Table of content

-

Foreign Direct Investment (FDI) in Nepal: Key Legal Highlights

01. Geographic Location

Nepal, officially the Federal Democratic Republic of Nepal, is a landlocked sovereign nation nestled in the heart of South Asia. Renowned for its rich cultural heritage, breathtaking landscapes, and diverse ecosystems, Nepal offers a unique blend of tradition and opportunity. As a country strategically positioned between two global economic giants, India and China, Nepal serves as a gateway for trade and investment in the region.

Nepal is located between latitudes 26° and 31°N and longitudes 80° and 89°E, bordered by China to the north and India to the south, east, and west. Covering a total area of approximately 147,181 square kilometers, Nepal is characterized by its dramatic topography, ranging from the fertile plains of the Terai in the south to the majestic Himalayas in the north, including Mount Everest, the world’s highest peak at 8,848 meters.

The country is divided into three distinct ecological zones:

-

The Himalayan Region: The northern region, home to towering peaks like Everest, Kanchenjunga, and Annapurna, attracts adventurers and tourists worldwide.

-

The Hill Region: The central belt, including cities like Kathmandu and Pokhara, is known for its cultural landmarks, moderate climate, and scenic beauty.

-

The Terai Region: The southern plains, a fertile agricultural and industrial hub, share a border with India and facilitate significant cross-border trade.

Connectivity to Global Markets

Nepal’s proximity to India and China positions it as a vital link in regional trade networks. The southern border with India facilitates seamless access to major Indian ports such as Kolkata and Visakhapatnam, enabling cost-effective trade routes for goods entering and exiting Nepal. The open border with India supports robust cross-border commerce, with key trade points like Birgunj and Bhairahawa handling significant volumes of imports and exports.

To the north, Nepal’s border with China connects to the Tibetan Plateau and, through initiatives like the Belt and Road Initiative (BRI), offers potential access to Chinese markets and ports such as Shenzhen and Shanghai via overland routes. The operational Rasuwagadhi-Kerung border point enhances trade connectivity with China, fostering opportunities for investors to tap into trans-Himalayan commerce.

Nepal also offers the lowest tax burden compared to its regional neighbours, has signed multiple double taxation avoidance treaties and bilateral investment protection treaties, has 57% of the population cable of entering the workforce, reduced investment threshold, permitted land ownership in companies name, allowed 100% foreign ownership in most sectors, simplified visa processes for tourists and investors making it an ideal place for foreign investment.

02. Diagrammatic presentation of Nepal

Fact Sheet of Nepal

| S.N. | Particulars | Details |

|---|---|---|

| 1 | Official Country Name | Federal Democratic Republic of Nepal |

| 2 | Time Zone | GMT + 5:45 (Nepal Standard Time) |

| 3 | Governing System | Multiparty Parliamentary System |

| 4 | International Memberships | United Nations (UN) South Asian Association for Regional Cooperation (SAARC) World Trade Organization (WTO) Asian Infrastructure Investment Bank (AIIB) World Bank Belt and Road Initiative (BRI) Asian Development Bank (ADB) International Monetary Fund (IMF) Multilateral Investment Guarantee Arrangement (MIGA) South Asian Free Trade Area (SAFTA) Bay of Bengal Initiative for Multi-Sectoral Technical and Economic Cooperation (BIMSTEC) UNESCO UNCTAD |

| 5 | Currency | Nepalese Rupee (NPR) |

| 6 | Economy | Open Market Economy |

| 7 | Human Development Index (HDI) (2023-24) | 0.601 |

| 8 | International Dialling Code | +977 |

| 9 | Population (million) | 30.9 million |

| 10 | GDP at Current Price (NPR billion) (2022-23 AD) | 5,381 |

| 11 | Real GDP at Basic Price (NPR billion) (2022-23 AD) | 2,312 |

| 12 | Annual GDP Growth Rate at Basic Price (%) (2022-23 AD) | 2.16% |

| 13 | USD NPR Exchange Rate (Period Average, 2024-25 AD) | 140.10 |

03. Governing laws of FDI in Nepal

Foreign Direct Investment (FDI) in Nepal is governed by a framework of laws and regulations that collectively aim to regulate, facilitate, and promote investment by foreign entities. These laws cover aspects such as investment approval, technology transfer, company formation, foreign exchange, and public-private partnerships. The primary legislative instruments applicable to FDI are as follows:

