Table of content

-

Recognition of Sweat Equity in Nepal and Changing Dynamics of Business Ownership

01. Introduction

As startups and emerging businesses strive to innovate and scale with limited financial resources, many turn to unconventional yet effective methods to recognize and reward the contributions of their core teams. One such mechanism is sweat equity, a concept that allows individuals to acquire ownership in a company not by investing money, but by investing their time, skills, knowledge, or services. Sweat equity offers a powerful incentive, especially in the early stages of a company, by aligning the interests of founders, employees, and other key contributors with the long-term growth of the enterprise.

Globally, sweat equity has been an integral part of startup culture, particularly in countries like the United States and India, where venture ecosystems recognize non-monetary contributions as valuable capital. It enables companies to attract talent, retain founders, and share ownership without immediate financial outlays.

Nepal’s business environment is gradually transitioning into a more dynamic and inclusive landscape with the legal recognition of progressive concepts such as Employee Stock Ownership Plans (ESOPs) and Sweat Equity. Among the most significant developments in this regard is the formal acknowledgement of sweat equity through a recent amendment to the Companies Act, 2063.

With the inclusion of Section 18 (3A), (3B), (3C), (3D), and (3E) by the Act titled “An Act to Amend Certain Nepal Laws to Improve the Economic and Business Environment and Increase Investment,” published in the Nepal Gazette on Chaitra 18, 2081 (March 31, 2025), Nepal has, for the first time, acknowledged the concept of rewarding non-financial contributions with equity. This marks a pivotal shift in how ownership is perceived and distributed in Nepali companies, particularly startups and emerging ventures.

This article explores the meaning and importance of sweat equity, outlines the new legal provision, and analyzes how it is reshaping traditional ideas of business ownership in Nepal.

02. Understanding Sweat Equity

Sweat equity refers to shares or ownership interest given to individuals in return for their non-cash contributions such as labor, technical expertise, intellectual property, or strategic input towards the growth of a business. Unlike financial investors who contribute capital, sweat equity holders invest effort and talent, often during the early and risk-laden stages of a company’s life.

- Common beneficiaries of sweat equity include:

- Founders and co-founders

- Key employees or executives

- Technical advisors or mentors

- Creative and Research and Development contributors

Globally, sweat equity has been a standard practice in startup ecosystems to attract and retain skilled individuals when cash compensation isn’t feasible. Until recently, however, Nepal lacked a formal legal basis for such arrangements

03. Sweat Equity in Other Countries: A Comparative Glimpse

While Nepal has only recently recognized sweat equity through its 2025 amendment to the Companies Act, many countries have long embraced the concept as a key tool to incentivize founders, employees, and advisors specially in startups.

3.1 India

Under Section 54 of the Companies Act, 2013, Indian companies can issue sweat equity shares to directors or employees for contributions like technical know-how or intellectual property. Issuance requires approval through a special resolution passed in a general meeting.

The issuance is limited to 15% of paid-up equity or ₹5 crores per year, whichever is higher, with an overall cap of 25% of the paid-up capital. Sweat equity shares must be locked in for 3 years, and this restriction should be clearly indicated on the share certificates.

This framework, combined with SEBI regulations for listed companies, enables startups and growing businesses to reward non-monetary contributions effectively.

3.2 USA

Sweat equity is a common and widely accepted practice in the United States, especially in Silicon Valley and other startup hubs. Although there is no specific federal law titled "sweat equity law," the practice is facilitated through various legal mechanisms.

Founders’ agreements allocate shares based on initial contributions, reflecting the value each founder brings to the startup. Additionally, stock option plans and restricted stock agreements governed primarily by state corporate laws, such as those in Delaware, allow companies to grant equity to employees and contributors.

Vesting schedules are typically used to ensure that equity is earned over time, encouraging ongoing commitment before shares are fully vested. Furthermore, the U.S. Internal Revenue Service (IRS) provides detailed guidance on the tax treatment of these equity arrangements.

This flexibility and broad acceptance of sweat equity have played a significant role in fostering the rapid growth of American technology startups.

