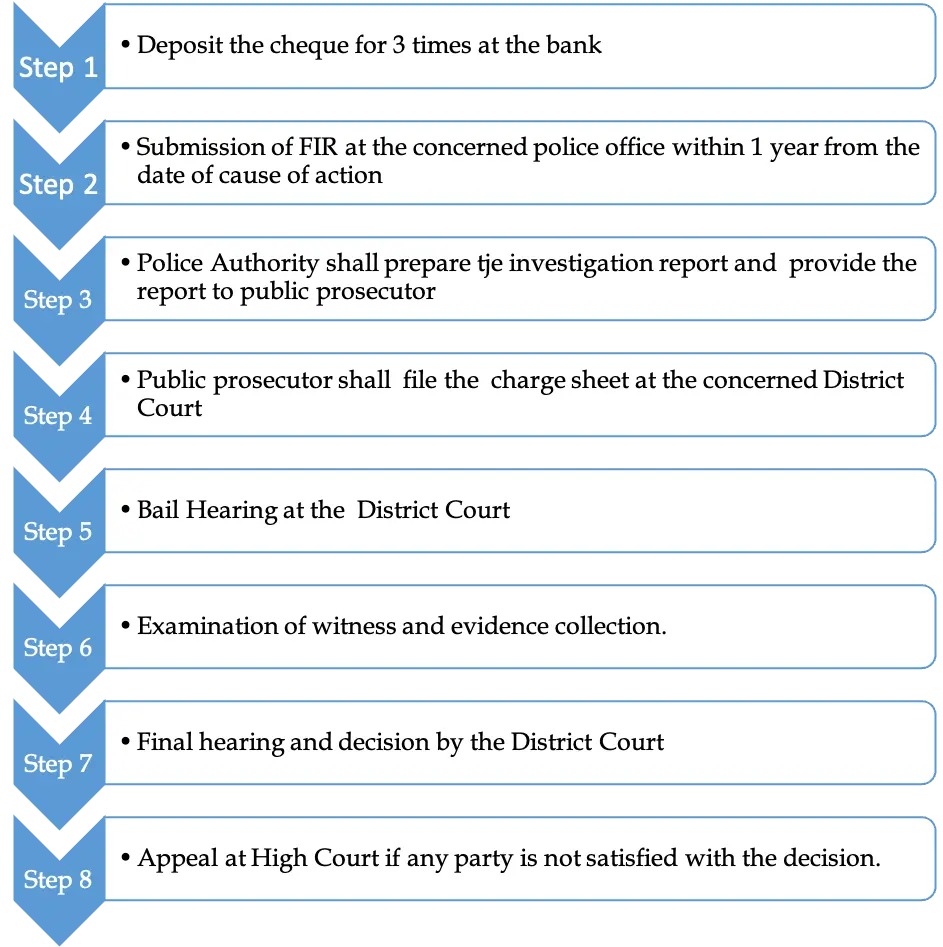

Banking Offence and Punishment Act prohibits any person to issue the cheque with a prior knowledge that his/her account does not have sufficient balance to cover the amount of the cheque drawn. Such act shall be considered as the offence against the state; therefore, the aggrieved party can file the FIR before the police authority. Public prosecutor shall file the case before concerned district court and state shall take the responsibility to over the case.

The detail process regarding the initiation of the case of the cheque bounce in Nepal is as mentioned:

Kindly note that aggrieved party has right to request the bank to blacklist the person who issue the cheque. Upon the request the bank will initiate the backlisting process as a consequence all the exiting bank account of the drawer of the cheque shall be blocked neither allowed to open new bank account.

3.1 Punishment

Section 15 of the Banking Offence and Punishment Act, 2064(2008) outlines the following punishments for cheque bounce offences:

- A fine amount equal to the value of the bounced cheque.

- Recovery of the amount equal to the cheque's value.

- Imprisonment for a period not exceeding three months.

