Table of content

-

Trading Company Registration Process in Nepal

Overview

This article aims to provide an overview on how trading companies are registered in Nepal, it contains information about the governing law, governing authority and the details about the registration process of trading companies.

Kindly note that those trading companies that aim to import products from foreign countries to sell in Nepal have to fulfil the additional step of applying for EXIM code. This article also covers in detail the registration process of Exim Code Registration in Nepal.

1. Governing Laws

Following are the laws that govern the registration process of the trading company in Nepal.

| S.N | Governing Law | Subject Matter of Governance |

|---|---|---|

| 1 | Companies Act, 2063 (2006) | Governs the company registration process. |

| 2 | Procedure for Providing EXIM Code, 2079 (2023) | Sets rules on obtaining an EXIM code, renewal, and related issues. |

2. Governing Authorities

The table below provides a list of the governing authorities that govern the registration process of trading company in Nepal.

| S.N | Governing Authority | Subject Matter of Governance |

|---|---|---|

| 1 | Office of the Company Registrar (OCR) | Main authority for registration of companies in Nepal |

| 2 | Department of Customs under the Ministry of Finance | Issues EXIM code |

| 3 | Department of Commerce, Supplies and Consumer Protection | Registers companies/firms/industries that wish to engage in import/export trade |

3. Process of registering trading companies

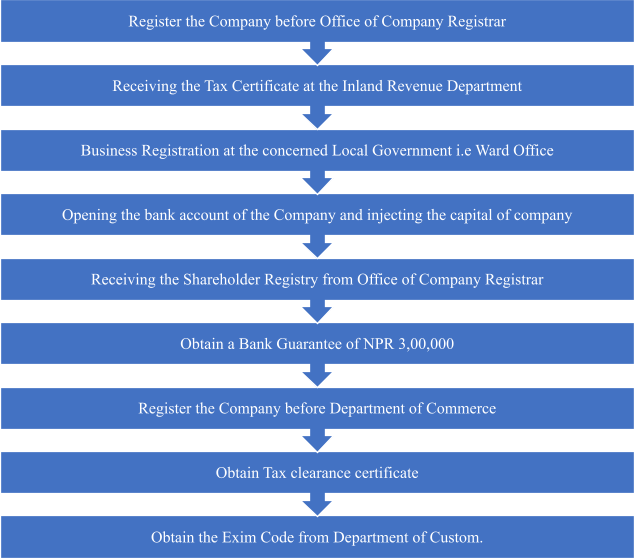

3.1. Steps to be taken to register trading companies in Nepal.

Registration of trading companies includes the following steps:

-

Step: 1: Registration of Company before Office of Company Registrar

-

Step: 2: Receiving the Tax Certificate at the Inland Revenue Department

-

Step: 3: Business Registration at the concerned Local Government i.e Ward Office

-

Step: 4: Opening the bank account of the Company and injecting the capital of company

-

Step: 5: Receiving the Shareholder Registry from Office of Company Registrar

-

Step: 6: Obtain a Bank Guarantee of NPR 3,00,000

-

Step: 7: Register the Company before Department of Commerce

-

Step: 8: Obtain Tax clearance certificate

-

Step: 9: Obtaining the Exim Code from the Department of Custom.

Kindly Note:

01. Company should deposit 3 Lakh Nepalese Rupees as a guarantee amount to receive the Exim Code.

02. The bank account must be opened with an A-category commercial bank.

03. The minimum paid-up capital required to get the EXIM Code is NPR 10,00,000 and NPR 60,00,00, if the company will engage in wholesale import and export.

04. The recommendation letter from the bank must be in the format mentioned in schedule 2 of the Procedure for Providing EXIM Code, 2079 (2023) where the applicant has a bank account. This is not required if the company is involved in export only.