| S.N. | Governing Law | Subject Matter of Governance |

|---|---|---|

| 1 | Foreign Investment and Technology Transfer Act 2019 (2075) (“FITTA”) | Establishes the legal framework for regulating, promoting, and facilitating foreign investment and technology transfer in Nepal. |

| 2 | Foreign Investment and Technology Transfer Regulations 2020 (2077) | Provides procedural guidelines and mechanisms for the implementation of FITTA. |

| 3 | Industrial Enterprises Act, 2020 (2076) (“IEA”) | Regulates the establishment, operation, and classification of industrial enterprises, including those with foreign investment. |

| 4 | Foreign Exchange Regulation Act, 1962 (2019) (“FERA”) | Governs foreign exchange transactions and ensures the proper management and control of foreign currency in Nepal. |

| 5 | Public Private Partnership and Investment Act, 2019 (2075) (“PPP” Act) | Facilitates joint investment initiatives between the public and private sectors, including projects involving foreign investors. |

| 6 | Companies Act, 2063 (2006) | Regulates the incorporation, operation, management, and dissolution of companies, including those with foreign ownership. |

04. Governing Authorities

The main authorities dealing with the approval, regulation, management, facilitation and monitoring of the foreign investment includes following:

| S.N. | Authority | Subject Matter of Governance |

|---|---|---|

| 1 | Department of Industries (“DOI”) | Approves all foreign investment. |

| 2 | Office of Company Registrar (“OCR”) | Incorporates and registers newly created companies. |

| 3 | Nepal Rastra Bank (“NRB”) | Regulates and supervises foreign exchange transactions and foreign exchange matters like capital infusion. |

05. Scope of Foreign Investment In Nepal

The Foreign Investment and Technology Transfer Act, 2019 (2075) of Nepal is used to govern all matters related to foreign direct investment. With the aid of the definition provided in this act, we can understand the scope of foreign investment.

5.1. Definition of Foreign Investment

Foreign investment, as defined under Section 2(j) of the FITTA, 2019, encompasses various forms of investment made by foreign investors in Nepal. These include:

-

Share Investment: Investment in foreign currency through equity participation in Nepalese industries or companies.

-

Reinvestment of Dividends: Reinvesting dividends or shares derived from foreign currency into an industry.

-

Lease Financing: Investment in assets such as aircraft, ships, machinery, construction equipment, or similar items, subject to limits prescribed by the FITTA.

-

Venture Capital Fund Investment: Contributions to a venture capital fund established under Section 9 of the FITTA.

-

Securities Market Investment: Investment in listed securities through the secondary securities market, as permitted under Section 10.

-

Purchase of Shares or Assets: Acquiring shares or assets of a company incorporated in Nepal.

-

Capital Market Securities: Investment obtained through banking channels after issuing securities in a foreign capital market by a Nepalese industry or company, as per Section 11.

-

Technology Transfer: Investment through agreements involving the transfer of technology, such as patents, trademarks, or technical expertise.

-

Establishment or Expansion of Industry: Investment made by establishing or expanding an industry in Nepal.

5.2. Regulatory Provisions for Foreign Investment

FITTA, 2019, specifies the procedures, conditions, and restrictions for foreign investment under various sections, as detailed below:

a. Individual or Joint Investment

Foreign investors may invest individually, jointly with other foreign investors, or in partnership with a Nepalese industry or citizen.

b. Investment by purchasing shares and assets of an industry

Section 5 states that a foreign investor may make foreign investment in Nepal by purchasing the assets or shares of an industry within the prescribed limit.

c. Lease investment

Section 6 states that a foreign investor can invest in aircraft, ships, machinery, construction, or similar equipment within the prescribed limit.

d. Investment through Technology Transfer.

Section 2(f) defines technology transfer as agreements between an industry and a foreign investor involving patents, designs, trademarks, formulas, processes, licenses, know-how, franchises, or technical, management, and marketing expertise. Section 7 states that foreign investment through technology transfer in Nepal is allowed under these conditions:

-

It must follow a technology transfer agreement between the industry and the investor.

