Table of content

-

Registration of Information Technology Business in Nepal through the Route of Foreign Direct Investment

1. Background for establishment of Information Technology (IT) Business in Nepal

Nepal offers a myriad of compelling reasons for foreign investors to consider establishing an Information Technology Business ("IT Business") in Nepal. Some of the reasons to establish an IT Business in Nepal are; a cost-effective workforce, untapped growth potential, outsourcing hub: leveraging cost-effective services, diversification of business operations, skilled workforce, growth potential, etc. Due to the mentioned advantage large number of foreign IT Companies have already started their operation in Nepal.

To embrace these advantages, viable business structures for the foreign investors are either (i) the establishment of a new local subsidiary company through foreign investment or (ii) invest in an already existing company. As a matter of practice foreign companies are also establishing the branch office of foreign company in Nepal by receiving the recommendation letter from Ministry of Information, Communication and Technology. Branch office establishment is only suitable for those companies who does not raise invoice to the Nepalese clients or else’s there shall be problem for the branch office to repatriate the amount from Nepal. Among the mentioned two options, establishment of local subsidiary company is the best option.

This article explains details regarding the viable options for foreign investors to establish the IT Business in Nepal.

2. Establishment of the new local subsidiary company through foreign direct investment.

2.1 Governing Laws:

The matters related to the establishment of the IT Business in Nepal by foreign investors are governed by (a) Foreign Investment and Technology Transfer Act, 2019 (“Foreign Investment Act”), (b) Industrial Enterprise Act, 2020 (“Industrial Enterprise Act”), (c) Foreign Exchange (Regulation) Act, 1962 (“Foreign Exchange Act”), and (d) The Companies Act, 2006 (“Companies Act”).

2.2 Permissibility:

One of the options available for foreign investors to operate an IT Business in Nepal is by establishing a subsidiary company through foreign investment in Nepal. For this option, a foreign company desirous to invest in Nepal must invest in a permitted sector of “industry” in Nepal. The permissibility of foreign investment in Nepal is subject to the fulfillment of the following two criteria:

(i) Firstly, the sector of industry must not fall under the “Negative List of Industries for Foreign Investment” provided in the Schedule of the Foreign Investment Act; and

(ii) Secondly, the sector of business must fall under the classification of an “industry” under the Industrial Enterprise Act, which is also called “Positive List”.

The Industrial Enterprise Act enlists IT Business under the classification of Positive List and the Foreign Investment Act does not include it under the Negative List. Thus, the Investor can apply for foreign investment approval to establish a company with the objective of operating an IT Business with 100% foreign ownership in equity shares of the company or in Joint Venture (JV) with Nepalese/foreign investors.

Kindly Note:

An IT Business through foreign investment can undertake various types of software solutions and development activities. However, the Investor is not allowed to engage directly in the retail business without developing or providing value addition to imported software. Also, the Foreign Investment Act prohibits foreign-invested companies to engage in trading activities in Nepal.

2.3 Minimum Capital Requirement:

Regarding the investment threshold, a minimum capital of NPR. 20 million (Approx. USD 1, 50,000) had to be invested to establish a company through foreign investment by each foreign investor till 2 October 2023.

However, through the Nepal Gazette published on date 2 October 2023 there is no minimum capital requirement for IT Companies. The minimum threshold has been removed.

