Table of content

-

Direct Selling Law in Nepal : Key Highlights

01. Concept of Direct Selling in Nepal

Direct selling is a method of selling products and services directly to consumers, bypassing traditional retail stores and intermediaries. It typically takes place in non-retail locations such as homes, online platforms, or other personal settings. This business model is used by both large global brands and small entrepreneurial companies to reach consumers more personally and efficiently.

Companies engaged in direct selling offer a wide range of products and services, including health supplements, cosmetics, cookware, insurance, and household goods. The direct selling business promotes face-to-face interaction, builds customer trust, and often provides opportunities for individuals to become independent sellers or distributors.

Direct Sales of Goods (Management and Regulation) Act, 2074 defined, "Direct sale or distribution of goods" as the act of the licensee selling or distributing the goods available from a manufacturing company or distribution company directly to the consumer and, "Direct seller or distributor of goods" as a person or representative who is at least eighteen years of age and appointed by the licensee to carry out marketing or market promotion related to the direct sale of goods.

02. Governing Law of Direct Selling in Nepal

Following are the governing law for direct selling in Nepal:

a. Direct Sales of Goods (Management and Regulation) Act, 2017 (2074) ( “Direct Selling Act”)

b. Direct Sales of Goods (Management and Regulation) Regulations, 2019 (2076) (“Direct Selling Regulation”)

c. Directive Governing Direct Selling Business, 2022 (2078)

03. Governing Authority

Department of Commerce, Supplies and Consumer Protection

(“Department of Commerce”) is the governing authorities that provides the direct selling licence and further regulate the direct selling business in Nepal.

04. Process of Obtaining Direct Selling License in Nepal

4.1. Requirement of Direct Selling License in Nepal

Direct sale or distribution of goods cannot be carried out without obtaining a license in Nepal. Pursuant to Section 3 of Direct Selling Act, license is required for the operation of direct selling business in Nepal.

Further the Section 11 of the Act Prohibits the Pyramid Structure of Business to be operated in Nepal.

4.2. Process of Obtaining Direct Selling License in Nepal

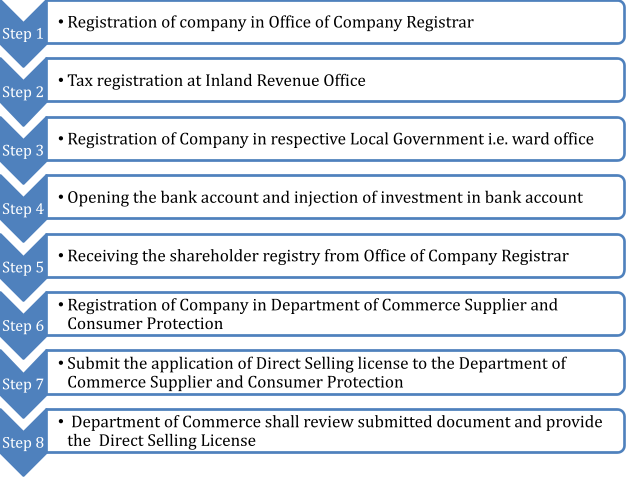

Following Process should be followed to obtain Direct Selling License :

- Step 1: Registration of company in Office of Company Registrar

- Step 2: Tax registration at Inland Revenue Office

- Step 3: Registration of Company in respective Local Government i.e. ward office

- Step 4: Opening the bank account and injection of investment in bank account

- Step 5: Receiving the shareholder registry from Office of Company Registrar

- Step 6: Registration of Company in Department of Commerce Supplier and Step 6 Consumer Protection

- Step 7: Submit the application of Direct Selling license to the Department of Step 7 Commerce Supplier and Consumer Protection

- Step 8: Department of Commerce shall review submitted document and provide Step 8 the Direct Selling License

Kindly Note:

a. The paid-up capital of the company applying for a license should be at least be one crore Nepalese rupees.

b. Foreigner investors are not allowed to invest on Direct Selling business in Nepal.

4.3. Documents required for obtaining direct selling license

Following document are required to be submitted to Department of Commerce for receiving the Direct Selling License:

| SN | DOCUMENTS |

|---|---|

| 1 | Copy of certificate of Nepalese citizenship of the director |

| 2 | Copy of company registration certificate, Memorandum and Articles of Association of Company |

| 3 | Tax Certificate |

| 4 | Latest tax clearance certificate |

| 5 | Detailed action plan related to direct sale of goods, dividend, commission distribution plan |

| 6 | A self-declaration of not being blacklisted, not having any defaults or fines to be paid in accordance with prevailing laws or court orders and Commitment made by manufacturer of the product that the product shall be provided to the Company |

| 7 | Exim Code Certificate (If company does imports of products from foreign jurisdiction) |

| 8 | Code of conduct of staff of company (HR policy) |

| 9 | Clear Address of the main office, distributer and other physical infrastructures of the company (including the ward of the respective city) |

| 10 | OCR compliance letter (updated letter) |

| 11 | Detail price of product (both foreign and domestic product) to be sold through direct selling |

| 12 | Approval letter from Inland Revenue office for software billing |

| 13 | Number of Seller and Distributors |

| 14 | In terms of goods that can be produced in Nepal or not, the quality assurance certificate from respective regulatory body |

Note:

The direct selling company must develop the website for their respective business and the link of the website should also be provided while submitting the application for issuing license.

4.4. Validity of the Direct Selling License

The license granted for the operation of direct selling business is valid for two years and shall renew the license every two year. If the license expires without renewal, such license will automatically be cancelled.

