Table of content

-

Real Estate Law in Nepal: Key Highlights

01. Background

Real state can be understood as a real property i.e.- land and any permanent structures built over it. With the increasing demand of land and housing specially in city areas, the real estate market has grown significantly in recent time and is continuously evolving. The concept of development, commercial space and urbanization has added the value to the booming market of real estate.

Considering this scenario, it’s clear that the real estate area is growing rapidly, and it needs to be well regulated in order to prevent wrongful real estate market practice.

Illegal market practice on real estate sector is strictly prohibited in Nepal. Real estate transaction must be done following the procedure set under real estate laws. The Muluki Civil Code, 2017 (2074) contains the major provisions relating to real estate along with several other specific acts and regulations.

02. Governing laws

The primary laws governing real estate in Nepal include the Muluki Civil Code 2017 (2074), Land (Measurement) Act 2019, Land Revenue Act,1977 (2034), Town Development Act 1998 (2045), and various local government bylaws. These laws regulate property ownership, registration, transfer, inheritance, leasing, and foreign ownership. Among others, following are the major governing laws on real estate in Nepal:

| S.N. | Act | Details |

|---|---|---|

| 1 | Constitution of Nepal 2015 (2072) | Article 25 guarantees the right to property, allowing individuals to acquire, own, and sell property, subject to legal provisions. |

| 2 | Muluki Civil Code, 2017 (2074) | Outlines property rights, contracts, inheritance, and obligations. |

| 3 | Land Act, 1964 (2021) | Regulates land ownership, tenancy, and land ceiling provisions. |

| 4 | Land Revenue Act, 1977 (2034) | Manages land registration, transfer, and taxation. |

| 5 | Land Acquisition Act, 1977 (2034) | Provides procedures for government acquisition of private land for public purposes. |

| 6 | Apartment Ownership Act, 1997 (2054) | Governs ownership and management of apartments. |

| 7 | Foreign Investment and Technology Transfer Act, 2019 (2075) | Regulates foreign investment, including in real estate. |

03. Due diligence of real estate

Due diligence is an essential step before purchasing any real estates. It involves a thorough investigation to identify liabilities and to avoid potential legal and financial risks associated with a property. Failure to conduct proper due diligence can result in legal complications and financial loss.

Key aspects of due diligence include:

3.1 Ownership verification:

Obtaining the original Land Ownership Certificate (Lalpurja) from the Land Revenue Office and verifying history of ownership and transfers to ensure a clear title.

3.2 Encumbrance Check:

To Obtain from the Land Revenue Office to ensure that the land is free from loans, mortgages, or court orders.

3.3 Tax Clearance:

Verifying that all property taxes (land revenue tax, house tax, etc.) are paid up to date by obtaining tax clearance certificates from the local municipality/ward office and Land Revenue Office.

3.4 Litigation History:

Investigating whether there is any past or pending legal disputes related to the property.

3.5 Physical Condition Assessment:

Visiting the site or appointing a licensed surveyor to confirm the accuracy of land maps and precise demarcation lines. Ensuring that the actual plot matches the official maps (Naksa) and checking if there is any illegal occupation or encroachments.

04. Transfer Process of Real Estate/ Property in Nepal

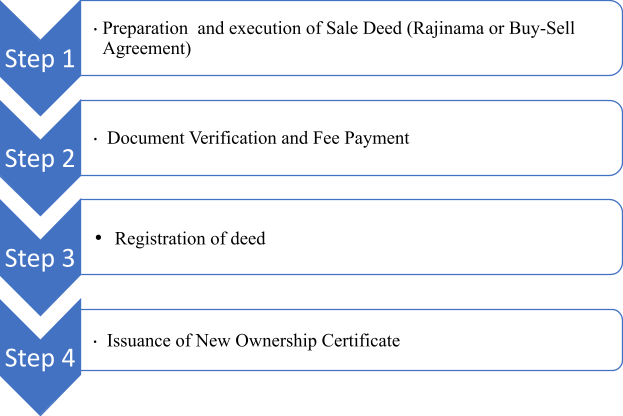

The transfer of real estate/property in Nepal is done by the Land Revenue Office (Malpot Karyalaya). The process of transferring real estate mainly involves following steps:

Step – 1: A licensed deed writer (Lekhandas) or a lawyer drafts the transfer deed (Rajinama), a legal document detailing the transaction, to be signed by both parties.

Step – 2: The Land Revenue Office verifies all documents and calculates applicable transfer fees and taxes. Parties have to make the Payment of applicable taxes and fees.

Step – 3: After fulfilling all the requirements the sale deed is registered at the Land Revenue Office, updating the ownership records.

Step – 4: The Land Revenue Office issues new ownership certificate and the buyer receives a new ownership document (lalpurja) in their name.

Please note that the tentative time frame for the completion of real estate transfer is 3 to 4 working days. Depending on the complexity of transaction (if there are disputes or irregularities in the property records it may take longer than this.

05. Tax Applicable for While Transferring the Real Estate Property

- Capital Gains Tax: Payable by the seller at 5% if the property has been owned for more than 5 years, the CGT is 7.5% of the profit if owned for less than 5 years.