3.2 Time Limitation to Initiate the Case of Cheque Bounce in Nepal

To initiate a case for cheque bounce, the FIR (First Information Report) should be submitted within 1 year from the date of the cause of action.

4. Remedy under Negotiable Instrument Act

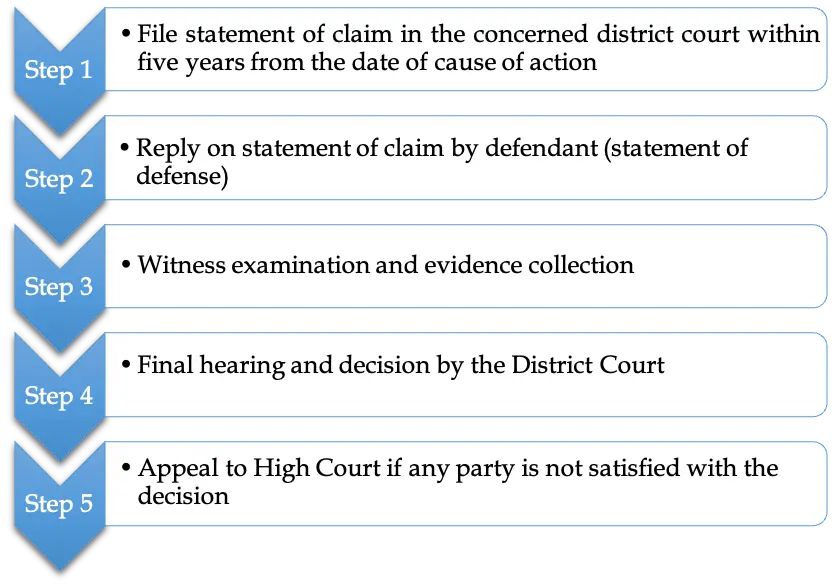

The Negotiable Instrument Act is applicable when an individual draws a cheque on a bank without sufficient funds. In such cases, the aggrieved party has the right to claim interest on the amount under the Negotiable Instrument Act, which is not permissible when initiating a case under the Banking Offence and Punishment Act.

The detailed process for initiating a case of cheque bounce in Nepal under the Negotiable Instrument Act in Nepal is as follows:

4.1 Punishment

Section 107(a) of the Negotiable Instrument Act, 2034(1977) provides the following punishments for cheque bounce:

i. Recovery of the amount with interest.

ii. Imprisonment not exceeding three months or a fine of up to 3000 Rupees or both.

4.2 Time Limitation to Initiate the Case

Under the Negotiable Instrument Act, the time limitation to file a case at the concerned district court is 5 years from the date of the cause of action.

5. Remedy to recover the interest amount

Negotiable Instruments Act provided the aggrieved party to recover the interest over the amount drown through the cheque, whereas, Banking Offence and Punishment Act does not provide such remedy. Pursuant to applicable law aggrieved party has right to recover 10% of the interest amount arising from the date at which such amount has to be received.

6. Selection of Remedy Against Cheque Bounce in Nepal

The prevailing legislation does not restrict compulsory adherence to one specific remedy. It is entirely at the discretion of the parties involved to choose any of the available remedies.

Date of Publication: 22 August 2023

Disclaimer: Bhandari Law and Partners is one of the leading law firm in Nepal with team of best professional lawyers in Nepal.This article , Cheque Bounce in Nepal is published on website of the law firm is just for information purpose only. It shall not be taken as the legal advice, advertisement, personal communication, solicitation or inducement. Bhandari Law and Partners or any of the team members of the firm shall not be liable for the consequence arising of the information provided. As the factual situation may be different on your case, thereof if you need further legal advice on the subject matter, please Contact Us.

Related Professionals:

Frequently Asked Question

For quick legal assistance:

You can directly call to our legal expert: +977-9808811027

Even can call or drop a text through What’s app , Viber, Telegram and We Chat at the same number.

Also can do email on : info@lawbhandari.com

contact us

Phone :,

,Connect with our professional lawyers in Nepal :

Follow Our Law Firm on Social Media :