3.3 UK

In the UK, sweat equity means giving company shares to individuals like founders, employees, or advisors in return for their services instead of cash. This is allowed under UK law (Companies Act 2006), which lets private companies issue shares for non-cash contributions. The company’s board must approve it and ensure the value of the work is fair.

If the person receiving shares is an employee or director, it may be treated like salary, and they may have to pay income tax and social security (called National Insurance) at the time of receiving the shares. Later, when selling the shares, they may also pay Capital Gains Tax, but tax relief like Business Asset Disposal Relief can reduce this if conditions are met.

To stay compliant, companies often get the share value approved by the tax authority (HMRC) and may use special schemes like EMI for better tax treatment. The company must also prepare proper documents, sign agreements, update shareholder records, and file a form called SH01 with Companies House (similar to Nepal’s Office of Company Registrar).

04. Sweat Equity in Nepal: An Emerging Concept

Nepal has taken a progressive step by formally recognizing sweat equity in its corporate legal framework. With the amendment to the Companies Act, 2063, introduced through “An Act to Amend Certain Nepal Laws to Improve the Economic and Business Environment and Increase Investment” (published in the Nepal Gazette on Chaitra 18, 2081 / March 31, 2025), a new legal basis for issuing shares in exchange for non-cash contributions has been established. This is particularly beneficial for startups and innovative companies seeking to incentivize talent and partners without immediate cash outflow.

4.1 Legal Basis for Sweat Equity

The newly inserted Section 18 (3A) to (3E) of the Companies Act, 2063 explicitly permits companies to issue or grant rights to shares in return for non-cash contributions, even after incorporation.

Section 18(3A): A company may, after incorporation, issue or grant rights to acquire shares to promoters or other individuals in any form other than cash.

This is especially beneficial for companies that want to involve talent or collaborators later in the business lifecycle without requiring monetary investment.

4.2 Share Issuance Procedure and Shareholder Approval

Issuing sweat equity shares isn’t automatic, it requires proper approval and corporate action.

Section 18(3B): The company must pass a special resolution at a general meeting before issuing or selling shares for non-cash consideration. This provision also permits shares to be issued at a discount, enabling flexibility in valuation.

This ensures that all shareholders are informed and in agreement with the issuance, promoting transparency and governance.

4.3 Recognized for non-cash contribution

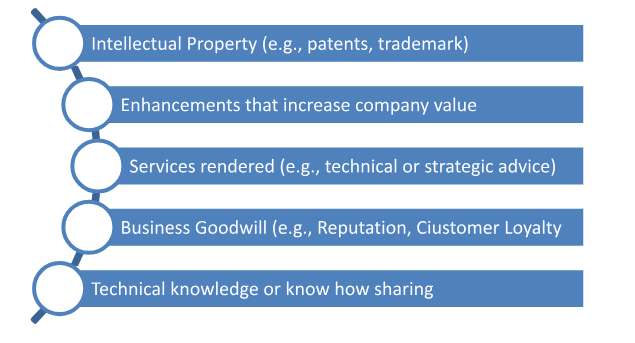

The law now formally accepts several types of intangible assets or efforts as valid contributions for sweat equity. Pursuant to section 18 (3C), the non-cash contribution may include:

These are now considered legally compensable through equity, aligning company interests with those of key contributors.

4.4 Valuation Requirement

To ensure that sweat equity is issued fairly and in accordance with professional standards, valuation is mandatory. This means that the company must determine the monetary value of the services or assets received just as it would value a cash investment. For example, if someone contributes software code or branding work, the accountant or engineer must estimate what that contribution is worth in monetary terms. That value is then used to calculate how many shares the contributor should receive.

The value of shares must be determined by:

- A certified engineer, where technical inputs or physical assets are involved, or

- A professional accountant, who must provide a reasoned and justifiable valuation basis supported by appropriate financial models or benchmarks.

4.5 Shares in Lieu of Employee Compensation

Under Section 18(3D) of the Companies Act, a company in Nepal may issue shares to an employee in lieu of remuneration, allowances, or other facilities, provided there is a written agreement between the company and the employee. This provision allows companies to manage their cash flow effectively while still compensating employees in a meaningful and potentially valuable way through ownership.