4.5. Renewal of Direct Selling License

The company shall submit an application to the department in the prescribed format along with the prescribed fee for license renewal sixty days prior to the expiry of the license

If the application is made at least fifteen days before the expiry of the license period, the application should be made by submitting double the license renewal fee.

Department of Commerce will then renew the license for two years within fifteen days from the date of receipt of the application. Following documents shall be submitted for the renewal to Department along with the following documents:

- Proof of tax payment of the previous financial year or filing of tax return,

- The original receipt or voucher deposited in the bank account designated by the department as the renewal fee that is 0.1% of paid up capital of company,

- If a bank guarantee has been filed instead of bond, the bank guarantee letter of the concerned bank showing renewal or updating of such bank guarantee.

05. Conditions to be followed by the licensee for operation of Direct Selling Business in Nepal

Following conditions has to be complied with during registration of direct selling business:

- Products should not be sold in such a package creating unlimited liability

- There should not be a binding arrangement under the business plan of the licensee, that mandates to purchase a certain amount of goods and if such amount of goods are not purchased, the bonus or commission that would otherwise be earned would be forfeited,

- The consumer should be allowed to purchase separate goods as per their wish,

- The licensee shall not act as a mere direct seller or distributor rather should also be involved in dealing of goods,

- Not to produce, promote, sell or distribute goods that can have adverse effect on the health of consumers,

- If any law mentions the approval of any other body to be obtained for the direct sale or distribution of any item, such approval must be obtained from the body,

- In case of transfer or change of ownership or liability of the company it should be reported to the department within seven days of such transfer or change of ownership or liability,

- The license and the price list of goods to be sold or distributed should be kept in a place where everyone can see and understand them.

06. Capital Requirement and Guarantee Amount

Pursuant to Section 4 of the Act Minimum capital of the direct selling business should be 1 crore and 50 % of total paid up capital should be provided as a guarantee amount.

07. Registration of Trademark of the Products

Trademark Registration is prime to receive the license of Direct Selling Business in Nepal. While receiving the Direct Selling License company needs to submit the trademark of the company and the products that are to be sold through direct selling.

Kindly note:

It shall take 8 to 9 months to receive the trademark certificate from Department of Industry. For detail understanding regarding the trademark registration process in Nepal, please go through the article : Trademark Registration In Nepal.

08. Investment in Direct Selling Business by Foreign Investors

As a matter of practice, Department of Commerce, Supplies and Consumer Protection does not allow foreign investor to invest in direct selling business in Nepal. It also does not allow establishment of companies with foreign investors through partnership.

09. Prohibition of Pyramid business

Pyramid based business is prohibited in Nepal. Section 11 of the Act has defined Pyramid based business as following activities:-

- Networked work that requires a mandatory subscription before purchasing the product,

- Networked work requiring compulsory purchasing of other items included in a lump sum package, while buying one item,

- A networked operation under which if in the event that the person purchasing the goods fails to make another direct seller or distributor under him, he/she won't be able to obtain any other item equivalent to the amount paid by him in the first place,

- Networked activities involving only charging fees by making a direct seller or distributor without dealing goods,

- For the purpose of selling goods by the company, the networked act of recruiting members or making them buy expensive goods by giving attractive gifts that seem unfair and impossible from a commercial point of view or alluring them of commission,

- A networked operation with a business plan that discourages the retail sale of goods, or

- The networked act of selling or distributing a product in the belief that it is a supernatural product that provides unexpected benefits or cures a disease proven by medical science to be incurable.

10. Cancellation of License

Section 9 of the Act provides the Department to cancel the license granted in any of the following situations:-

(a) If it is found that a license has been obtained by submitting false documents or particulars,

(b) If the paid-up capital is not increased or if no additional bond is filed, within the specified period even after the order issued by the department,

(c) Carrying on pyramid based business,

(d) If the business is conducted without an agreement between direct seller or distributor and the licensee disclosing the services, facilities, commissions or bonuses to be received from the licensee for the sale or distribution of goods,

(e) If the compensation to be given to the consumer is not given within the specified period,

(f) If the fine imposed is not paid within three months of the due date,

(g) If within a period of two years, an act that could be imposed fine as per law is committed for the third time.

11. Punishment and offense

Following acts can be deemed as an offense relating to direct sale of goods;

(a) Direct sale or distribution of goods without obtaining license,

A person, who gets involved in direct sale of goods without obtaining license, is punished with a fine as per the monetary value if the monetary value is clear, and if it is not clear, a fine of one lakh rupees to five lakh rupees or imprisonment from six months to one year or both.

(b) Carrying out pyramid-based business

A person carrying out such business will be liable to a fine as per the monetary value if the monetary value of the offense is clear, and if not, a fine of five lakh rupees to ten lakh rupees or imprisonment for a term of three to five years, or both,

If a licensed company commits such an offense, the founder, manager or relevant officer of the company is punished. A person inciting or abetting the offense is punished with half of the punishment of commission of the offense.

Date of Publication: 17 April 2025

Disclaimer: This article is provided for informational purposes only and does not constitute legal advice. It reflects the laws and practices in Nepal as of April 17, 2025. Readers are advised to consult qualified legal professionals for guidance on specific matters.

Related Professionals:

Frequently Asked Question

For quick legal assistance:

You can directly call to our legal expert: +977-9808811027

Even can call or drop a text through What’s app , Viber, Telegram and We Chat at the same number.

Also can do email on : info@lawbhandari.com

contact us

Phone :,

,Connect with our professional lawyers in Nepal :

Follow Our Law Firm on Social Media :