Table of content

-

Franchise Law in Nepal: Franchise of Foreign Brand in Nepal

This article explains detail procedure about the franchise of foreign brand in Nepal. Nepalese Company desiring to franchise the foreign brand should take approval from Department of Industry before the operation of the franchise business. Detail is explained in below paragraph.

1. Governing law of franchise in Nepal

There is no specific law regarding foreign franchise in Nepal. Somehow, the Foreign Investment and Technology Transfer Act, 2019(2075) ("FITTA") has provided term "technology transfer" and franchise falls under the category.

FITTA has defined technology transfer as any transfer of technology to be made under an agreement between an industry and a foreign investor on the matter of:

- a. Patent, design, trademark, goodwill, technological specificity, formula, process,

- b. User’s license, technological know-how sharing or use of technological knowledge (franchise),

- c. Foreign technical adviser, management and marketing service or other technological skill or knowledge.

Besides FITTA, other governing laws for the foreign franchise in Nepal are:

- a. Patent Design and Trademark Act, 2022 (1965) ("PDTA")

- b. Foreign Investment and Technology Transfer Regulations 2022 (2077)

2. Pre-conditions for the approval of franchise of foreign brand

The trademark registration of the foreign brand is the pre-conditions for the approval of franchise of foreign brand in Nepal. The detail regarding the registration of trademark is as mentioned:

2.1 Process of Registration of trademark in Nepal

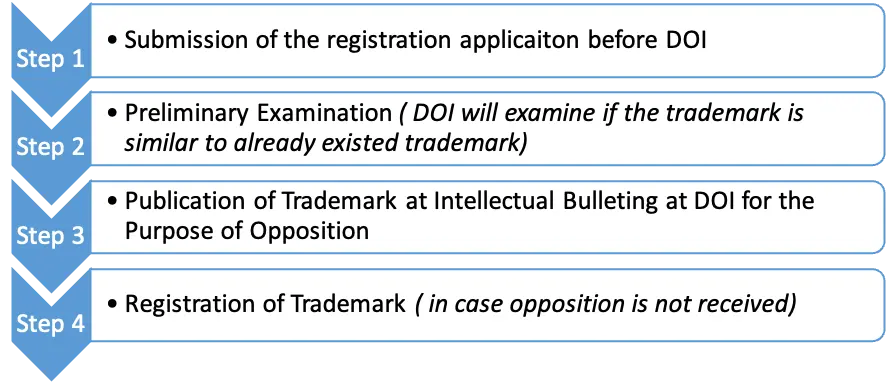

Without registration of trademark under Department of Industry, no one shall do franchise agreement. The process for the registration of trademark in Nepal is as follow:

2.2 Time required for trademark registration in Nepal

The interval of time for the registration of trademark in Nepal 6 to 8 months, if no opposition file petition against the applied trademark.

2.3 Registration of Trademark based on priority

Section 21C of the PDTA provides that the DOI can register a foreign trademark in Nepal without conducting examination. The home registration certificate is considered a major basis for registration of the foreign trademark in Nepal. Further the PDTA also allows the trademark to be registered based on priority claim as recognized by the Paris Convention. The priority claim period is of 6 months.

2.4 Renewal and validity of trademark in Nepal

A trademark once registered is valid for 7(seven)years from the date of registration. Trademark can be renewed for any number of times for a period of 7(seven) years at a time.

Trademark should be renewed within the period of 35(Thirty-Five) days from the date of expiry of the validity of the trademark. The PDTA also provides right to the trademark holder to renew the trademark by making payment of penalty of NPR. 1,000(One Thousand Rupees only) within 6(Six)months from the expiry of the validity period.

3. Procedure for franchising foreign brand in Nepal

FITTA has provided the procedures for the franchising of foreign brand in Nepal. The procedures are as follows:

4. Required documents for franchising foreign brand

The documents that require for the franchising foreign brand in Nepal are:

- a. An original copy of application of licensing of foreign brand

- b. A notary certified copies of Foreign Registration Certificate of Licensor or Passport of Foreign partner including Memorandum of Association (MOA) and Articles of Association (AOA) of the foreign company.

- c. Two(2) copies of the Franchise Agreement or other related agreement (if any exist).

- d. A copy of the certificate of incorporation including MOA and AOA of local company.

- e. Company profile or Bio-data of foreign investor.

- f. Industry registration certificate of a local company along with authorized representative in Nepal.

- g. A copy of minute of boards of local company and foreign company.

- h. A notary certified copy of Current Audit Report and Tax Clearance Certificate.

- i. A notary certified copy of power of attorney.

5. Royalty rate for technology transfer

The royalty rate for other technology transfer agreement

| Royalty | Local Sales | Export Sales |

|---|---|---|

| Total amount or total sales amount. | Up to 5% of total sales excluding VAT. | Up to 10% of total sales excluding VAT. |

| If royalty is based on net profits. | Up to 15% of net profits. | Up to 20% of net profits. |

Royalty rate trademark franchise agreement :

| Local Sales | Export sales |

|---|---|

| Up to 2% of total sales excluding VAT for alcoholic and tobacco industry | Up to 5% of total sales excluding VAT for alcohol and tobacco industry |

| Up to 3% of total sales excluding VAT for other industries | Up to 6% of total sales excluding VAT for other industries |

Disclaimer: Bhandari Law and Partners is one of the leading law firm in Nepal with team of best professional lawyers in Nepal.This article published on website of the law firm is just for information purpose only. It shall not be taken as the legal advice, advertisement, personal communication, solicitation or inducement. Bhandari Law and Partners or any of the team members of the firm shall not be liable for the consequence arising of the information provided. As the factual situation may be different on your case, thereof if you need further legal advice on the subject matter, please Contact Us.

Related Professionals:

Frequently Asked Question

For quick legal assistance:

You can directly call to our legal expert: +977-9808811027

Even can call or drop a text through What’s app , Viber, Telegram and We Chat at the same number.

Also can do email on : info@lawbhandari.com

contact us

Phone :,

,Connect with our professional lawyers in Nepal :

Follow Our Law Firm on Social Media :