Table of content

-

Highlights of Foreign Investment and Technology Transfer Act 2019(2075)

01. Background

The Foreign Investment and Technology Transfer Act, 2019(2075) (“FITTA”) and Foreign Investment and Technology Transfer Rule, 2021(2077) (“FITTR”) are the principle law governing foreign investment in Nepal. This article gives a clear overview of FITTA and FITTR, the approval process, required documents, and the rights and responsibilities of foreign investors, helping potential investors understand how to start and manage their investment in Nepal. The reading of the FITTA needs to be done together with Public Private Partnership and Investment Act 2075 (2019) (“PPPI”), Industrial Enterprises Act, 2076 (2020) (“IEA”) as well as Foreign Exchange Regulation Act 2019 (1962) (“FERA”) for a comprehensive study.

02. Governing Autority

The authorities dealing with the approval, regulation, management, facilitation and monitoring of the foreign investment includes following:

| S.N. | GOVERNING AUTHORITIES | FUNCTIONS |

|---|---|---|

| 1 | Department of Industries (DoI) | The DoI approves foreign investments, facilitates registration and approvals, maintains records of investments and technology transfers, oversees repatriation of investment and income, recommends visas for investors and foreign staff, and monitors compliance to prevent misuse of government-provided facilities. |

| 2 | Investment Board Nepal (IBN) | IBN is responsible for regulating the foreign investments in its implementation and execution phase after the approval by DoI. It advises the government on Foreign Direct Investment (FDI) related policies, and assists in resolving repatriation and investment-related issues. |

| 3 | Nepal Rastra Bank (NRB) | NRB regulates the inflow of foreign currency, grants approval for foreign exchange transactions, oversees loan and repatriation activities, and ensures all financial dealings related to FDI comply with Nepal’s financial and monetary laws. |

03. Definition of Investment

The FITTA does not define the investment per se. However, Section (j) of the Act lists out investments that could be termed "Foreign investment" if made by a foreign investor in an industry or company:

a. Share investment in foreign currency,

b. Re-investment in an industry of dividends derived from foreign currency or shares,

c. Lease finance

d. Investment made in venture capital fund

e. Investment made in listed securities through secondary securities market

f. Investment made by purchasing shares or assets of a company incorporated in Nepal,

g. Investment received through the banking channel after issuing securities in a foreign capital market by an industry or company incorporated in Nepal

h .Investment made through technology transfer, or Investment maintained by establishing and expanding an industry in Nepal

The following acts have been added within the definition of foreign investment through an amendment:

a. Investment in units of a Specialized Investment Fund (“SIF”)

b. Equity investments in Nepali industries by purchasing units of capital investment funds (venture capital funds) or specialized investment funds registered with the Securities Board of Nepal, subject to prior approval from the Securities Board of Nepal.

The FITTA is not applicable in foreign investment in certain sectors regulated by separate legislations. For instance, NRB Act 2058 (2002) regulates the foreign investment in banking sectors.

04. Loan Financing

Section 11 and Section 12 of the FITTA has provision of loan financing through foreign capital markets and foreign financial institutions respectively.

| Category | Description | Key Requirements |

|---|---|---|

| Foreign Capital Markets | FITTA allows public limited companies or corporate bodies authorized to issue securities to raise foreign investment by borrowing loans or acquiring foreign currency through the issuance of bonds, debentures, or other securities in international capital markets. | • Approval from both the Nepal Rastra Bank (NRB) and the Securities Board of Nepal (SEBON) • Capital raised must be invested in Nepal. |

| Foreign Financial Institutions | FITTA allows an industry with foreign investment to borrow a project loan from, or a loan by entering into a project financing agreement with, any foreign financial institution. | • Must obtain recommendation from the Ministry of Industries, Commerce and Supplies • Requires approval from the Nepal Rastra Bank • Must comply with Nepal’s prevailing financial and foreign exchange regulations. |

05. Technology Transfer

Pursuant to Section 7 of the Act, a foreign investor can invest through technology transfer by entering into a formal agreement with a local industry. As per Section 2(f) of the Act, technology transfer refers to any transfer of technology under a formal agreement between a Nepali industry and a foreign investor. This may include:

a. Intellectual Property Rights such as patents, trademarks, designs, goodwill, technical specifications, and proprietary formulas or processes.

b. Licensing Arrangements including the right to use technical knowledge, brand franchises, or technological know-how.

c. Provision of Services such as “management and technical services, information technology, marketing and market research, finance, accounting and auditing, engineering, outsourcing, human resource outsourcing, digital data processing and digital data migration, design services or other technical skills or knowledge.”

