Table of content

-

Post-Incorporation Compliance for FDI Companies in Nepal

01. Introduction

Foreign Direct Investment (FDI) companies in Nepal must adhere to a series of mandatory post-incorporation compliance requirements after the company formation as stipulated by Nepalese law. This article provides a comprehensive and professional guide to these obligations, ensuring foreign investors can maintain regulatory compliance and operate effectively within Nepal’s legal framework.

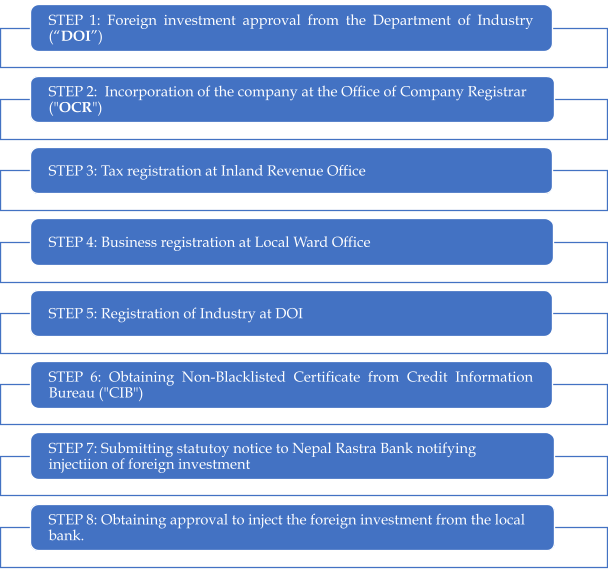

The incorporation of an FDI company in Nepal involves several critical steps, including:

Upon completion of these steps, FDI companies must fulfill post compliance obligations to remain in good standing. This article outlines these requirements, compliance tasks, to assist foreign investors in navigating Nepal’s regulatory environment.

02. Post-Compliance Obligations

Following compliance has to be done after FDI Company incorporation:

2.1. Labor Law Compliance

Compliance with Nepal’s labor laws requires the preparation of a company handbook and the execution of employment agreements with staff to ensure adherence to employment regulations. The Company further need to be enrolled in Social Security Fund which is contribution based social security scheme. Please refer to this article if you want to know more about Labor law in Nepal: https://lawbhandari.com/publication/labor-law-in-nepal:-highlights-of-labor-act-2017-(2074)

2.2. Completion of Three-Month Compliance

The following tasks must be completed within three months of incorporation to ensure compliance with the Companies Act of Nepal.

a. Registration of Office Address

Under Section 184 of the Companies Act, private companies, including FDI entities, are required to register their office address with the OCR within three months of incorporation. This submission must include contact details such as telephone, fax, and email. Any subsequent changes to the registered address must be promptly notified to the OCR to maintain accurate records.

b. Formation of the Board of Directors

Section 86 of the Companies Act mandates that private companies establish a Board of Directors in accordance with their Articles of Association (AOA) within three months of incorporation. Section 97 further stipulates that the AOA governs the procedures for board meetings. The appointment of directors must be documented in meeting minutes, which should be retained as part of the company’s official records.

c. Appointment of an Auditor

As per Section 110 of the Companies Act, every private company must appoint an auditor. Section 111 specifies that the auditor is selected based on the Memorandum of Association (MOA), AOA, or a shareholder consensus. In the absence of such an agreement, the auditor is appointed at a general meeting. The OCR must be notified of the auditor’s appointment within 15 days, and the initial auditor serves until the company’s first Annual General Meeting (AGM).

2.3. Injection of Foreign Investment Amount

Foreign investment must be remitted to Nepal in convertible foreign currency through authorized banking channels, as outlined in Rule 9 of the Foreign Investment and Technology Transfer Regulation, 2077 (FITTR). Indian investors may remit funds in Indian rupees. The FITTR specifies a three-stage investment injection schedule:

| Stage | Timeline | Percentage of Investment |

|---|---|---|

| Stage 1 | Within 1 year of investment approval | 25% (NPR 20M), 15% (NPR 20M–250M), or 10% (NPR 250M–1B) |

| Stage 2 | Upon commencement of production or commercial transactions | Up to 70% of the investment |

| Stage 3 | Within 2 years of production or transaction commencement | Remaining 30% of the investment |

The full authorized capital must be injected within two years from the commencement of production or commercial transactions.

Kindly Note to ensure the investment is recognized, the following procedures must be followed:

- Funds must be transferred from the investor’s personal bank account (for individuals) or corporate bank account (for entities) to the FDI company’s local bank account established during incorporation.

- The transfer must be executed via SWIFT payment; other methods are not recognized as valid investments.

- During the injection of investment amount the investor shall mention “Capital Investment” or similar remarks on purpose of injection of capital. In case wrong purpose is written on remarks bank may not recognize such payment as investment.

- Upon completion of the transfer, the local bank issues an investment inflow certificate and a SWIFT transfer message.