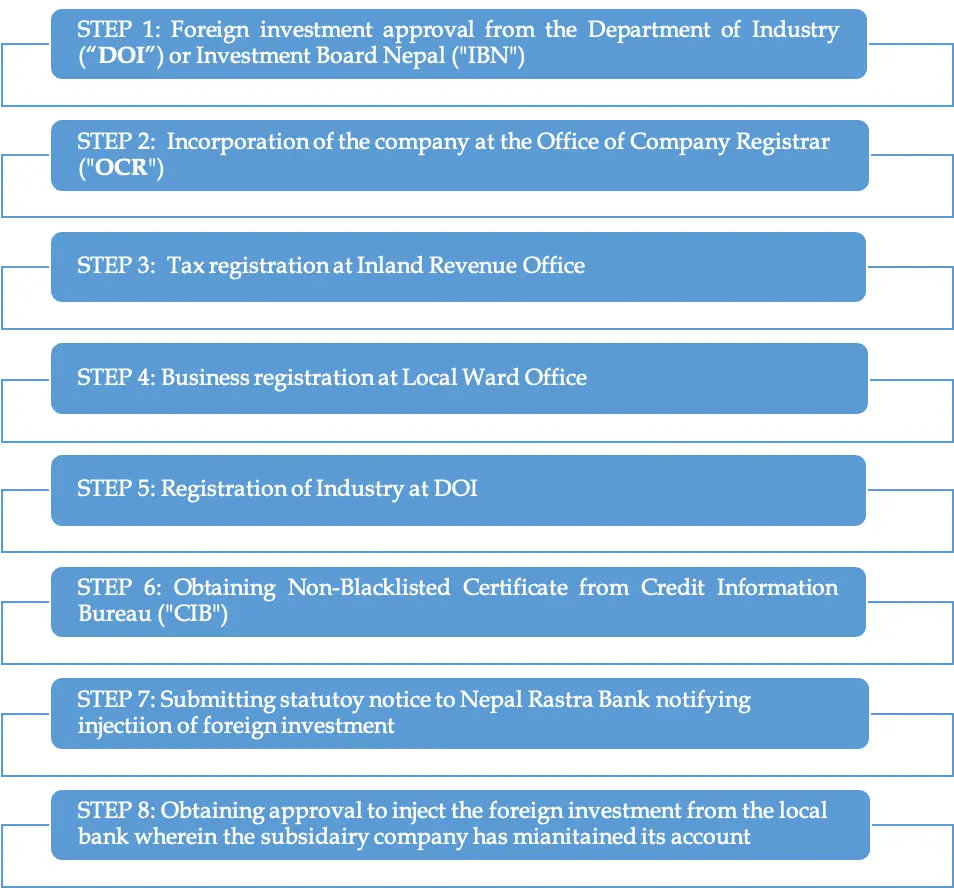

2.4 Procedure of establishment of local subsidiary company in Nepal

Following steps are followed for registration of local subsidiary office:

'

2.5 Required documents:

The list of the documents required for foreign investor are as follows:

| S.N. | Documents |

|---|---|

| 1. | Company incorporation certificate (if the company is an investor) |

| 2. | Memorandum of Association |

| 3. | Article of Association |

| 4. | Copy of passports of all the directors and shareholders of an investor |

| 5. | Copy of passport or citizenship of an investor's authorized representative |

| 6. | Project Report and schedule for investment |

| 7. | Financial Credibility Certificate ("FCC") |

| 8. | Latest financial statement |

| 9. | Board Resolution of the investor company (if the company is an investor) |

| 10. | Profile of the company or biodata of an individual investor |

| 11. | Power of attorney |

2.6 Timeline for incorporation of a subsidiary company

The overall time period for the registration of foreign direct investment in Nepal takes about three to five (3 to 5) months.

2.7 Timeline for injection of Foreign Investment amount

Foreign investors are required to bring following percentage of the FDI amount within 1 (one) year from the date of DOI approval.

| S.N. | FDI approval | % of Capital injection |

|---|---|---|

| 1 | NPR. 20 million (approx. USD. 150,000) | 25% |

| 2 | NPR. 20 million to NPR. 250 million (approx. USD. 150,000 to USD. 1.8 million) | 15% |

| 3 | NPR. 250 million to NPR 1 billion (approx. USD. 1.8 million to USD 8.5 million) | 10% |

| 4 | Above NPR. 1 billion (approx. USD 8.5 million) | 5% |

Notwithstanding the above, FITTA Regulation requires investors to bring in 70% of the total FDI amount before commercial operation of the company, and the remaining 30% within 2 (two) years thereafter.