The terms and conditions of such agreement must be explicitly mentioned, and it must not stipulate a royalty repatriation amount exceeding the ceiling prescribed by the government.

The royalty rate for technology transfer agreement includes following:

| Category | Description | Key Requirements |

|---|---|---|

| Foreign Capital Markets | FITTA allows public limited companies or corporate bodies authorized to issue securities to raise foreign investment by borrowing loans or acquiring foreign currency through the issuance of bonds, debentures, or other securities in international capital markets. | • Approval from both the Nepal Rastra Bank (NRB) and the Securities Board of Nepal (SEBON) • Capital raised must be invested in Nepal. |

| Foreign Financial Institutions | FITTA allows an industry with foreign investment to borrow a project loan from, or a loan by entering into a project financing agreement with, any foreign financial institution. | • Must obtain recommendation from the Ministry of Industries, Commerce and Supplies • Requires approval from the Nepal Rastra Bank • Must comply with Nepal’s prevailing financial and foreign exchange regulations. |

Royalty rate for Trademark Franchise Agreement includes following:

| Sales Type | Alcohol and Tobacco Industry | Other Industries |

|---|---|---|

| Local Sales | Up to 2% of total sales excluding VAT | Up to 3% of total sales excluding VAT |

| Export Sales | Up to 5% of total sales excluding VAT | Up to 6% of total sales excluding VAT |

06. Minimum Investment Amount

The FITTA provides that the minimum cap for equity amount of foreign investment would be as prescribed. Currently, the minimum investment amount has been reduced to Rs. 20 million (approximately USD 15 hundred thousand) from Rs 50 million in the project. However, there exists no such minimum investment for the IT company.

07. Approval Requirement

The process of approving FDI in Nepal begins with the submission of an application to DoI, which is the Foreign Investment Approving Body under Section 17 of the FITTA. Following requirements need to be satisfied for FDI approval process:

7.1 Determination of Type and Eligibility of Investment

Foreign investment is only limited to industrial activities and not for trading activities. To initiate foreign investment in Nepal, a foreign investor must first verify that the proposed investment falls under permissible categories. The permissible categories include:

a. The sectors that are not included in the restricted sectors under Schedule of the FITTA (“Negative List”)

Even if a sector is not under the Negative List, if it is not included in the Positive List as a industry, then also the investment is not allowed; the investment must comply with both the Positive and Negative Lists.

Industries or Businesses Restricted for Foreign Investment (“Negative List”

i. Poultry farming, fisheries, bee-keeping, fruits, vegetables, oil seeds, pulse seeds, milk industry and other sectors of primary agro-production,

ii. Cottage and small industries,

iii. Personal service business (hair cutting, tailoring, driving etc.),

iv. Industries manufacturing arms, ammunition, bullets and shell, gunpowder or explosives, and nuclear, biological and chemical (N.B.C.) weapons; industries producing atomic energy and radio-active materials,

v. Real estate business (excluding construction industries), retail business, internal courier service, local catering service, moneychanger, remittance service,

vi. Travel agency, guide involved in tourism, trekking and mountaineering guide, rural tourism including homestay,

vii. Business of mass communication media (newspaper, radio, television and online news) and motion picture of national language, Management, account, engineering, legal consultancy service and language training, music training, computer training, and

ix. Consultancy services having foreign investment of more than fifty-one percent.

In addition, investors must also identify the form of investment such as equity, lease financing, technology transfer, or securities trading outlined in Section 3 and 5 to 11 of the FITTA.

7.2 Supporting Documents

While FITTA refers to “prescribed” documents, in practice, the following are commonly required:

a. Company registration certificate of the foreign investor (from the investor's home country)

b. Passport copy (for individual investors)

c. Board resolution or a letter of intent from the investor company authorizing investment

d. Financial statements or bank guarantee to show capital availability

e. Project proposal or business plan, including projected costs, employment generation, and returns

f. Technology transfer agreement, if applicable

g. Lease agreement or land ownership documents, if premises are secured

h. Joint venture agreement, if the investment is made with a Nepali partner

i. Power of attorney, if someone is authorized to act on behalf of the investor (must be notarized)

08. FDI Approval Process in Nepal

The FDI approval process begins with the submitting the application and the proposal to the foreign investment approving authority in Nepal in the format prescribed by them. The step-by-step process is given below:

