Table of content

-

Shareholder Agreement in Nepal : Key Drafting Consideration

01. Introduction to Shareholder Agreement

A Shareholder Agreement (“SHA”) is a private contract among the shareholders of a company and often the company itself, that governs their rights, responsibilities and relationships. It supplements the company's Articles of Association (AOA) and Memorandum of Association (MOA), which are public documents filed with the Office of Company Registrar (OCR). While the AOA governs the internal management of the company and is binding on all shareholders by virtue of their share ownership, an SHA provides a more detailed and flexible framework for specific shareholder arrangements that may not be suitable for public disclosure or amendment through general corporate resolutions.

In Nepal, the Companies Act, 2063 (2006) is the primary legislation governing companies in Nepal. The Act recognizes the freedom of contract and as such, Shareholder Agreements are generally upheld as legally binding contracts between the parties involved. They are treated as separate and distinct from the public constitutional documents of the company (MOA and AOA). However, it's crucial to understand that an SHA cannot contradict or override the mandatory provisions of the Companies Act or any other prevailing laws. If a clause in an SHA conflicts with a non-derogable provision of the Companies Act, the Act will prevail.

Nevertheless, SHAs are widely used in Nepal, particularly in private companies, joint ventures and companies with a limited number of shareholders, to:

-

Define the rights and obligations of shareholders beyond what is stipulated in the AOA.

-

Provide for dispute resolution mechanisms specific to shareholder disagreements.

-

Regulate share transfers, pre-emption rights and anti-dilution provisions.

-

Establish specific governance rules, such as supermajority voting for certain decisions.

-

Protect minority shareholders' interests.

02. Mandatory Requirement of JV Agreement for FDI Companies

For companies involving Foreign Direct Investment (FDI) in Nepal, the concept of a Joint Venture (JV) Agreement often overlaps significantly with a Shareholder Agreement. The Foreign Investment and Technology Transfer Act, 2075 (2019) and its associated regulations implicitly or explicitly require a formal agreement between local and foreign partners for the establishment of a joint venture company in Nepal.

While the term "JV Agreement" is often used, in essence, for newly formed companies, this agreement serves the purpose of a comprehensive Shareholder Agreement. It is a mandatory document that must be submitted to the Department of Industry (DOI) as part of the foreign investment approval process. These authorities scrutinize the JV Agreement to ensure compliance with foreign investment laws, sector-specific policies and to understand the operational modalities, profit repatriation plans and dispute resolution mechanisms for the foreign investment.

Therefore, for FDI companies, what is commonly referred to as a "Joint Venture Agreement" functions as a mandatory Shareholder Agreement, detailing the relationship between the foreign investor and their local counterpart(s) and is a prerequisite for obtaining foreign investment approval.

03. Main Clauses of Shareholder Agreement

A well-drafted Shareholder Agreement typically includes clauses addressing various aspects of corporate governance and shareholder relations. Key clauses often found in an SHA include:

| Clause Category | Description |

|---|---|

| 1. Parties | Identifies all shareholders and often includes the company itself as a party to the agreement. |

| 2. Recitals/Background | Provides an overview of the company, its purpose, and the rationale for entering into the SHA. |

| 3. Share Capital & Shareholdings | Details on authorized and issued share capital, initial shareholding structure, and future capital contributions or share issuances. |

| 4. Board of Directors | Covers board size, appointment/removal of directors, qualifications, and remuneration, especially concerning shareholder groups. |

| 5. Management & Operations |

|

| 6. Transfer of Shares |

|

| 7. Funding and Dividends | Sets out capital raising, funding requirements, capital calls, and dividend policy. |

| 8. Confidentiality | Requires shareholders to keep company information confidential. |

| 9. Non-Compete & Non-Solicitation | Prevents shareholders from engaging in competing businesses or soliciting company clients/employees. |

| 10. Deadlock Resolution | Outlines how to resolve fundamental disagreements (e.g., mediation, arbitration, shotgun clauses). |

| 11. Default and Remedies | Defines defaults under the agreement and remedies available to non-defaulting shareholders. |

| 12. Termination | Conditions for termination of the SHA (e.g., mutual agreement, company dissolution, single shareholder remaining). |

| 13. Representations & Warranties | Statements by shareholders confirming authority and validity of their shareholding. |

| 14. Indemnification | Specifies compensation for losses due to breaches of the agreement. |