3. Registration of branch office

The second option for the Investor to establish an IT Business in Nepal is by establishing a branch office. The branch office can carry out the business activities that the Investor carries out in the country of its incorporation as stated in the Memorandum of Association or related incorporation documents. Thus, the incorporation documents of the company issued from the home country must state the objective related to IT Business if it wants to carry out such activities in Nepal.

3.1. Governing Laws:

The registration of a branch office of a foreign company in Nepal is governed by the Companies Act, 2006 (2063) (“Companies Act”). Section 154 (1) of Companies act incorporates the provision related to the registration of branch office of a foreign company in Nepal.

Approval from the relevant government authority must be obtained for registration of the branch office. For a branch office registration of an IT company, approval has to be obtained from the Ministry of Communication and Information Technology of the Government of Nepal.

3.2. Minimum Capital Requirement:

The minimum capital investment threshold is not applicable to this option. It is free to transfer the operating costs into the local bank account as required for the branch office. However, the activities of making an investment in share of any company, lending money to any company, or participating in the operation or management of such company is not allowed.

3.3. Act that does not constitute an establishment of a branch office:

The establishment of business through equity investment and its management, engaging the agent or distributor in Nepal would not be construed to have established a branch office in Nepal.

Also, the branch office establishment does not provide the legal status of a separate legal personality. It shall be considered as part of foreign company operating in Nepal.

3.4. Procedure for establishment of the branch office

Following steps are followed for branch office registration:

Kindly Note:

Separate approval shall not be required if the foreign company has already executed the agreement with government authority.

3.5. Required documents:

The list of the documents required for the establishment of a branch office are as follows:

| S.N. | Documents |

|---|---|

| 1. | Certificate of Registration, Memorandum of Association, Article of Association of the Foreign Company and its Nepalese Translation. |

| 2. | Application for Branch Office Registration |

| 3. | Board Resolution of the Foreign Company to set up a branch office. |

| 4. | Signed Copy of Company Profile |

| 5. | Copy of passport of all directors of Company |

| 6. | Copy of citizenship certificate of Nepal Representative authorized to receive notices |

| 7. | Letter of appointment of Authorized Representative |

| 8. | Proposed Plan of Branch Office |

| 9. | Power of Attorney. |

| 10. | Declaration of director or their representative of Company that the information submitted is correct and accurate |

| 11. | Approval letter from the Ministry of Communication and Information Technology |

| 12. | Agreement executed by the foreign company with the government authority of Nepal (if available) |

3.6. Timeline for completion of registration of branch office

The timeline for registration of a branch office in Nepal is usually 30 to 45 days. Sometimes it may require additional days to receive the approval from concerned government authority.

4. Tax Incentive for IT Business

Income Tax Act of Nepal has given some tax incentives for the IT businesses. The general rate of Income tax is Nepal is 25 %. The incentives are normally in the form of rebates in income tax rates.

| S.N. | Particulars | Effective Income Tax Rate |

|---|---|---|

| a) | IT business providing direct employment to 100 or more Nepali citizens throughout the year | 22.5% |

| b) | IT business providing direct employment to 300 or more Nepali citizens throughout the year | 20% |

| c) | IT business providing direct employment to 500 or more Nepali citizens throughout the year | 18.75% |

| d) | IT business providing direct employment to 1,000 or more Nepali citizens throughout the year | 17.5% |

| e) | IT business providing direct employment to 100 or more Nepali citizens throughout the year, of which at least one-third are women, dalits (oppressed) or incapacitated | 20.25% |

| f) | IT business providing direct employment to 300 or more Nepali citizens throughout the year, of which at least one-third are women, dalits (oppressed) or incapacitated | 18% |

| g) | IT business providing direct employment to 500 or more Nepali citizens throughout the year, of which at least one-third are women, dalits (oppressed) or incapacitated | 16.875% |

| h) | IT business providing direct employment to 1,000 or more Nepali citizens throughout the year, of which at least one-third are women, dalits (oppressed) or incapacitated | 15.75% |

| i) | IT business providing direct employment to 1,000 or more Nepali citizens throughout the year, of which at least one-third are women, dalits (oppressed) or incapacitated | 15.75% |

| j) | Export Income earned in foreign currency from Business Processes Outsourcing, Software programming, cloud computing services including service income based on IT 50% tax exemption on application income tax rate from such export income earned in foreign currency up to the NFY 2084/85 (2027/28 AD) | 50% tax exemption on application income tax rate from such export income earned in foreign currency up to the NFY 2084/85 (2027/28 AD) |

