Table of content

-

Employee Stock Ownership Plans (ESOP) Law in Nepal: Key Highlights

01. Background of ESOPs Law in Nepal

As businesses grow in complexity and competition intensifies across industries, companies are constantly exploring innovative ways to incentivize, retain, and empower their workforce. One such mechanism that has gained global traction is the Employee Stock Ownership Plan (ESOP). ESOP is a financial tool that enables employees to become partial owners of the organization they work for thereby creating a sense of shared responsibility and mutual success.

ESOPs are well-established in countries like India, the United States and the United Kingdom, where supportive legal frameworks and favorable tax policies have positioned employee ownership as a key driver of productivity, innovation, and inclusive growth. In contrast, adoption in Nepal has remained limited and fragmented, largely due to the absence of a comprehensive legal and regulatory framework. Historically, ESOPs were not formally recognized under Nepalese law and were rarely practiced in the corporate sector.

However, a significant shift occurred with the recent amendment to the Companies Act, 2063. Through the addition of Section 66A, introduced via an act titled "An Act to Amend Certain Nepal Laws to Improve the Economic and Business Environment and Increase investment," published in the Nepal Gazette on 18th Chaitra, 2081 (31st March, 2025), the concept of ESOP has been legally acknowledged for the first time in Nepal. This marks an important milestone in aligning Nepal’s corporate practices with global trends and opens new possibilities for employee ownership in the country.

02. Introduction of Employee Stock Ownership Plans

An Employee Stock Ownership Plan (ESOP) is a structured program or scheme that allows employees to acquire ownership interest in the company they work for, typically in the form of company shares. It is both a retirement benefit plan and an employee incentive mechanism, designed to align the interests of employees and shareholders by making employees partial owners of the business.

Under an ESOP, a company sets aside a certain portion of its shares or newly issued stock for employees, either for free or at a discounted rate. These shares are usually held in a trust until the employee meets certain conditions, such as a minimum tenure or retirement. Once vested, the employee can either retain the shares or sell them back to the company or in the open market, depending on the structure and whether the company is publicly listed.

This structure ensures that employees benefit directly from the company’s growth and profitability, fostering a stronger commitment and sense of ownership that can lead to increased productivity and long-term company success.

03. Key Terms and Concepts in ESOPs

Understanding ESOPs becomes much easier when we know the basic terms involved. Below are some common terms explained with examples.

Offer Date → Vesting Period → Exercise (buy at exercise price) → Lock-in (if any) → Sale (market or company buyback)

| S.N. | Terms | Meaning |

|---|---|---|

| 1 | Offer/Grant Date | The date on which the company officially offers or grants ESOP shares to the employee. Example: ABC Pvt. Ltd. grants 1,000 shares to an employee on January 1, 2025. This is the offer date. |

| 2 | Vesting Period | The minimum period an employee must work before they gain full ownership of the granted shares. Example: Shares vest over 2 years. If the employee leaves before 2 years, they may lose unvested shares. |

| 3 | Exercise Price (or Grant Price) | The price at which an employee can purchase shares once vested. Example: Shares are granted with an exercise price of NPR 500 per share. If market price is NPR 700, the employee gains NPR 200 per share. |

| 4 | Exercise Period | The timeframe (after vesting) when employees can buy their shares. If employees don’t exercise within the period, they lose the right to buy the shares. |

| 5 | Lock-in Period | A time frame during which employees cannot sell their vested shares. Example: After vesting, shares may be locked in for 1 year before sale is allowed. |

| 6 | Dilution | When a company issues new shares, existing shareholders’ ownership percentage decreases. ESOPs can cause dilution if new shares are issued to employees. |

04. Global Practices and Comparative Overview of ESOPs

Employee Stock Ownership Plans (ESOPs) have evolved into a mature and strategic component of corporate structure in many developed economies. Different countries implement ESOPs with unique objectives, tax regimes, and legal frameworks, but the underlying principle remains the same: empowering employees by offering them ownership in the companies they help build.

4.1 USA

In the United States, the concept of Employee Stock Plan (ESOPs) is well established and clearly defined under federal law. According to the Internal Revenue Code (IRC) of 1986, ESOP is a defined contribution plan that functions as either as a stock bonus plan or a combination of a stock bonus and money purchase plan provided both are qualified under section 401(a) of the IRC. This section governs qualified retirement plans, which are eligible for tax benefits

However, meeting this definition alone is not sufficient. To be officially treated as an ESOP under U.S. law, the plan must also comply with a range of regulatory provisions under the Inland Revenue Code. Section 409 (h) ensures that employees have right to sell (or “put”) their shares back to the company upon retirement, resignation, or termination, especially in the case of privately held companies where a public market may not exist. This protect employees by ensuring liquidity.