4.6 Cap on Issuance

According to Section 18(3E) of the Companies Act, the issuance of shares to promoters or any other persons as consideration other than cash must not exceed 20% of the company’s paid-up capital. This limit helps prevent excessive dilution of existing shareholders’ interests.

However, for companies registered as startup enterprises, the law provides greater flexibility, allowing the issuance of such shares to increase up to 40% of the paid-up capital. This higher threshold is designed to support startups in rewarding promoters and contributors who provide value through non-cash means, such as services or intellectual property, thus encouraging entrepreneurship and innovation.

Summary of Sweat Equity Provisions under Nepal’s Companies Act Amendment.

| Section | Provisions | Key Details |

|---|---|---|

| 18 (3A) | Legal Basis for Sweat Equity | Companies can issue or grant shares for non-cash contributions after incorporation. |

| 18 (3B) | Shareholder Approval | Issuance requires a special resolution at a general meeting; shares may be issued at a discount. |

| 18 (3C) | Recognized Non-Cash Contributions | Includes intellectual property, technical know-how, services, assets, and other intangible contributions. |

| 18 (3C) | Fair Valuation | Contribution value must be assessed by a certified engineer (technical/physical assets) or accountant (financial value). |

| 18 (3D) | Shares in Lieu of Employee Compensation | Companies may issue shares instead of salary, allowances, or benefits if there is a written agreement. |

| 18 (3E) | Cap on Issuance | Maximum 20% of paid-up capital for non-cash share issuance to promoters/others; 40% cap for startups. |

05. Changing Dynamics of business Ownership

Nepal’s corporate landscape is evolving with the legal recognition of sweat equity and ESOPs, moving beyond the traditional capital-focused ownership model. These provisions enable startups and growing companies to reward contributors through skills, time, and effort aligning Nepal with global startup practices and transforming how ownership and incentives work.

01. From Capital to Contribution

With the legal introduction of both sweat equity and Employee Stock Ownership Plans (ESOPs), Nepal is shifting from a model where ownership is solely tied to financial investment. Now, time, skills, and effort are also recognized as valuable contributions that can earn equity, broadening participation in company ownership.

02. Empowering Founders, Employees, and Advisors

Sweat equity enables founders and early team members who may lack capital to receive ownership for their work and ideas. Meanwhile, ESOPs provide a structured way for companies to offer equity-based incentives to a wider employee base, promoting inclusiveness and rewarding key contributors.

03. Attracting, Motivating, and Retaining Talent

Both sweat equity and ESOPs help startups overcome cash constraints by offering ownership stakes instead of high salaries. This alignment of interests encourages loyalty, motivates high performance, and strengthens the company’s growth potential.

04. Flexibility and Diversity in Ownership Structure

The coexistence of sweat equity and ESOP schemes introduces greater flexibility in designing equity distribution. Companies can tailor ownership to reflect diverse contributions, financial, intellectual, or operational, making ownership more balanced and dynamic

05. Need for Clear Regulatory Frameworks

As these mechanisms become more common, clear rules on valuation, issuance limits, lock-in periods, and tax treatment are essential to protect shareholder interests and ensure transparency.

06. Legal and Practical Analysis of Sweat Equity in Nepal

The formal introduction of sweat equity through Sections 18(3A) to 18(3E) of the Companies Act, 2063 (amended on Chaitra 18, 2081 / March 31, 2025) marks a pivotal development in Nepal’s corporate law. In a country where startups and early-stage companies often lack capital, this legal provision offers a practical solution allowing companies to issue shares in exchange for non-cash contributions such as expertise, intellectual property, or services.

By legally recognizing contribution-based ownership, Nepal aligns itself with global practices, supporting a more inclusive and innovation-driven business environment. The law sets a solid foundation: it allows post-incorporation issuance of shares for non-cash consideration, requires shareholder approval via a special resolution, mandates professional valuation, and limits such issuance to 20% for regular companies and 40% for startups ensuring a balance between flexibility and shareholder protection.