3.2. Government Fee To be Paid during Incorporation of Company

| S.N | Particulars | Rate of Government Fee |

|---|---|---|

| 1 | Government fee to be paid before OCR for company registration | Depends upon the authorized capital of company. |

| 2 | Business Registration at Ward Office | Approx. NPR 10,000 to NPR 20,000 (USD 75 to 150) (Please note that the business registration fees are specific to each local level and subject to change every fiscal year.) |

| 3 | House Rent Tax | 10% of house rent amount per month (During the incorporation need to pay 4 to 6 months house rent tax) |

| 4 | Department of Commerce, Supplies and Consumer Protection | Government fee depends on capital of company. |

3.3. Timeline for Complete Registration

It shall take 30 to 45 days for completion of the entire registration process of trading companies. Obtaining EXIM code however takes only 15-20 minutes, given that all prerequisites are fulfilled.

3.4. Documents required for the registration of company

Below are the documents required to register a trading company.

| S.N | Documents Required |

|---|---|

| 1 | Application for registration of company in the standard format |

| 2 | Memorandum of Association and Article of Association of the Nepalese Entity |

| 3 | Shareholders agreement, if any |

| 4 | Citizenship certificate/Passport of investor in case of an individual |

| 5 | Copy of certificate of registration and other registration documents (MOA, AOA) of corporate entity in case a corporate entity wants to invest in the company |

| 6 | Resolution of the corporate entity for incorporating the entity in case a corporate entity wants to invest in the company |

3.5. Documents required to receive the Exim Code

Below are the documents that are required in the process of registering trade companies:

| S.N | Documents Required |

|---|---|

| 1 | Application letter issued with signature |

| 2 | Copy of PAN card and VAT registration |

| 3 | If dealing with excisable goods, a copy of relevant permit |

| 4 | Copy of Tax Clearance certificate up to the last fiscal year |

| 5 | Registration certificate from the Department of Industry/Department of Commerce/Domestic and Small Industries with renewal, if renewal is required |

| 6 | If separate permission is required for any transaction, a copy of the permit |

| 7 | Original bank guarantee certificate of NPR 300,000 |

| 8 | Original copy of the bank recommendation with a photo attached as per Schedule 2 for an existing bank account |

| 9 | Location map clearly identifying the place of business/operation |

| 10 | For Pvt. Ltd. or partnership firms, a copy of the minute from the board of directors’ decision to obtain an EXIM Code, along with copies of the Articles of Association, Rules, and Share Register |

| 11 | Recommendation letter from the Department of Industry if registered with the Provincial Government under Domestic and Small Industries |

| 12 | Self-attested copies of documents |

4. Renewal requirements of trading companies

Section 8 of Procedure for Providing EXIM Code, 2079 (2023)) states that every fiscal year, the EXIM Code must be renewed electronically. If a lump sum fee is paid, the company, firm, or industry may renew the EXIM Code for a maximum of five (five) fiscal years. Every year throughout this renewal period, a bank guarantee is necessary. The renewal fee is NPR 1,000.

Documents required for the renewal :

01. Tax clearance document;

02. Bank guarantee is worth NPR 3,00,000 (three lakh Nepalese rupees) for the duration of the renewal.

5. Restriction of Investment by Foreign Investor in Trading Company

Foreign investors are prohibited from engaging in trading businesses in Nepal, as such activities are included in the Negative List under the Foreign Investment and Technology Transfer Act 2019 (2075). Additionally, foreign investors are also not permitted to establish companies in partnership with Nepali citizens by allocating shares to local individuals.

However, foreign investors are allowed to sell their products in Nepal by appointing a local distributor or agent, provided they formalize the arrangement through a valid distributorship or agency agreement.

Date of publication : 2024/12/30

Disclaimer: Bhandari Law and Partners is one of the leading law firm in Nepal with team of best professional lawyers in Nepal.This article published on website of the law firm is just for information purpose only. It shall not be taken as the legal advice, advertisement, personal communication, solicitation or inducement. Bhandari Law and Partners or any of the team members of the firm shall not be liable for the consequence arising of the information provided. As the factual situation may be different on your case, thereof if you need further legal advice on the subject matter, please Contact Us.

Related Professionals:

Frequently Asked Question

For quick legal assistance:

You can directly call to our legal expert: +977-9808811027

Even can call or drop a text through What’s app , Viber, Telegram and We Chat at the same number.

Also can do email on : info@lawbhandari.com

contact us

Phone :,

,Connect with our professional lawyers in Nepal :

Follow Our Law Firm on Social Media :