5. Classification of IT Business under Industrial Enterprises Act

IT business options permitted by Foreign Investment Act are:

5.1. Information Technology Industries

· Technology park;

· IT park;

· Biotech park;

· Software development;

· Computer and related services;

· Data processing;

· Cyber café;

· Digital mapping;

· Business process outsourcing (B.P.O), knowledge process outsourcing (K.P.O);

· Data center, data mining, cloud computing;

· Digital signature certifying agency;

· Web portal, web designing service, web hosting, online classified advertising service

5.2. Information Technology- based industries

· Internet service provider (ISP);

· Telephone, mobile phone, mobile satellite phone operator service;

· Teleport service;

· Establishment and operation of the satellite, the establishment of satellite broadcasting center, VSAT service;

· Broadband infrastructure, telecom tower, optical network, satellite network;

· Social networking, online messages, video calls, conferences.

5.3. Dissemination Technology-Based Industries:

· FM radio, digital radio service;

· Digital land surface television, satellite television, cable television;

· IP television, online service;

· Digital cable television, network, direct-to-home (DTH) satellite service, MMDS network, digital television (DTTV) network;

· Recording studio, broadcasting studio;

· Print media industries, audio-visual material production industries, advertisement production industries;

· Production of motion pictures or documentaries.

6. Differences between establishing the subsidiary company and branch office:

Following are the comparison chart outlining the differences between the provided options:

| S.N. | Matter | Subsidiary Company | Branch office |

|---|---|---|---|

| 1. | Liability | The subsidiary company will be a private limited company with limited liability. | The work and liability of the branch office shall be directly attributable to the foreign registered company. |

| 2. | Repatriation facility | Pursuant to Section 20 of the Foreign Investment Act, a local subsidiary company has right to repatriate the following amounts back to the Investor's country:

| Pursuant to Nepal Rastra Bank Foreign Investment and Loan Management By-Laws, 2021, a branch office can repatriate its profit by obtaining approval on the basis of necessary evidence and justification. However, the approval procedure is still new and largely depends on the discretion of the approving authorities. |

| 3. | Visa facility | Pursuant to Section 30 of Foreign Investment Act, the facility of following visas are provided to the Investor:

| Business visa and residential visa are not provided for foreign employees of the branch office. |

7. Recommended Option

Among the two options we recommend foreign investors to establish the local subsidiary company.

Related Article Link:

Please click the article published at our law firm website, which are related to the above article topic:

Establishment of Business in Nepal by the Foreign Investor

Registration of Company in Nepal

Procedure of Establishment of Company through Foreign Direct Investment

Registration of Liaison Office of Foreign Company in Nepal

Date of Publication: 26 September 2023

Disclaimer: This article published at our website is just for information purpose only. It shall not be taken as the legal advice, advertisement, personal communication, solicitation or inducement. Bhandari Law and Partners or any of the team members of the firm shall not be liable for the consequence arising of the information provided. As the factual situation may be different on your case, thereof if you need further legal advice on the subject matter, please Contact Us.

Related Professionals:

Frequently Asked Question

For quick legal assistance:

You can directly call to our legal expert: +977-9808811027

Even can call or drop a text through What’s app , Viber, Telegram and We Chat at the same number.

Also can do email on : info@lawbhandari.com

contact us

Phone :,

,Connect with our professional lawyers in Nepal :

Follow Our Law Firm on Social Media :