-

Royalty repatriation is capped within the prescribed limit.

-

The agreement requires approval from the foreign investment authority.

-

Approval terms are based on international practices and the industry’s production and sales capacity.

e. Investment via establishing a branch of a foreign industry

Pursuant to Section 8 of FITTA, Foreign industries may establish or expand branches in Nepal, subject to compliance with prevailing laws and prescribed regulations.

f. Investment through establishing a Venture Capital Fund

Institutional foreign investors can establish a venture capital fund in Nepal by forming a company under local laws and obtaining approval from the Securities Board. The fund must follow investment procedures, submit semi-annual reports to the Department, and adhere to prescribed regulations.

g. Trading in securities may be made

Institutional foreign investors with a registered venture capital fund can trade securities in eligible industries through the secondary market. They must register with the Securities Board and comply with prescribed rules on minimum purchases, investment limits, holding periods, and foreign currency reserves.

h. Capital Market Securities and Loans

Public limited companies or authorized corporate bodies in Nepal may borrow loans or acquire foreign currency by issuing securities in foreign capital markets, with approval from the Nepal Rastra Bank and the Securities Board. Such funds must be invested in Nepal.

i. Loans from Foreign Financial Institutions

Industries with foreign investment may borrow project loans or enter project financing agreements with foreign financial institutions, subject to the recommendation of the Ministry and approval from the Nepal Rastra Bank.

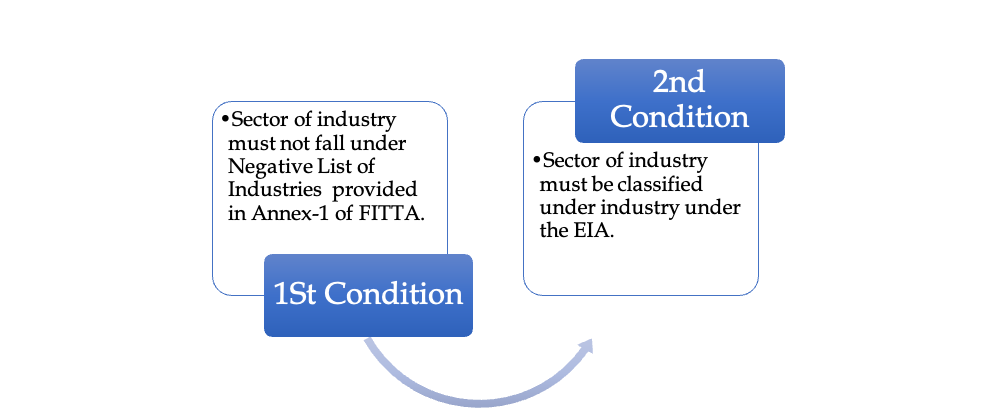

06. Permissibility for Foreign Direct Investment

Foreign Investment is not permissible in every business. Following two conditions has to be fulfilled for the permissibility of FDI Companies in Nepal:

Negative List of Industries provided in Annex- 1 of FITTA:

Following are the industrial sector where foreign investment is not permissible:

| S.N. | Industry / Business Name |

|---|---|

| 1 | Industries, except the large industries exporting at least seventy-five percent of their own products, in the sectors of animal husbandry, fisheries, beekeeping, fruits, vegetables, oilseeds, pulses, dairy business, and other industries or business related to primary products of agriculture. |

| 2 | Cottage and small industries. |

| 3 | Personal service business (hair cutting, tailoring, driving, etc.). |

| 4 | Industries manufacturing arms, ammunition, bullets and shells, gunpowder or explosives, and nuclear, biological, and chemical (N.B.C.) weapons; industries producing atomic energy and radioactive materials. |

| 5 | Real estate business (excluding construction industries), retail business, internal courier service, local catering service, moneychanger, and remittance service. |

| 6 | Travel agency, guide involved in tourism, trekking and mountaineering guide, rural tourism including homestay. |

| 7 | Business of mass communication media (newspaper, radio, television, and online news) and motion picture of national language. |

| 8 | Management, account, engineering, legal consultancy service, and language training, music training, computer training. |

| 9 | Consultancy services having foreign investment of more than fifty-one percent. |