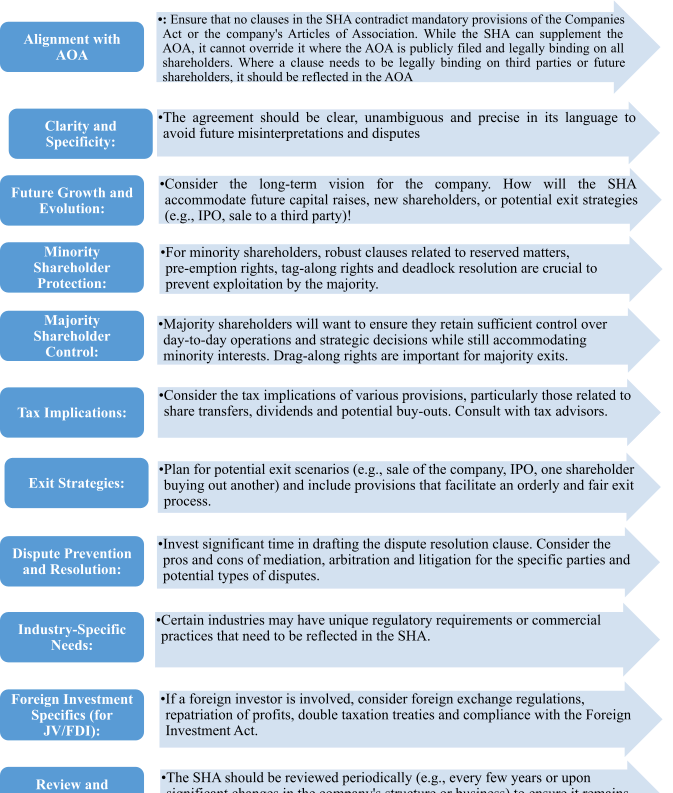

04. Key Considerations Taken While Drafting the Shareholder Agreement

By carefully considering these aspects, parties can draft a comprehensive and effective Shareholder Agreement that serves as a robust framework for their relationship and the long-term success of the company in Nepal.

05. Importance of Shareholder Agreement

A well-drafted Shareholder Agreement is essential for several reasons, especially in the context of the legal and business environment in Nepal. Here are the key reasons why having an SHA is important:

5.1 Clarity of Rights and Obligations

In the absence of a shareholder agreement, disputes can arise over issues such as voting rights, profit sharing and decision-making authority. A well-defined SHA can eliminate ambiguity by specifying the rights and obligations of each shareholder, which can prevent future misunderstandings and conflicts.

5.2 Protection of Minority Shareholders

In Nepal, as in other jurisdictions, majority shareholders may sometimes exercise disproportionate power. An SHA can protect minority shareholders by granting them certain rights such as:

-

Tag-along rights: Allowing minority shareholders to join in the sale of shares if the majority shareholder decides to sell.

-

Drag-along rights: Allowing majority shareholders to compel minority shareholders to sell their shares under specific circumstances, often when the company is being sold.

5.3 Decision-Making and Governance

The agreement outlines how decisions will be made within the company, ensuring that shareholders are clear about how power is distributed. This is especially important in private companies where the board of directors may not always represent the diverse interests of all shareholders.

5.4 Prevention of Future Disputes

Disputes are common in companies with multiple shareholders. A well-drafted SHA anticipates potential points of conflict and provides mechanisms for resolving them. These mechanisms could include mediation, arbitration, or even predefined buyout clauses.

5.5 Exit Strategy and Share Transfer Conditions

An SHA often addresses the process for shareholders who wish to exit the company. It can lay out conditions under which shares can be transferred, how the valuation of shares will be conducted and the priority order of who can buy the shares when they are sold. This is particularly important in a country like Nepal, where informal business networks play a significant role in transactions.