However, while the intent is progressive, the framework remains underdeveloped. Critical terms like “non-cash contribution” and “startup enterprise” are undefined. There is no guidance on vesting schedules, lock-in periods, or tax treatment, and procedural clarity is lacking. Without detailed implementing rules and oversight, the law risks being underutilized or misapplied.

To fully realize its benefits, coordinated efforts are needed ranging from regulatory clarification to professional training and awareness-building among stakeholders. Sweat equity has the potential to transform how companies build teams and distribute ownership, but its success will depend on effective implementation, governance, and trust.

07. Understanding Advantages of Sweat Equity in Nepal

Following shall be advantage of Sweat Equity in Nepal :

| S.N. | Advantage | Explanation |

|---|---|---|

| 1 | Encourages Innovation and Entrepreneurship | Empowers startups to build strong teams without relying solely on financial capital. |

| 2 | Incentivizes Talent and Loyalty | Attracts skilled professionals by offering ownership in place of or in addition to cash compensation. |

| 3 | Aligns Interests Between Contributors and the Company | Equity-based rewards foster a sense of ownership and long-term commitment. |

| 4 | Supports Startup Ecosystem Development | The higher 40% issuance cap for startups promotes a founder and talent friendly growth environment. |

| 5 | Improves Cash Flow Management | Enables companies to conserve liquidity while rewarding non-monetary value. |

| 6 | Legal Certainty and Shareholder Control | Requirement of a special resolution ensures transparency and informed shareholder involvement. |

| 7 | Valuation Requirement Enhances Fairness | Mandating valuation by professionals reduces the risk of arbitrary or inflated equity allocations. |

08. Understanding Disadvantages of Sweat Equity in Nepal

Following shall be drawbacks of Sweat Equity in Nepal:

| S.N. | Disadvantage | Explanation |

|---|---|---|

| 1 | No Vesting or Lock-in Provisions | No Vesting or Lock-in Provisions. |

| 2 | Unclear Tax Implications | The law is silent on income tax or capital gains tax treatment of sweat equity. |

| 3 | No Detailed Procedural Guidelines | No rules on timelines, forms, reporting obligations, or regulatory filings have been issued. |

| 4 | No Regulatory Oversight or Appeal Mechanism | Disputes over valuation or eligibility may arise without a clear grievance redressal body. |

| 5 | Risk of Equity Manipulation | Without safeguards, companies could undervalue contributions to issue shares to insiders improperly. |

| 6 | Low Financial Literacy | Many small companies may struggle to understand and properly implement sweat equity provisions. |

09. Implementing Challenges in Nepal

| S.N. | Challenge | Explanation |

|---|---|---|

| 1 | Lack of Awareness Among Entrepreneurs | Many business owners are unaware of the new provisions or their practical use cases. |

| 2 | Shortage of Qualified Valuers | Nepal lacks enough certified accountants and engineers with experience valuing intangible assets. |

| 3 | Regulatory Vacuum | No supporting regulations or guidelines have been issued by the Company Registrar or related bodies. |

| 4 | No Tax Guidance | Tax treatment of sweat equity is uncertain for both the company and recipient. |

| 5 | Administrative and Legal Complexity | Without streamlined procedures, the compliance burden may deter companies from using sweat equity. |

| 6 | Investor Caution | Investors may view companies using sweat equity as riskier without strong governance safeguards. |

| 7 | Difficulty in Certifying Startups | No formal criteria or process for determining who qualifies as a "startup enterprise." |

Date of Publication: June 22, 2025

Disclaimer: . This article published on website of the law firm is just for information purpose only. It shall not be taken as the legal advice, advertisement, personal communication, solicitation or inducement. Bhandari Law and Partners or any of the team members of the firm shall not be liable for the consequence arising of the information provided. As the factual situation may be different on your case, thereof if you need further legal advice on the subject matter, please Contact Us.

Related Professionals:

Frequently Asked Question

For quick legal assistance:

You can directly call to our legal expert: +977-9808811027

Even can call or drop a text through What’s app , Viber, Telegram and We Chat at the same number.

Also can do email on : info@lawbhandari.com

contact us

Phone :,

,Connect with our professional lawyers in Nepal :

Follow Our Law Firm on Social Media :