| 10 | Ride sharing having foreign investment of more than seventy percent. |

07. Minimum Investment Amount

The minimum threshold for Foreign Direct Investment (FDI) in Nepal has undergone several revisions in accordance with the government’s evolving investment policies and economic priorities. Prior to 2012, the threshold was fixed at NPR 1.6 million, which was subsequently increased to NPR 5 million in September 2012 to attract more substantial foreign capital inflows. In a major policy shift, the Government of Nepal raised the minimum threshold to NPR 50 million on 23 May 2019, aiming to promote large-scale investments and ensure higher-value foreign participation. However, this amount was later considered restrictive for smaller investors, leading to its reduction to NPR 20 million through the national budget for the fiscal year 2022/23.

At present, the minimum FDI threshold in Nepal stands at NPR 20 million, applicable to most sectors. Nonetheless, recognizing the growth potential of the digital economy, the Government of Nepal has completely removed the minimum investment threshold for the information technology (IT) sector) as of May 2023. This policy shift aims to facilitate small and medium-scale foreign investments, promote innovation-driven enterprises, and enhance Nepal’s competitiveness in the global technology landscape.

Note:

The recent amendment in FIITA Act states that for Information Technology based industries that are seeking foreign investment approval through the automated route, this limit won’t be applicable. Those industries are listed below:

| S.N. | Information Technology Based Industry |

|---|---|

| 1 | Technology Park |

| 2 | IT Park |

| 3 | Biotech Park |

| 4 | Software Development |

| 5 | Data Processing |

| 6 | Digital Mapping |

| 7 | Business Process Outsourcing (B.P.O), Knowledge Process Outsourcing (K.P.O) |

| 8 | Data Centre, Data Mining, Cloud Computing |

| 9 | Web Portal, Web Designing Service |

08. Capping of Investment

While foreign investors are permitted to hold 100% ownership in local subsidiary companies, domestic law restricts investment through investment capping in certain sectors as detailed below:

| Sector | Investment Percentage Ratio |

|---|---|

| Telecommunication | 80% |

| Banking and Financial Institution | Minimum 20% and Maximum 85% |

| Insurance Companies | 80% |

| Consultancy Business | 51% |

| Ride Sharing | 70% |

09. Procedure of Foreign Direct Investment (FDI) approval in Nepal

The graphical representation of above steps is outlined as below:

10. Timeline

The overall time period for the registration of foreign direct investment Company in Nepal takes about two to three (2 to 3) months.

11. Required Documents for FDI

Following documents and information are required depending on whether the investor is a legal entity or an individual:

a. Legal Entity as an Investor

-

Notarized Copy of Company Registration Certificate, Memorandum of Association, and Article of Association

-

Notarized Copy of Passport of Director and Shareholders of Company

-

Signed Company Profile of the investing company

-

Notarized Copy of passport/citizenship of investor’s authorized representative

-

Proposed Name of company and address of company in Nepal

-

Proposed Investment Amount

-

Project Report for the operation of a local subsidiary company

-

Financial Credibility Certificate (FCC) of Investor issued by a local bank in the home country

-

Notarized latest audit report of Investor Company

-

Resolution of the Investor for investing in Nepal

-

Power of attorney authorizing individuals to complete the approval and registration process on behalf of the Investor

-

Notarized Joint Venture Agreement in case of two or more than two investor

-

Additionally, if the investor company is owned by another company, then the documents of the ultimate beneficiary company are also required

b. For Individual as an Investor

-

Notarized Copy of Passport of Individual Investor/s

-

Bio Data in case of an Individual Investor/s

-

Proposed Name of Company and address of company in Nepal

-

Proposed Investment Amount

-

Project Report for the operation of a local subsidiary company

-

Financial Credibility Certificate (FCC) of Investor issued by a local bank in the home country

-

Power of attorney authorizing individuals to complete the approval and registration process on behalf of the Investor