06. Key Components of a Shareholder Agreement in Nepal

A comprehensive Shareholder Agreement in Nepal should cover the following key components:

6.1 Parties to the Agreement

The first section of the SHA identifies the parties involved, i.e., the shareholders of the company. It provides details about their ownership percentages and their respective roles and responsibilities within the company.

6.2 Share Capital and Ownership Structure

This section specifies the shareholding structure of the company. It should clearly outline the number of shares held by each shareholder, the classes of shares (if applicable) and the total share capital of the company. This is important for establishing the rights and entitlements associated with different classes of shares, such as voting rights and dividend preferences.

6.3 Management and Decision-Making

An important component of any SHA is the governance structure. This section of the agreement typically outlines:

-

Board composition: The number of directors, their powers and how they are appointed. It also specifies the quorum required for board meetings and the voting rights of directors.

-

Majority and minority voting rights: Rules governing how major decisions, such as mergers, acquisitions, or changes to the company's structure, are made.

-

Deadlock provisions: These provisions ensure that in the event of a deadlock between shareholders, there is a mechanism for breaking it, such as mediation or arbitration.

6.4. Dividend Distribution

The SHA should outline how and when profits will be distributed among shareholders. It may stipulate a policy on dividend payouts, such as whether dividends will be paid annually or retained within the company for reinvestment.

6.5 Transfer of Shares

This clause addresses the process and restrictions on transferring shares. It may include:

-

Right of first refusal: The existing shareholders may have the right to purchase shares before they are sold to an outsider.

-

Tag-along rights and drag-along rights: As mentioned earlier, these rights protect minority shareholders and ensure that the sale of shares aligns with the interests of all shareholders.

6.6 Dispute Resolution

A well-drafted SHA should include provisions for resolving disputes among shareholders. This could involve a structured approach to mediation, followed by arbitration if necessary, to ensure conflicts are resolved efficiently and without resorting to litigation.

6.7 Exit Strategy and Buyout Provisions

The SHA often includes provisions outlining the conditions under which a shareholder can exit the company and the procedures for valuing and buying back their shares. It may also include pre-agreed terms for an IPO (Initial Public Offering) or the sale of the company.

6.8 Confidentiality and Non-Compete Clauses

Many shareholder agreements include confidentiality clauses to prevent shareholders from disclosing sensitive company information to third parties. Additionally, non-compete clauses can be included to restrict shareholders from engaging in businesses that directly compete with the company after their exit.

07. Formalities of Execution of a Shareholder Agreement in Nepal

Executing a Shareholders’ Agreement (SHA) in Nepal must follow specific legal and procedural steps to ensure its validity and enforceability. Proper compliance strengthens the agreement’s legal standing and is particularly important if disputes arise in the future.

Once the shareholders have negotiated and agreed on all terms, the agreement should be formally executed. Each shareholder must sign the document in the presence of independent witnesses. The witnesses should clearly state their full name, address and government-issued identification number (such as citizenship certificate number) to enable proper verification if required later. These signatures and attestations serve as proof of authenticity and strengthen the legal evidentiary value of the agreement.

The agreement must also mention the precise date of execution, as it determines when the rights and obligations take effect.

Although the Shareholders’ Agreement is primarily a private contract among shareholders and its registration is not mandatory under the Companies Act 2006, parties may choose to register or notarize it—such as with the Office of Company Registrar or a Notary Public; to enhance evidentiary strength, especially for enforcement against third parties or institutional stakeholders.

In addition, SHAs executed under Nepalese law must comply with the general contract requirements prescribed by the Muluki Civil Code, 2017. Signature by hand is sufficient and thumbprints are not mandatory. However, when a company signs, a rubber stamp must be affixed for formal recognition.

Pursuant to Section 187 of the Companies Act 2006, shareholders executing an SHA must provide two copies of the signed agreement to the company within 15 days. The company must then submit one copy to the Office of the Company Registrar within the next 15 days. For consensus agreements executed before incorporation, the SHA must be submitted along with the company registration documents.