Section 409 (o) governs the rules for distributing shares or their cash equivalents to employees, including how and when the valuation of those shares must be conducted. It ensures that employees receive fair value for their holdings at the time of distribution.

Section 409(p) restricts the allocation of shares to highly compensated individuals following a significant change in the company’s ownership structure. This is designed to prevent the misuse of ESOPs by company insiders during corporate transitions.

Section 409(p) introduces anti-abuse provisions aimed at preventing excessive concentration of ESOP-owned shares in the hands of a small group of individuals, particularly in S corporations, thereby promoting broader and fairer employee ownership.

Lastly, Section 664(g) outlines the specific rules that apply when ESOPs are used within charitable remainder trusts, ensuring that the tax-exempt purposes of such trusts are not compromised by the ESOP arrangement.

These provisions ensure that ESOPs are not only used as tools for employee ownership but are also equitable, transparent, and aligned with tax and corporate governance norms in the U.S.

4.2 India

In India, Employee Stock Ownership Plans (ESOPs) are a widely used tool for talent retention and employee motivation, especially in startups and the tech sector. Indian companies offer ESOPs as part of employee compensation to align the interests of employees with the long-term growth of the company.

The issuance of Employee Stock Option Plans (ESOPs) is primarily governed by the Companies Act, 2013 and relevant rules under it, especially Rule 12 of the Companies (Share Capital and Debentures) Rules, 2014. While listed companies must also comply with the SEBI (Share Based Employee Benefits and Sweat Equity) Regulations, 2021, unlisted companies follow the Companies Act based provisions.

To issue ESOPs, a company must obtain shareholder approval via a special resolution. The resolution and the explanatory statement must disclose key details such as the total number of options, the classes of employees eligible, vesting requirements, exercise price/formula, lock-in periods, appraisal criteria, and conditions for lapse of options.

Notably, ESOPs cannot be issued to promoters or directors holding more than 10% of the equity unless the company is a startup, in which case this restriction is relaxed for the first five years of incorporation.

Companies have the flexibility to determine the exercise price in line with applicable accounting policies. Options granted are non-transferable and cannot be pledged or hypothecated. They are exercisable only by the employee, except in cases of death or permanent incapacity, where they vest in legal heirs or the incapacitated employee, respectively.

Upon resignation or termination, unvested options lapse. However, vested options can still be exercised within a specified period, as determined by the company’s ESOP policy.

4.3 UK

An Employee Stock Ownership Plan (ESOP) in the UK is a scheme that allows employees to acquire shares in the company they work for, giving them a direct stake in its success. These plans are designed to motivate employees, improve retention, reward long-term service, and offer tax advantages to both employers and employees. Typically, employees are not required to make financial contributions to join an ESOP, making the program accessible to all staff.

Companies usually set up an Employee Ownership Trust (EOT), a separate legal entity that holds shares on behalf of employees. The trust purchases shares often from existing shareholders or newly issued stock and distributes them to employees based on criteria such as salary or length of service. There are several forms of stock options under ESOP, including Incentive Stock Options (ISOs), which offer favorable tax treatment, and Non-Qualified Stock Options (NSOs), which are taxed at the time of exercise and again upon sale. Put options may also be used, giving employees the right to sell shares back to the company at a predetermined price. Benefits of ESOPs include tax efficiency, employee engagement, and the potential for financial gain, while drawbacks include administrative costs and market-related risks.

Legally, employees can receive tax relief on shares if they meet certain criteria, such as investing at least £2,000 and not holding more than 25% of the company’s voting rights, either personally or through close connections. Additionally, employers are required to fund independent legal advice for employees considering such agreements. Overall, ESOPs in the UK serve as a practical and inclusive way for companies to share ownership and align employee interests with business performance.

05. Employee Stock Ownership Plans (ESOPs) in Nepal: An Emerging Concept

Employee Stock Ownership Plans (ESOPs) are still a relatively new and evolving concept in Nepal. While there is no comprehensive, standalone ESOP law in Nepal as seen in countries like the US or India, with the recent amendment to the Companies Act, 2063, Nepal has taken a major step forward. The introduction of Section 66A, through the "Act to Amend Certain Nepal Laws to Improve the Economic and Business Environment and Increase Investment," published in the Nepal Gazette on 18th Chaitra, 2081 (31st March 2025), legally acknowledges ESOPs for the first time. This inclusion represents a key milestone in aligning Nepal’s corporate laws with global norms and supporting modern human resource strategies such as employee ownership.

