Table of content

-

FAQs on IT Company Registration in Nepal through FDI

01. Is foreign investment in the IT sector permitted in Nepal?

Yes, foreign investors can establish IT company in Nepal with 100% ownership.

02. What types of IT businesses can foreign investors operate in Nepal?

Under the Industrial Enterprises Act, the following activities are classified as Information Technology Industries:

-

Technology park

-

IT park

-

Biotech park

-

Software development

-

Computer and related services

-

Data processing

-

Cyber café

-

Digital mapping

-

Business Process Outsourcing (BPO) and Knowledge Process Outsourcing (KPO)

-

Data center, data mining, and cloud computing

-

Digital signature certifying agency

-

Web portal, web design, web hosting, and online classified advertising services.

03. Is there a minimum capital requirement for foreign investment in IT companies in Nepal?

There is no minimum capital requirement for investment in IT companies. But it is recommended that foreign investor invest at least 10,00,000 Nepalese Rupees as the minimum capital.

04. What is the process of registration of IT company in Nepal through foreign investment ?

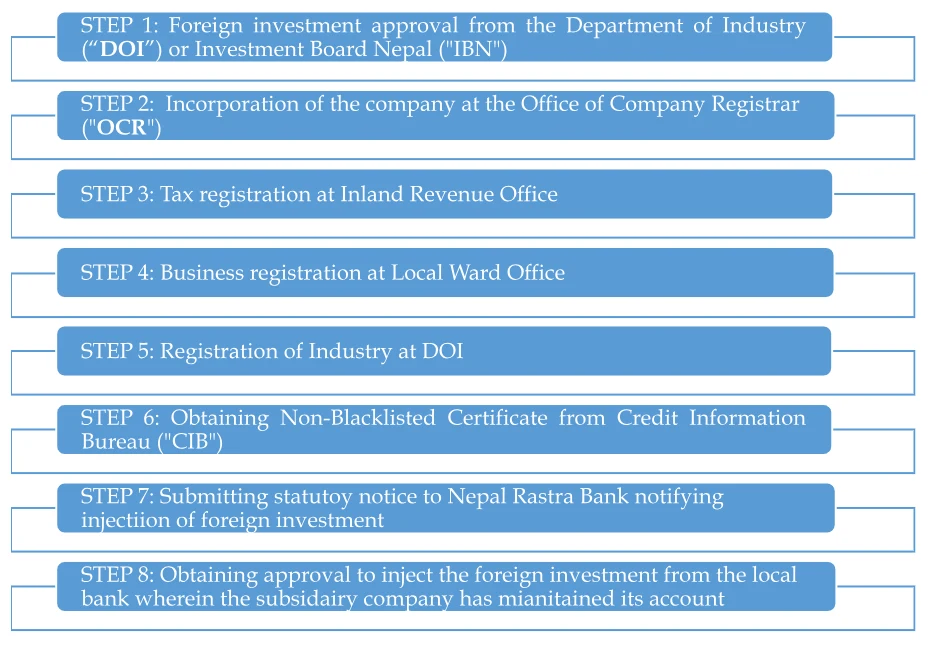

The following steps are followed for registration of local subsidiary office:

STEP 1: Foreign investment approval from the Department of Industry (“DOI”) or Investment Board Nepal ("IBN")

STEP 2: Incorporation of the company at the Office of Company Registrar ("OCR")

STEP 3: Tax registration at Inland Revenue Office

STEP 4: Business registration at Local Ward Office

STEP 5: Registration of Industry at DOI

STEP 6: Obtaining Non-Blacklisted Certificate from Credit Information Bureau ("CIB")

STEP 7: Submitting statutory notice to Nepal Rastra Bank notifying injection of foreign investment

STEP 8: Obtaining approval to inject the foreign investment from the local bank wherein the subsidiary company has maintained its account

05. What are the documents required for establishment of IT Company in Nepal ?

The list of the documents required for foreign investor are as follows:

| S.N. | Documents |

|---|---|

| 1 | Company incorporation certificate, Memorandum of Association, Article of Association (if the investor is the company) |

| 2 | Copy of passports of all the directors and shareholders of an investor |

| 3 | Project Report and schedule for investment |

| 4 | Financial Credibility Certificate ("FCC") from foreign banks |

| 5 | Latest financial statement (in case of company as the investor) |

| 6 | Board Resolution of the investor company |

| 7 | Profile of the company or biodata of an individual investor |

| 8 | Power of attorney |

06. What is the timeline for the incorporation of an IT company with FDI?

The overall process of FDI approval and company registration generally takes 2 to 3 months.

07. What post-incorporation compliance must a foreign-invested IT company in Nepal fulfill?

The Key compliance obligations include:

-

Submission of 3 months compliance document before OCR,

-

Recording of investment at NRB,

-

Submit Annual Compliance Document at OCR,

-

Compliance with Companies Act, Labor Act, Tax Law and other applicable law of Nepal during the operation of the local subsidiary company.

For further understanding regarding post-incorporation compliance check the article link of our website: https://lawbhandari.com/publication/post-incorporation-compliance-for-fdi-companies-in-nepal

08. Is it mandatory to have a local partner or director?

No. It is not mandatory to have a local partner or director in an IT company with foreign investment.

09. Can a foreign investor acquire shares of an existing Nepali IT company?

Yes. Foreign investors may invest by acquiring shares of an existing IT company. Foreign investment approval of Department of Industry and NRB is required.

10. Can profits and dividends be repatriated abroad?

Yes. After fulfilling all tax obligations and obtaining NRB approval, foreign investors may repatriate:

-

Dividends and profits

-

Capital gains

-

Royalties and fees for technology transfer

-

Sale proceeds upon exit

All repatriations must be conducted through formal banking channels and supported by relevant approvals.

11. Why is the IT sector in Nepal attractive for foreign investors?

Nepal offers several advantages for IT FDI:

a. Cost-effective skilled workforce

b. English-speaking technical talent

c. Growing digital infrastructure

d. Full foreign ownership permitted

e. Tax incentives

f. Favorable Repatriation Policy

g. Favorable Policy for Tech Industry

Date of Publication: 3 November 2025

Disclaimer: This article published on our website is just for information purpose only. It shall not be taken as the legal advice, advertisement, personal communication, solicitation or inducement. Bhandari Law and Partners or any of the team members of the firm shall not be liable for the consequence arising of the information provided. As the factual situation may be different on your case, thereof if you need further legal advice on the subject matter, please Contact Us.

Related Professionals:

Frequently Asked Question

For quick legal assistance:

You can directly call to our legal expert: +977-9808811027

Even can call or drop a text through What’s app , Viber, Telegram and We Chat at the same number.

Also can do email on : info@lawbhandari.com

contact us

Phone :,

,Connect with our professional lawyers in Nepal :

Follow Our Law Firm on Social Media :