08. Governing Law and Dispute Resolution

8.1 Dispute Resolution Mechanism

A well-structured dispute resolution framework is essential in a Shareholders’ Agreement (SHA) to ensure clarity and certainty in the event of disagreements among shareholders. Under Nepalese law, parties enjoy autonomy in selecting the governing law and forum for dispute resolution, subject to statutory requirements and public policy considerations.

8.2 Governing Law

In most cases, Shareholders’ Agreements related to Nepal-incorporated companies are governed by the laws of Nepal. This ensures consistency with the Companies Act 2006, Muluki Civil Code 2017 (MCC) and relevant regulatory frameworks.

However, Nepalese contract law also recognizes party autonomy. Pursuant to Section 709 of the Muluki Civil Code, the parties may mutually agree to apply a foreign governing law, particularly in cross-border investment transactions. Such choice must not conflict with Nepal’s public policy or mandatory corporate governance requirements applicable to Nepal-registered companies.

Accordingly:

-

Domestic SHAs typically select Nepal law as the governing law.

-

Foreign investors may negotiate foreign governing law for specific contractual aspects, while operational and corporate matters remain subject to Nepalese corporate law.

8.3 Dispute Resolution Framework

Disputes arising under a shareholders’ agreement may be resolved either through the court system or arbitration. Parties must exercise diligence when drafting the dispute resolution clause, as Nepalese procedural law features jurisdictional overlaps:

-

District Courts generally handle contractual disputes, while

-

High Courts have jurisdiction over matters arising under the Companies Act 2006.

Also, parties should specify the geographic venue for dispute resolution to mitigate procedural uncertainty.

8.4 Arbitration Preference and Considerations

Arbitration is increasingly the preferred dispute resolution mechanism in SHAs, especially where foreign investors are involved, due to its neutrality, confidentiality and enforceability advantages. Nepalese law recognizes both domestic and international arbitration and arbitration agreements are enforceable under the Arbitration Act 1999.

Well-drafted arbitration clauses should ensure:

-

professional and impartial administration of proceedings;

-

swift and independent appointment of arbitrators;

-

minimal need for judicial intervention in the appointment process;

-

court authority to grant interim measures, such as injunctions, to maintain the status quo pending final determination; and

Selecting an appropriate seat of arbitration, institutional rules (e.g., UNCITRAL, ICC, NAAC) and mechanism for interim relief is crucial for safeguarding shareholder rights, particularly in transactions involving cross-border investments and multinational shareholders.

09. Conclusion

In Nepal’s evolving corporate environment, a well-drafted Shareholder Agreement (SHA) serves as a vital instrument for establishing clarity, trust and structure among shareholders. It complements the company’s Memorandum and Articles of Association by addressing specific governance arrangements, rights, obligations and dispute resolution mechanisms that may not be suitable for public disclosure or statutory documentation. Particularly in private companies, joint ventures and entities with foreign direct investment (FDI), the SHA often termed a Joint Venture Agreement for FDI purposes—is not only essential but also a mandatory submission for regulatory approvals. While the SHA must align with Nepal’s Companies Act and other prevailing laws, it provides flexibility to tailor arrangements according to the unique needs of the parties involved. For it to be effective, proper execution formalities, legal compliance and enforceable dispute resolution provisions must be ensured. Therefore, engaging qualified legal counsel is strongly recommended to draft a robust SHA that balances the interests of all shareholders and supports the long-term stability and success of the company.

Date of Publication: 2. November 2025

Disclaimer: This article published on our website is just for information purpose only. It shall not be taken as the legal advice, advertisement, personal communication, solicitation or inducement. Bhandari Law and Partners or any of the team members of the firm shall not be liable for the consequence arising of the information provided. As the factual situation may be different on your case, thereof if you need further legal advice on the subject matter, please Contact Us.

Related Professionals:

Frequently Asked Question

For quick legal assistance:

You can directly call to our legal expert: +977-9808811027

Even can call or drop a text through What’s app , Viber, Telegram and We Chat at the same number.

Also can do email on : info@lawbhandari.com

contact us

Phone :,

,Connect with our professional lawyers in Nepal :

Follow Our Law Firm on Social Media :