5.1 Eligibility Criteria

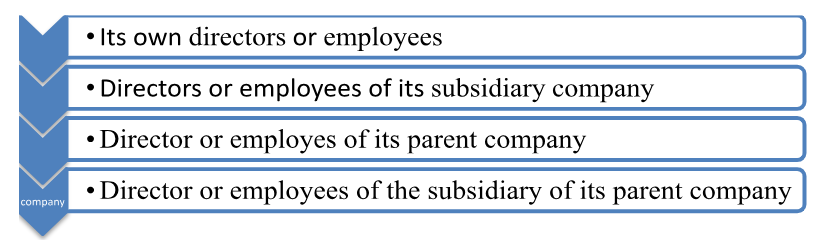

One of the key provisions introduced under Section 66A of the Companies Act, 2063, pertains to the eligibility of individuals who may be granted shares through an Employee Stock Ownership Plan (ESOP).

According to this provision, a company is permitted to implement an ESOP for the benefit of the following categories:

However, in the case of directors, the law has imposed a specific condition i.e., the director must be in regular employment with the company in order to be eligible to receive shares under the ESOP.

Additionally, the right to purchase or not to purchase the shares under this plan is vested on the relevant director or employee.

5.2 Mandatory Requirements before Implementing ESOP

Before a company can implement an Employee Stock Ownership Plan (ESOP) under Section 66A, it must obtain approval through a special resolution passed at its general meeting. Following the approval, the ESOP plan must include the following key details:

(a) Number of shares to be issued or made available for purchase under the scheme.

(b) Eligibility criteria, specifying the employees (or directors in regular employment) who may participate.

(c) Purchase window, i.e., the period during which the shares will be available for purchase.

(d) Purchase price at which the shares will be offered to eligible participants.

(e) Share allocation limit, stating the number of shares each employee is allowed to purchase.

(f) Any other appropriate matters, which the company may deem necessary to include for clarity and implementation.

| Topic | Description |

|---|---|

| Special Resolution | A special resolution must be passed by the company’s general meeting before implementing the ESOP. |

| Number of Shares | The plan must specify how many shares will be issued or made available for purchase under the ESOP. |

| Eligible Employees/Directors | The plan must list which employees and directors (in regular employment only) are eligible to participate. |

| Purchase Period | The plan should define the timeframe within which employees or directors can exercise their option to purchase shares. |

| Purchase Price | The price at which shares will be offered must be clearly stated in the plan. |

| Share Allocation Limit | The maximum number of shares that an individual employee or director can purchase must be specified. |

| Other Matters | Any other relevant or suitable matters that the company wishes to include, such as vesting schedules, restrictions, or conditions of transfer. |

5.3 Additionally Legal Provisions Governing ESOP under section 66A

Section 66A of the Companies Act also outlines additional conditions to guide the implementation and reporting of ESOPs. Shares purchased under the ESOP cannot be sold or transferred during a lock-in period set by the company. Only employees in active service during the offer period are eligible to participate, and if they choose not to purchase the shares, those shares may be offered to other employees.

Moreover, companies are required to disclose ESOP related details such as the number of shares issued and purchased within their annual report under Section 109(4).

5.4 Facilitation of Foreign ESOP under Nepal Foreign Exchange (Regulation) Act, 2019

A notable provision has been introduced through an amendment to section 10A of the Foreign Exchange Regulation Act, 2019 which directly impacts employee share schemes involving foreign parent companies. Under this provision, Nepali citizen employees residing in Nepal, who are employed by a company incorporated in Nepal, are permitted to acquire shares and earn income from such shares under an employee share sale scheme operated or implemented by the company’s foreign parent or its subsidiary without the remittance of convertible currency outside Nepal.

This amendment removes a key regulatory barrier, making it legally and procedurally easier for employees in Nepal to participate in international employee ownership programs.

06. Legal and Practical Analysis of ESOP in Nepal

Nepal has taken a significant step forward by formally recognizing Employee Stock Ownership Plans (ESOPs) through the introduction of Section 66A in the Companies Act, 2063 via an amendment published in the Nepal Gazette on Chaitra 18, 2081 (31 March 2025). This legislative development enables companies incorporated in Nepal to issue or offer shares to their employees and directors (who are in regular employment), as well as to employees of their parent, subsidiary, or fellow subsidiary companies, both domestic and foreign. The implementation of ESOPs is subject to board approval and shareholder approval via a special resolution, with clearly laid out requirements for plan content and disclosures.

Additionally, a notable amendment to the Foreign Exchange (Regulation) Act, 2019 has further expanded the ESOP framework. It allows Nepali citizens residing in Nepal who are employed by a Nepal-incorporated company whose parent or subsidiary is based abroad to participate in international employee share schemes without remitting convertible foreign currency from Nepal. This provision eliminates a significant regulatory hurdle and aligns Nepal with global practices in promoting employee equity participation in multinational corporate structures.