- Registration Fee: Usually up to 5% of the property valuation as per the government-assessed rate.

- Local Tax: Some local bodies charge a local property transfer tax (up to 2%).

- Property Tax (Malpot): This is an annual land tax that needs to be paid by the property owner. It's crucial to ensure all previous years' taxes are cleared before transfer.

Please note that above mentioned fees and tax are tentative and is subject to change.

06. Valuation of Real Estate

Valuing a property is essential for mortgage, selling, and tax considerations. The government uses the Land Revenue Office to value real estate using official rates, which are frequently less than market rates. Although banks or certified appraisers may conduct private valuations for loan or investment purposes, the official rate is utilized for legal purposes (tax calculation, registration).

Common methods of real estate valuation are:

- Government Valuation: The Land Revenue Office sets a minimum value for tax purposes.

- Market Valuation: Reflects the property's current market value, often higher than the government valuation.

- Professional Appraisal: Banks and financial institutions may require an independent valuation for loan approvals.

07. Leasing of Real Estate Property

Leasing and rental agreements in Nepal are primarily governed by the Muluki Civil Code, 2017 (2074), under chapter -9, section (383-405). Laws define rights and obligations for landlords (e.g., providing essential services) and tenants (e.g., paying rent, maintaining property).

- Lease Agreement: Should be in writing, specifying terms, duration, and rent and must be registered with the local Land Revenue Office. However, a written agreement is not mandatory if the monthly rent does not exceed NPR 20,000. (Section 386)

- The period of house rent shall be as set forth in the agreement, not exceeding five years however there shall be an exception provided that if a house is rented for a commercial purpose. (Section 385)

- Tenant Rights: Tenants have rights against arbitrary eviction, and landlords must provide proper notice for termination before 35 days. (Section 401)

08. Foreign Ownership of Real Estate

There is a very strict law regarding foreign ownership over immovable property in Nepal to preserve national interest and land resources. Foreigners are not allowed to acquire any ownership over real estate. Non-resident Nepalis (NRNs) have more flexibility and can own limited residential property. Section 432 of the Muluki Civil Code 2017 (2074) of Nepal specifically prohibits immovable property transfers to foreigners without prior government approval. This clause forbids foreigners from acquiring land in Nepal. There are, however, some exceptions:

- Foreign investors who set up a business in Nepal are able to buy real estate for their enterprise, as long as they do so through a company that is registered in Nepal.

- Through long-term leasing (up to 50 years), or via joint ventures with Nepali partners.

- Diplomatic missions and international organizations can acquire property with government approval.

09. Inheritance and Succession of Real Estate

The Muluki Civil Code 2019 (2074) is the main law governing succession and inheritance. It guarantees equal inheritance rights for sons and daughters to family property. Parents also inherit if there are no lineal descendants.

It recognizes both:

9.1 Testate succession (with a will):

Follows the testator's wishes. One can create a will to dictate the distribution of their self-acquired property after their demise. The will must comply with legal requirements to be valid.

9.2 Intestate (without a will) succession:

Property is typically divided equally among legal heirs which follows a detailed order of preference starting with the husband or wife in an undivided family, followed by sons, daughters, and other relatives. With special provisions for widows and unborn child.

- Such heirs inheriting property are generally obliged to settle the deceased's debts and liabilities, though not exceeding the value of the inherited property.

- Individuals who intentionally cause the death of the deceased for succession purposes are disqualified from inheriting.

- NRNs are generally eligible to acquire property through inheritance, and special provisions apply to the transfer and registration of such property in their name.

10. Dispute Resolution in Real Estate

Number of problems can lead to real estate disputes, such as fights over inheritance, ownership claims, boundary disputes, contract violations, and landlord-tenant conflicts. There exist multiple mechanisms for resolution. Such as:

Negotiation: The first and frequently chosen approach is negotiation, in which parties try to settle the conflict directly and amicably.

Mediation: Through communication facilitation and assistance in reaching a mutually agreeable solution, a mediator acts as a neutral third party. Mediation Act of 2011(2068) governs this procedure. Both private and court-annexed mediation are in practice.

Arbitration: Disputes may be submitted to one or more arbitrators, who will render a legally enforceable ruling. In Nepal, arbitration is governed under the Arbitration Act, 2055 (1999). Arbitrators' decisions are final and enforceable.

Beside these alternative dispute resolution method, other formal means of dispute resolution such as Court litigation, local level judicial committee and quasi-judicial bodies can always be invoked.

Date of Publication: 05 June 2025.

Disclaimer: This article published at our website is just for information purpose only. It shall not be taken as the legal advice, advertisement, personal communication, solicitation or inducement. Bhandari Law and Partners or any of the team members of the firm shall not be liable for the consequence arising of the information provided. As the factual situation may be different on your case, thereof if you need further legal advice on the subject matter, please Contact Us.

Related Professionals:

Frequently Asked Question

For quick legal assistance:

You can directly call to our legal expert: +977-9808811027

Even can call or drop a text through What’s app , Viber, Telegram and We Chat at the same number.

Also can do email on : info@lawbhandari.com

contact us

Phone :,

,Connect with our professional lawyers in Nepal :

Follow Our Law Firm on Social Media :