Step 1 : Foreign Investment approval from Dol

Step 2: Incorporation of the Company at the Office of Company Registrar

Step 3: Business Registration at the Local Ward Office

Step 4: Tax Registration at the Inland Revenue Office

Step 5 : Registration of the Industry at Dol

Step 6: Obtaining Non-Blacklisted Certificate from Credit Information Bureau (CIB)

Step 7: Obtaining Approval to inject the Foreign Investment from the local bank wherein the subsidiary company has maintained its account

Step 8: Submitting Statutory notice to Nepal Rastra Bank notifying injecition of foreign investment

09. Capital Injection

The investment capital should be brought into Nepal in convertible foreign currency through authorized banking channels, as outlined in Rule 9 of the Foreign Investment and Technology Transfer Regulation, 2077 (2020) (“FITTR”). Indian investors are allowed to use Indian rupees for this purpose.

FITTR has categorized 3 stages of timeline to inject the foreign investment amount. The schedule of investment as mentioned:

| Stages | Details | Percentage of Injection of Investment |

|---|---|---|

| Stage I | Within 1 year of receiving the investment approval | Depends on the amount of investment |

| Minimum investment amount i.e. NPR 20 Million | 25% | |

| 20 to 250 million NPR | 15% | |

| 250 million NPR to 1000 Million | 10% | |

| Stage 2 | When the company starts production or does start the commercial transaction | Up to 70% of the investment amount |

| Stage 3 | After 2 years of production or commencement of transaction | Remaining 30% of the investment amount |

10. One-Stop Service Centre

The FITTA has introduced the concept of a One-Stop Service Mechanism to facilitate foreign investment, which is to be implemented in accordance with the prevailing Industrial Enterprises Act. This mechanism has already been established under the Industrial Enterprises Act and is currently operating within the premises of the Department of Industries (DoI).

The Government of Nepal may offer various exemptions, facilities, concessions, and services to foreign investors through the One-Stop Service Mechanism. These services include industry registration, necessary approvals, labor permits, visa processing, quality testing and control of industrial products, among others.

11. Facilities and Concessions

As per Section 24 of FITTA, in addition to the facilities and concessions under the FITTA, industries with foreign investment are also entitled to exemptions, facilities, concessions, or protection as provided in the IEA and other prevailing laws.

However, sick industry facilities under other laws do not apply to foreign-invested industries. Foreign investment industries under the FITTA includes:

10.1. Facilities on Foreign Currency

Foreign investors or industries with foreign investment are allowed to open bank accounts in Nepali currency with local banks, and in convertible foreign currency with licensed banks, subject to approval from NRB. Such industries can also access foreign exchange facilities for purposes including payment of salaries to foreign employees, repayment of principal and interest on bonds or debentures, and repatriation of investment or profits.

10.2. Visa Facility

FITTA has made a provision for three types of Visa facilities to the prospective investors, and the approved investors:

| S.N. | VISA | ELIGIBILITY |

|---|---|---|

| 1 | Non-tourist visas | For conducting study, research, or survey for foreign investment (up to 6 months) |

| 2 | Business Visa | Foreign investors, one authorized representative, and their family members |

| 3 | Residential Visa | Foreign investors who invest over USD 1 million (or equivalent in convertible currency) at one time. |

12. Protection of Foreign Investment

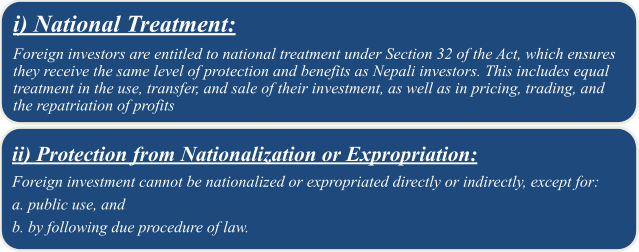

FITTA mainly guarantees two types of protection for the foreign investor namely, i) national treatment, and ii) protection from nationalization and expropriation.

In addition, if any changes are made to the current Act that would be disadvantageous to the foreign investments or foreign investors having obtained approval prior to such a change, it shall not apply to such an investor or investment.