-

Notarized Joint Venture Agreement in case of two or more than two investor

12. Government fees Applicable for FDI Approval Process:

Before proceeding with the establishment of a company through Foreign Direct Investment (FDI) in Nepal, investors should be aware of the various government fees and deposits applicable at different stages of the approval and registration process. These fees vary depending on the nature of the business, location, and authorized capital. The following table provides an overview of the major government fees typically incurred during the FDI approval and company registration process in Nepal:

| S.N. | Particulars | Government Fee |

|---|---|---|

| 1 | Guarantee amount to be deposited at DOI | NPR 20,000 (Approx. USD 155) |

| 2 | Government fee for Company Registration at OCR | Depends on the authorized capital of the company. |

| 3 | Business Registration at Ward Office | NPR 5,000 to NPR 15,000 per year (Approx. USD 38 to USD 115) Note: The business registration fees are specific to each local level. |

| 4 | House Rent Tax | 10% of the house rent amount per month. Note: House rent rates depend on each local level and are subject to change every fiscal year. |

13. Post Incorporation Compliances Of FDI Companies In Nepal

Foreign Direct Investment (FDI) companies in Nepal must adhere to a series of mandatory post-incorporation compliance requirements as stipulated by Nepalese law.

13.1. Three-Month Compliance Requirements

The following tasks must be completed within three months of incorporation to ensure compliance with the Companies Act of Nepal.

-

Registration of Office Address

Under Section 184 of the Companies Act, private companies, including FDI entities, are required to register their office address with the OCR within three months of incorporation. This submission must include contact details such as telephone, contact no. and email. Any subsequent changes to the registered address must be promptly notified to the OCR to maintain accurate records.

-

Formation of the Board of Directors

Section 86 of the Companies Act mandates that private companies establish a Board of Directors in accordance with their Articles of Association (AOA) within three months of incorporation. Section 97 further stipulates that the AOA governs the procedures for board meetings. The appointment of directors must be documented in meeting minutes, which should be retained as part of the company’s official records.

-

Appointment of an Auditor

As per Section 110 of the Companies Act, every private company must appoint an auditor. Section 111 specifies that the auditor is selected based on the Memorandum of Association (MOA), AOA, or a shareholder consensus. In the absence of such an agreement, the auditor is appointed at a general meeting. The OCR must be notified of the auditor’s appointment within 15 days, and the initial auditor serves until the company’s first Annual General Meeting (AGM).

13.2 Annual General Meeting (AGM)

Companies are required to convene their first AGM within one year of incorporation, submitting the following documents to the OCR:

-

Details of the AGM, confirming adherence to the Companies Act.

-

Audited financial statements and an audit report for the fiscal year.

From the second year onward, AGMs must be held annually, with annual reports submitted to the OCR within six months of the fiscal year-end (typically June or July).

13.3 Operation and Extension

FDI companies must commence operations within one year of industry registration with the Department of Industry. Prior to commencing operations, at least 70% of the authorized capital must be injected. The issuance of the first invoice marks the start of operations, and companies must notify the Department of Industry within 30 days of this event. Non-compliance may result in fines.

If operations cannot commence within one year, companies must apply for an extension at least one month prior to the expiry of the industry registration at DOI. For instance, if the registration date is January 1, 2025, an extension application must be submitted by December 1, 2025, to extend the operational deadline beyond January 1, 2026. And Industry Operation Annual Report has to be submitted every year after the industry commencement fiscal year.

13.4. Injection of Foreign Investment Amount

Foreign investment must be remitted to Nepal in convertible foreign currency through authorized banking channels, as outlined in Rule 9 of the Foreign Investment and Technology Transfer Regulation, 2077 (FITTR). he FITTR specifies a three-stage investment injection schedule:

| Stages | Details | Percentage of Injection of Investment |

|---|---|---|

| Stage I | Within 1 year of receiving the investment approval: | Depends on the amount of investment |

| Minimum investment amount i.e. NPR 20 Million | 25% | |

| 20 to 250 million NPR | 15% | |

| 250 million NPR to 1000 Million | 10% | |

| Stage 2 | When the company starts production or does start the commercial transaction | Up to 70% of the investment amount |

| Stage 3 | After 2 years of production or commencement of transaction | Remaining 30% of the investment amount |

The full authorized capital must be injected within two years from the commencement of production or commercial transactions.

Investment Injection Process

To ensure the investment is recognized, the following procedures must be followed:

-

Funds must be transferred from the investor’s personal bank account (for individuals) or corporate bank account (for entities) to the FDI company’s local bank account established during incorporation.

