Table of content

-

Recording of Foreign Investment in Nepal: Step by Step Guide

01. Introduction of Recording of Foreign Investment in Nepal

Foreign Direct Investment (“FDI”) companies in Nepal must adhere to the mandatory compliance requirements after the company formation as prescribed under Nepalese law. Among these compliances recording of foreign investment is one the crucial.

This article provides a comprehensive and professional overview to the mandatory obligations of recording of foreign investment in Nepal.

It aims to guide foreign investors and company representatives to understand regarding the process of recording of foreign investment in Nepal including the documents requirement and the timeline.

02. Government Authority and Law

Nepal Rastra Bank (“NRB”) is the responsible for the Recording of the Foreign Investment amount in Nepal.

Recording of the Foreign Investment is governed by the Nepal Rastra Bank Foreign Investment and Foreign Loan Management Bylaw, 2021 (hereinafter referred to as the "Bylaw") which was enacted on 8 June 2021 (25 Jestha 2078) pursuant to the Nepal Rastra Bank Act, 2002.

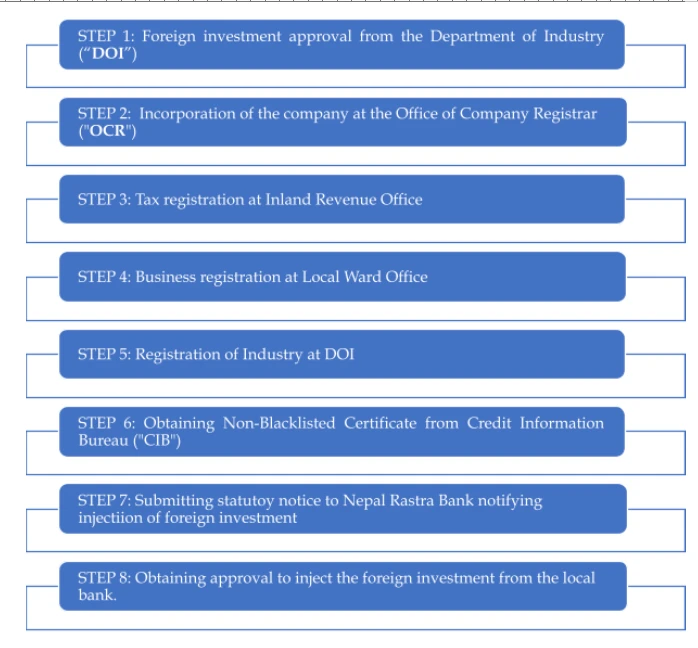

03. Steps of Incorporation of Foreign Investment Company in Nepal

The incorporation of a FDI company in Nepal involves several critical steps including:

Once the foreign investment is brought into Nepal, the company has to mainly received the following documents for the recording of the foreign investment:

(i) inflow certificate from Commercial Bank in Nepal,

(ii) shareholder registry from Office of Company Registrar

3.1. Receiving the Inflow Certificate from the Bank

Once the pre-notification is submitted to Nepal Rastra Bank (NRB) to remit the foreign currency for the approved investment in Nepal, the investor is permitted to transfer the investment amount to the company’s local bank account in Nepal from the foreign bank account. The remittance must be clearly identified as “Foreign Investment,” “FDI for capital investment,” or a similar designation in the SWIFT message, to ensure proper indication of the investment amount.

After the investment amount has been credited to the company’s bank account, the company must submit the necessary documents to the bank to initiate the issuance of the Inflow Certificate. This process typically involves submitting the application for the investment amount to be deposited, copy of the foreign investment approval, non-blacklist certificate from Credit Information Bureau among other required documents.

The Inflow Certificate, issued by the receiving bank, serves as official proof that the investment funds were legally transferred into Nepal through a formal banking channel and in full compliance with NRB regulations. This certificate is essential for recording the foreign investment with NRB and for future repatriation of profits or capital.

3.2. Receiving the Shareholder registry from Office of the Company Registrar

Based on inflow certificate we need to apply for shareholder registry at Office of Company Registrar (OCR). Along with the application, bank statement, share registry form and other supporting documents has to be submitted at OCR. OCR is will grant the certified shareholder registry which is the official and legal proof of ownership of shareholder in a company.

04. Recording of Foreign Investment at NRB

After the inflow certificate and shareholder registry is received, company can initiate the recording process. The recording process ensures that the investment is officially recognized and eligible for benefits such as repatriation of dividends or capital gains. The foreign investment must be recorded with the NRB within 6 months as mandated by the Bylaw.