13. Dispute Settlement in Foreign Investment

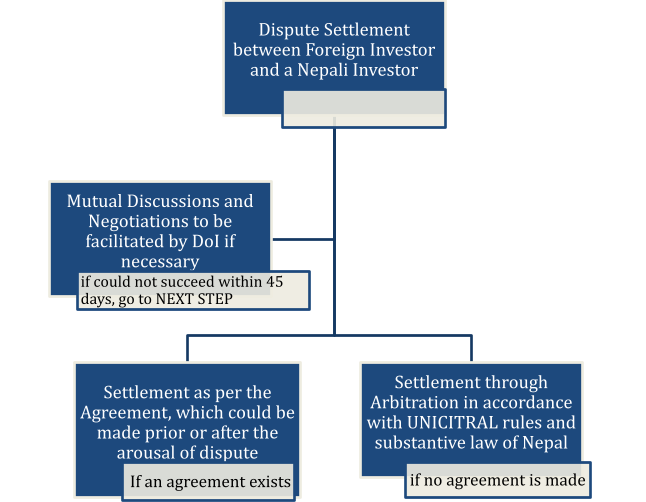

The FITTA, first of all, gives priority to mutual discussion and negotiations for the settlement of any dispute between a foreign investor and a Nepali investor in relation to the foreign investment with the assistance of the Department of Industry. However, if such dispute is still not settled within 45 days, then, the parties can choose to resolve it as per their agreement.

The agreement regarding dispute resolution could be made prior to the dispute, as well as after the dispute has arisen. In both cases, the parties have the autonomy to decide how they want the case to be settled.

In case, no such agreement is made, the dispute is settled through arbitration in accordance with the prevailing rules of United Nations Commission on International Trade Law (UNICITRAL) as a procedural law and law of Nepal as the substantive law.

14. Repatriation

Investors are allowed to repatriate their investment capital, profits, dividends, royalties, and other earnings after paying all applicable taxes, pursuant to Section 20 of the FITTA. However, in regard to the liquor industries, the royalty cannot exceed 5% of the net selling price (before tax), unless the liquor is 100% exported. Similarly, in technology transfer as well, repatriation of royalty in excess of the prescribed ceiling is not allowed pursuant to Section 7 of the Act.

Repatriation requires approval from the foreign investment approving body, and then the NRB for currency exchange facilities. The repatriation can be done in the same currency on which the investment was made or any other convertible foreign currency at the prevailing exchange rate. In addition, foreign employees are also permitted to repatriate their savings after paying applicable taxes.

If an investor is not satisfied with the decision of the approving authority regarding the repatriation amount, they may file an application with the Ministry, which must decide on the matter within 30 days of receiving the application.

15. Recent Ammendment

On 31 March, 2025 (2081/12/18), the FITTA was amended by the Act to amend Certain Nepal Acts relating to improving the Financial and Corporate Environment and Investment. Some of the major changes brought by the amendment includes following:

14.1 Compliance with the Negative List only

Previously, foreign investment was allowed only in sectors listed under the Positive List of the IEA and not included in the Negative List (Schedule) of FITTA, limiting investment to predefined industries. The term ‘any industry’ used in FITTA required classification under IEA as well. This meant, even if the industry was not enlisted under the restricted list of FITTA, the Negative List, if it was not classified as an industry under the Positive List of IEA then the foreign investment in such sector was not allowed.

However, the recent amendment replaced the term ‘any industry’ with ‘any industry other than those included in the Schedule, thereby expanding the scope of foreign investment, to include newer and evolving sectors not specifically listed.

14.2 Foreign Investment in Private Equity Fund

Earlier, FITTA permitted foreign investment only in the shares of companies or industries, excluding investment in units of Special Investment Funds (“SIFs”), since SIFs do not fall under the category of companies or industries. This created a barrier for foreign investors looking to engage in Nepal’s private equity market. The recent amendment addresses this by adding Section 9A, which now explicitly allows foreign investors to invest in SIF units with approval from SEBON, without needing separate prior approval from the Department of Industries.

Date of Publication:

Disclaimer: This article published on website of the law firm is just for information purpose only. It shall not be taken as the legal advice, advertisement, personal communication, solicitation or inducement. Bhandari Law and Partners or any of the team members of the firm shall not be liable for the consequence arising of the information provided. As the factual situation may be different on your case, thereof if you need further legal advice on the subject matter, please Contact Us.

Related Professionals:

Frequently Asked Question

For quick legal assistance:

You can directly call to our legal expert: +977-9808811027

Even can call or drop a text through What’s app , Viber, Telegram and We Chat at the same number.

Also can do email on : info@lawbhandari.com

contact us

Phone :,

,Connect with our professional lawyers in Nepal :

Follow Our Law Firm on Social Media :