-

The transfer must be executed via SWIFT payment; other methods are not recognized as valid investments.

-

Upon completion of the transfer, the local bank issues an investment inflow certificate and a SWIFT transfer message.

13.5 Share Registry with OCR

Following receipt of the investment inflow certificate, companies must obtain a share registry from the OCR. Required documents include:

-

Board meeting minutes.

-

Investment details.

-

Investment inflow certificate and bank statement reflecting the remitted funds.

The OCR verifies these documents and issues an approved share registry, which serves as a record of the investment tied to the company’s shares.

13.6 Investment Recording with NRB

The investment must be recorded with Nepal Rastra Bank (NRB) using the investment inflow certificate and approved share registry. This step is critical, as unrecorded investments may complicate future repatriation of capital or profits.

14. Taxation for FDI Companies

The key taxes applicable to foreign investment companies in Nepal include the following:

14.1 Income Tax:

Following is the rate of income tax for various industries:

| S.N. | Industries | Tax Rate |

|---|---|---|

| 1 | General Corporate Tax | 25% |

| 2 | Manufacturing and Hydropower sector | 20% |

| 3 | Agriculture, Forestry and Mining industries | 20% |

| 4 | Banking and Financial institutions | 30% |

| 5 | Tobacco and Alcohol manufacturing industries | 30% |

| 6 | Telecom and Internet Services | 30% |

| 7 | Dividends | 5% |

14.2 Value Added Tax (VAT):

The VAT Act prescribes a uniform rate of 13% VAT for all types of transactions involving goods and services that are subject to VAT as prescribed under the VAT Act.

Some of the goods and services as prescribed in Schedule-I of Value Added Tax Act, 2052 are exempt from the VAT. Likewise, some of the goods and services as prescribed in Schedule-II of Value Added Tax Act, 2052 are subject to zero rate of VAT.

14.3 Withholding tax/tax deducted at source (TDS):

Certain payments are subject to withholding tax. They are listed below:

| S.N. | Payments | Withholding Tax Rate |

|---|---|---|

| 1 | Salary including any monetary allowance paid to an employee | Slab Rate as per Annexure-I Section-1 |

| 2 | Payment of royalties under technology transfer | 15% |

| 3 | Payment for Service Fees • Service provider is registered in VAT or provides exempt services under VAT • Service provider is not registered under VAT | 1.5% 15% |

| Service Fees from the entity registered under VAT or supplying exempt services under VAT | 1.5% | |

| 4 | Payment of rent • Rent payment for vehicle rental service to VAT registered entity • Other general lease rental payment | 1.5% 10% |

| 5 | Payment for goods transport services • To the entity registered under VAT • To the entity not registered under VAT | 1.5% 2.5% |

| 6 | Payment of windfall gain (lottery, prize on contest, etc.) | 25% |

| 7 | Payment for contract to a resident entity if the payment made within last 10 days exceeds NPR 50,000 | 1.5% |

| 8 | Payment made to non-resident person | 5% |

15. Repatriation of Investment and other Returns from Nepal

A foreign investor is allowed to repatriate the following:

-

earnings through dividend or through sale proceeds against investment in shares,

-

Compensation and Indemnity,

-

Sale Proceeds upon Share Transfer,

-

Returns of Capital at the Time of Liquidation,

-

Technology transfer fees, royalty and license fees that have been earned through technology transfer and

-

Lease rent under lease financing.

The investor has obligation to show that all local subsidiary company have complied all the laws, obtained all the necessary approval, pay tax and compiled with all the obligation before repatriation. Approval from DOI or IBN and NRB approval is required before repatriation. Investor can repatriate the investment and earning in the same currency or in other convertible foreign currency.

For a proper and detailed understanding, refer to the article published by Bhandari Law and Partners on the Repatriation of Investment and Returns from Nepal: https://lawbhandari.com/publication/repatriation-of-foreign-investment-and-returns-in-nepal

16. Facilities, Protection Provided For Foreign Investor

Nepal has established a supportive legal framework that not only facilitates investment operations but also safeguards investor rights. These measures aim to ensure transparency, stability, and security for investors while balancing national priorities.