However, there remains a regulatory gap when it comes to remote workers residing in Nepal who are directly employed by a foreign company with no legal presence in Nepal. The current provisions under both the Companies Act and the Foreign Exchange Regulation Act do not explicitly recognize or facilitate ESOP participation for such individuals. This creates ambiguity regarding the legality and procedural framework for receiving and holding foreign equity in such contexts. As remote work arrangements become more prevalent, this gap may pose challenges for both compliance and participation unless further clarifications or legal reforms are introduced.

While these legislative developments are progressive, other key areas such as tax treatment of ESOP benefits, valuation protocols, accounting standards, and exit mechanisms remain underdeveloped in Nepal’s legal framework. Additionally, there is limited operational readiness and understanding among smaller firms and startups, which could hamper effective adoption and administration of ESOPs.

07. Understanding the Advantages of ESOP

| S.N. | Advantages |

|---|---|

| 1 | Align employees’ interests with company performance, boosting motivation and productivity. |

| 2 | Helps attract and retain talented employees by offering ownership stakes. |

| 3 | Encourages long-term commitment and loyalty among employees. |

| 4 | Can improve company culture through increased employee engagement. |

| 5 | Offers potential financial benefits to employees if company shares appreciate. |

| 6 | Provides tax advantages in some jurisdictions for both companies and employees. |

08. Understanding Disadvantages of ESOP

| S.N. | Disadvantages |

|---|---|

| 1 | Dilution of existing shareholders’ equity due to new shares issued. |

| 2 | Complexity and cost involved in setting up and administering the plan. |

| 3 | Potential financial risk for employees if the company’s share price falls. |

| 4 | May lead to short-term focus if employees try to maximize share value quickly. |

| 5 | Legal and regulatory compliance requirements can be burdensome. |

| 6 | Possible conflicts of interest between employees as shareholders and management. |

09. Key Challenges in Implementing ESOP in Nepal

| Challenge | Explanation |

|---|---|

| Regulatory Uncertainty | Since ESOP provisions are newly introduced, there is limited clarity and detailed guidelines on implementation, which may cause confusion and delay. |

| Lack of Awareness and Understanding | Many companies and employees are still unaware or unfamiliar with ESOP concepts, leading to hesitation in adoption. |

| Legal and Procedural Complexity | Compliance with recent amendments and foreign exchange regulations may be cumbersome for companies, especially SMEs. |

| Valuation and Pricing Issues | Determining fair value and exercise price of shares can be challenging due to lack of standardized frameworks. |

| Limited Market for Shares | In Nepal’s less mature capital markets, liquidity for employee shares may be limited, affecting attractiveness. |

| Taxation Ambiguities | Unclear tax treatment of ESOP income and gains may cause compliance difficulties and impact employee benefits. |

| Cross-border Restrictions | Despite amendments, complexities remain for employees working remotely for foreign companies without Nepalese legal presence. |

10. Understanding the Difference between ESOP and Sweat Equity

Both Employee Stock Ownership Plans (ESOPs) and Sweat Equity Shares are tools used by companies to reward and retain talent. While they both involve issuing shares to employee or directors, they differ significantly in terms of purpose, consideration, and legal treatment.

| Basis of Difference | ESOP (Employee Stock Option Plan) | Sweat Equity Shares |

|---|---|---|

| Definition | Option given to the employees to purchase company share at a predetermined price. | Share issued to employees/directors for providing know-how or value addition. |

| Purpose | Incentivize and retain employees | Reward intellectual contribution, technical know-how, or value addition. |

| Consideration (Payment) | Employee pays the exercise price to acquire shares. | Usually issued for non-cash consideration (e.g., services, IP, know-how) |

| Eligibility | Generally offered to employees and sometimes directors. | Offered to employees, directors, consultants and other contributors. |

| Ownership Transfer | Happens only when the employees exercise the option and pays for shares. | Ownership is transferred immediately when shares are issued. |

| Vesting Requirement | Usually has a vesting period before the option can be exercised. | There is no vesting period and shares are granted directly. |

| Objective | Employee motivation, performance-based incentives, and long term retention. | Recognition of services or contributions without cash compensation. |

Publication: 8 June 2025

Disclaimer: This article published at our website is just for information purpose only. It shall not be taken as the legal advice, advertisement, personal communication, solicitation or inducement. Bhandari Law and Partners or any of the team members of the firm shall not be liable for the consequence arising of the information provided. As the factual situation may be different on your case, thereof if you need further legal advice on the subject matter, please Contact Us.

Related Professionals:

Frequently Asked Question

For quick legal assistance:

You can directly call to our legal expert: +977-9808811027

Even can call or drop a text through What’s app , Viber, Telegram and We Chat at the same number.

Also can do email on : info@lawbhandari.com

contact us

Phone :,

,Connect with our professional lawyers in Nepal :

Follow Our Law Firm on Social Media :