4.1. Process of Recording of Foreign Investment in Nepal

Once the investment amount is received from the foreign investor at respective bank account of company then following process has to be followed for recording of foreign investment:

Step 1: Receive the Inflow Certificate from Commercial Bank

Step 2: Receiving the Shareholder Certificate from OCR

Step 3: Submit the application at NRB for the recording of the investment

Step 4: NRB examines the documents and provide the recording certificate

4.2. Documents to be submitted for the recording of the Foreign Investment

Different Documents has to be submitted at NRB for the recording of the foreign investment.:

(A) Documents related to registered Nepalese Company

| S.N. | Documents |

|---|---|

| 1. | A copy of the decision of the board of directors or the authorized personnel related to recording of foreign investment or the application from the concerned foreign investor/individual or organization authorized by the foreign investor. |

| 2. | Copy of approval of foreign investment. |

| 3. | Copy of company/industry registration certificate. |

| 4. | Copy of business operation license (as required). |

| 5. | Copy of permanent account number certificate. |

| 6. | Copy of Memorandum of Association and Articles of Association. |

| 7. | Copy of latest audited financials. |

| 8. | Copy of proof of latest tax clearance or submission of tax returns. |

| 9. | Copy of updated shareholder's registration record from the Office of the Company Registrar (in case of a company listed in stock market, shareholder's record certified by a share registrar licensed by the Securities Board). |

| 10. | Certificate and system generated evidence issued by relevant bank and financial institution regarding the inflow of foreign currency into Nepal for foreign investment. (In the case of investment made through machines, tools, or equipment under Section 3 of the Foreign Investment and Technology Transfer Act, 2075, the customs declaration form specifying the value of such machines, tools, or equipment.) |

| 11. | Certified copy of foreign investment agreement and approved share purchase-sale agreement (as required). |

| 12. | For inflow of foreign currency, evidence of approval or ratification approval from the Rastra Bank or prior information provided to the Rastra Bank. |

| 13. | If the inflow amount related to foreign investment is lower due to SWIFT charge, bank commission, service fee etc. charged by foreign and domestic bank and financial institution, such can also be recorded as foreign investment based on document evidences. However, such fee cannot be recorded as foreign investment if it exceeds more than 3 percent of the net inflow amount. |

| 14. | If the number of shares of a company/industry change or if the ownership of shares changes, the receipt of applicable tax payment as per the law shall be submitted. |

B) Document Related to Foreign Investor

Different documents must be submitted to the NRB depending on whether the investment is made by an individual or an institution. The required documents are categorized accordingly in the table below.

i)Document requirement in case institution as foreign investor:

| S.N. | Documents |

|---|---|

| 1. | Certified copy of registration certificate of institution. |

| 2. | Certified copy of the latest audited financials. (However, if the investment amount is less than or equal to USD 1 million or its equivalent in foreign currency, it is not mandatory to include the audited financials. Similarly, if the financial statement submitted by the foreign investor is accompanied by the financial statement prepared by the board of directors/higher management along with the evidence stating that it does not need to be audited, the audited financials shall not be mandatory.) |

| 3. | Certified copy of the document verifying the identity of the beneficial owner (not required in case of company listed in stock market). |

OR

ii) Document requirement in case for natural person as foreign investor:

| S.N. | Document |

|---|---|

| 1. | Certified copy of passport. (However, submission of copy of passport is not required for non-resident Nepalis for investments made in Nepal in case of otherwise.) |

05. Timeline for Recording of Investment in Nepal

The entire process of recording the investment at Nepal Rastra Bank (NRB) typically takes 15 to 20 working days from the date of submission of all required documents.

06. Consequences of Non-Compliance of Recording of Investment

The investment must be recorded with Nepal Rastra Bank (NRB) within six months of the remittance of the investment amount. This step is crucial, as failure to record the investment shall hinder future repatriation of capital, dividends, interest, or loan repayments at foreign country .

Also, the non-compliance is of recording NRB shall affect other regulatory, administrative work and legal proceedings of company.

Date of Publication: 03 July 2025

Disclaimer: This article published at our website is just for information purpose only. It shall not be taken as the legal advice, advertisement, personal communication, solicitation or inducement. Bhandari Law and Partners or any of the team members of the firm shall not be liable for the consequence arising of the information provided. As the factual situation may be different on your case, thereof if you need further legal advice on the subject matter, please Contact Us.

Related Professionals:

Frequently Asked Question

For quick legal assistance:

You can directly call to our legal expert: +977-9808811027

Even can call or drop a text through What’s app , Viber, Telegram and We Chat at the same number.

Also can do email on : info@lawbhandari.com

contact us

Phone :,

,Connect with our professional lawyers in Nepal :

Follow Our Law Firm on Social Media :