16.1 Facilities Available for Foreign Investors

Foreign investors in Nepal are entitled to a range of facilities designed to provide operational ease and confidence in maintaining their investment.

a. Ownership of Private Land

Companies with foreign investment are considered local companies and can own private land in Nepal.

b. Business Visa for Individual Investors

Individual foreign investors are allowed to obtain a business visa until their investment is retained in Nepal.

c. Business Visa for Company Representatives and Families

Representatives of foreign investment companies can obtain a business visa until the investment is retained in Nepal. Their family members are also eligible for a business visa during this period.

d. Residential Visa for Large Investments

Foreign investors and their family members who invest an amount equal to or more than one million United States dollars at once are eligible for a residential visa, valid as long as the investment is retained in Nepal.

e. Foreign Currency Accounts and Transactions

Foreign investment companies and investors can open foreign currency accounts and conduct transactions in foreign currency.

f. Employment of Foreign Experts

Foreign investment companies can hire foreign nationals for highly technical or managerial positions if suitable Nepali citizens are unavailable.

g. Repatriation of Investments and Returns

Foreign investors have the right to repatriate their investment and returns in convertible foreign currency.

16.2 Protection provided of foreign investment in Nepal

16.2.1 Bilateral Investment Treaties

Nepal has signed six bilateral investment treaties (BIT) with India, Finland, Mauritius, United Kingdom, France and Germany. Out of these six, only four are in force as the two BITs with India and Mauritius haven’t been implemented yet. Below are the principles that BITS has incorporated:

| S.N. | Safeguards | Provisions |

|---|---|---|

| 1 | National Treatment | The treatment of foreign investors or investments shall not be less favourable than that of their local counterparts. |

| 2 | Most Favoured Nation Treatment | The treatment of foreign investors or investments shall not be less favourable than the treatment given to foreign investors or investments of any third country. |

| 3 | Fair and Equitable Treatment of Investments and Returns of Investors | Protection against:

|

16.2.2 Protection to Investor under FIITA 2019

| S.N. | Types of Protection | Provisions |

|---|---|---|

| 1 | National Treatment | FITTA 2019 ensures foreign investments in Nepal are treated equally to domestic investments. Protections under national treatment include:

|

| 2 | Visa |

|

| 3 | Change in Law | Investments approved under previous foreign investment laws will continue to be governed by those laws, and no changes that reduce their benefits will be made without the investors' consent. |

| 4 | Nationalization | FITTA 2019 protects foreign investors from nationalization and direct or indirect expropriation of their companies, except for public purposes. |

| 5 | Obtaining Land | If foreign investors cannot acquire land, DOI or IBN will assist with recommendations, coordination, and facilitation with local authorities to arrange it for business operations. |

| 6 | Authorization | A foreign investor may delegate authority to any person to act on their behalf. |

| 7 | Repatriation | Foreign investors are allowed to repatriate investments and returns in convertible currency. |

Note:

Kindly note the following exceptions to national treatment of foreign investors and investment:

-

Compulsory licensing of intellectual property under WTO agreements.

-

Benefits for local industries through public procurement laws.

-

Special treatment for government involvement in regional or multi-sectorial organizations.

-

Conditions set by regulatory authorities for repatriation of investment, loan payments, or service fees outside Nepal.

-

Government subsidies or concessions.

-

Non-commercial services provided by the government.

-

Financial services managed by the government to protect investors.

-

Protection of public health, animals, plants, or the environment.

Date of Publication: 2. November 2025

Disclaimer: This article published on our website is just for information purpose only. It shall not be taken as the legal advice, advertisement, personal communication, solicitation or inducement. Bhandari Law and Partners or any of the team members of the firm shall not be liable for the consequence arising of the information provided. As the factual situation may be different on your case, thereof if you need further legal advice on the subject matter, please Contact Us.

Related Professionals:

Frequently Asked Question

For quick legal assistance:

You can directly call to our legal expert: +977-9808811027

Even can call or drop a text through What’s app , Viber, Telegram and We Chat at the same number.

Also can do email on : info@lawbhandari.com

contact us

Phone :,

,Connect with our professional lawyers in Nepal :

Follow Our Law Firm on Social Media :