2.4. Receiving the Shareholder Registry from OCR

Following receipt of the investment inflow certificate, companies must obtain a share registry from the OCR. Required documents include:

- Board meeting minutes.

- Investment details.

- Investment inflow certificate and bank statement reflecting the remitted funds.

The OCR verifies these documents and issues an approved share registry, which serves as a record of the investment tied to the company’s shares.

2.5. Obtaining Business Visa

If a foreign individual or a corporate entity from foreign jurisdiction intends to invest in Nepal, such individuals or representatives of the corporate entity can obtain a business visa in Nepal if they intend to stay in Nepal. This visa is necessary for their stay and for conducting business operations within Nepal. It's important to note that any foreign national wishing to work in Nepal must obtain either a business visa or a work permit in compliance with the country's regulations.

Please refer to this article if you want to know more about business visa: https://lawbhandari.com/publication/procedure-of-obtaining-business-visa-in-nepal

2.6. Recording of foreign investment at Nepal Rastra Bank

The investment must be recorded with Nepal Rastra Bank (NRB) using the investment inflow certificate and approved share registry within 6 months of injection of investment amount. This step is critical, as unrecorded investments may complicate future repatriation of capital or profits.

2.7. Industry Operation and Extension

FDI companies must commence operations within one year of industry registration with the Department of Industry. Prior to commencing operations, at least 70% of the authorized capital must be injected. The issuance of the first invoice marks the start of operations, and companies must notify the Department of Industry within 30 days of this event. Non-compliance may result in fines.

If operations cannot commence within one year, companies must apply for an extension at least one month prior to the expiry of the industry registration. And Industry Operation Annual Report has to be submitted every year after the industry commencement fiscal year.

2.8. Annual General Meeting (AGM)

Companies are required to convene their first AGM within one year of incorporation, submitting the following documents to the OCR:

- Details of the AGM, confirming adherence to the Companies Act.

- Audited financial statements and an audit report for the fiscal year.

From the second year onward, AGMs must be held annually, with annual reports submitted to the OCR within six months of the fiscal year-end (typically June or July).

2.9. Tax Compliance

FDI companies must comply with the Income Tax Act, 2058, which includes the following obligations:

- Record Retention: Maintain books of account, invoices, and related documents for at least five years following the relevant fiscal year.

- Income Tax Returns: File income tax returns with the IRD within three months of the fiscal year-end.

- Advance Tax Payments: Remit 40% of the estimated tax by the end of Poush (mid-January), 70% by the end of Chaitra (mid-April), and 100% by the end of Ashad (mid-July). Companies taxed on transactions may follow a different schedule.

- Tax Deducted at Source (TDS): Withhold applicable taxes as per the Income Tax Act and submit a TDS statement to the IRD within 25 days of the month’s end, preferably via electronic submission (e-TDS).

Please refer to this article if you want to know more about taxation for FDI companies in Nepal: https://lawbhandari.com/publication/understanding-tax-law-for-local-and-fdi-companies-in-nepal

2.10. Repatriation

Foreign Investor may repatriate its investment, dividends and royalties etc. upon obtaining the approval of governing bodies after the paying all the applicable taxes in accordance with the Prevailing law of Nepal.

Investors may repatriate funds at the prevailing exchange rate. Repatriation can occur in a) the same foreign currency originally invested, or b) in a different foreign currency, for which approval from NRB will be required.However, Foreign investor are not allowed to repatriate their investment amount during the 1st year of investment. NRB sets out the condition at the of granting its approval.

Please refer to this article published by our law firm if you want to know more about repatriation process of capital and profit: https://lawbhandari.com/publication/repatriation-of-foreign-investment-and-returns-in-nepal

03. Conclusion

Post-incorporation compliance is a critical aspect of operating an FDI company in Nepal. By diligently addressing the three-month compliance requirements, conducting AGMs, initiating industry operations, injecting foreign investment in accordance with regulatory guidelines, and fulfilling tax and labor obligations, companies can maintain compliance and mitigate risks. Timely coordination with the OCR, Department of Industry, NRB, and IRD is essential to ensure seamless operations. Engaging local lawyer is recommended to navigate these requirements effectively and support long-term success in Nepal’s business environment.

Date of Publication: June 22, 2025

Disclaimer: . This article published on website of the law firm is just for information purpose only. It shall not be taken as the legal advice, advertisement, personal communication, solicitation or inducement. Bhandari Law and Partners or any of the team members of the firm shall not be liable for the consequence arising of the information provided. As the factual situation may be different on your case, thereof if you need further legal advice on the subject matter, please Contact Us.

Related Professionals:

Frequently Asked Question

For quick legal assistance:

You can directly call to our legal expert: +977-9808811027

Even can call or drop a text through What’s app , Viber, Telegram and We Chat at the same number.

Also can do email on : info@lawbhandari.com

contact us

Phone :,

,Connect with our professional lawyers in Nepal :

Follow Our Law Firm on Social Media :