Table of content

-

Prosecution of Foreign Currency Crime in Nepal: Key Highlights

01. Illegal import export of foreign currency in Nepal

The act of importing or exporting illegal currency is strictly prohibited in Nepal. Any activities involving illegal currency results as a criminal offence. As per the Nepal Government’s official notice published in Nepal gazette on 26th May, 2023 (2080/2/15) Nepali or foreign citizens can carry or bring in US$5,000 or its equivalent in cash or other convertible foreign currency when traveling to Nepal or coming from foreign countries. In case of bringing in or taking out more than that amount of cash or convertible foreign currency, it must be declared at the customs office. Carrying currency more than US $5,000 without any declaration or authority’s permission may lead to the criminal charges and penalties.

Foreign Exchange (Regulation) Act, 1962 (2019) Section 3 explicitly mentions that any person, firm, company or body who intends to carry on the foreign exchange transaction must obtain the license from the Bank. Similarly, section 5 provisioned about restriction on export or import of certain currency stating that the Government of Nepal may issue an order by a Notification in the Nepal Gazette, thereby restricting the importing of or sending any certain type of Nepalese currency or foreign currency by any person, firm, company or body into or to the whole or any certain area of Nepal, without obtaining the license from the Bank.

02. Governing law

Following are the major governing laws on illegal import export of foreign currency:

| S.N. | Act | Details |

|---|---|---|

| 1 | Foreign Exchange (Regulation) Act, 1962 (2019) | Prohibits unauthorized foreign exchange and currency import export. All foreign currency inflows/outflows must be declared and routed through authorized channels. |

| 2 | National Penal Code 2074 (Chapter 22 – crime relating to currency, sec 256-266) | Prohibits counterfeit currency and penalizes activities that compromise the authenticity and trust in the nation's currency system. |

| 3 | Custom Act, 2007 (2064) | Obligation to declare currency above NRB-set limits at customs. Seizure of undeclared goods (including currency). |

| 4 | NRB Unified Circular (Issued on 2081/12/22) | Allows to carry or bring in US$5,000 or its equivalent in cash or other convertible foreign currency. In case of bringing in or taking out more than that amount of cash or convertible foreign currency, it must be declared at the customs office. |

03. Governing authority

The major authorities in such cases are Nepal Police which acts as a first investigating authority by conducting arrests, preliminary investigations and Department of Revenue Investigation (DRI) which further Investigates and files cases related to illegal currency smuggling.

04. Investigation and prosecution process

Revenue Investigation Department (the “Department”) acts as a major investigating body on currency smuggling cases. After getting information of such cases or arresting the people the police handovers the case to the department for further investigation. The team formed by department will conduct all the required investigation on such matter. Major investigation process includes:

4.1 Search of any suspicious person

If there is adequate reason and ground to doubt that any person has any foreign exchange in contravention of this Act, the body of such a person may be searched by an employee of at least Gazetted second class by the order of the investigating officer.

4.2 Power to stop and search motor vehicle

If there is adequate reason and ground to doubt that any motor vehicle has been used or is going to be used in committing any act in contravention of this Act or that any foreign exchange is concealed in the motor vehicle in a manner to be in contravention of this Act, the investigating officer may stop such a motor vehicle at any time or place.

4.3 Power to search building or place of transaction

If there is adequate reason and ground to believe that that any foreign exchange is concealed or held in any building or place of transaction in contravention of this Act, the investigating officer may, by executing a memorandum to that effect, order to search such a building or place of transaction.

4.4 Power to arrest

If there is adequate reason and ground to doubt that any person has done an act or is going to do any act in contravention of this Act, such a person may be arrested at any place by the order of the investigating officer.

4.5 Power to hold in detention

A person arrested under this Act may, with the permission of the Adjudicating Authority, be held in detention in the course of inquiry and investigation, for a period not exceeding Thirty days and not more than Seven days at a time.

After completing the investigation department files a charge sheet in the concerned District Court in the name of Government of Nepal. The District Attorney General’s office oversees and provides opinion on prosecution of case. Cases of illegal foreign currency import export fall under the category where state stands as a party and initiates the further court procedures

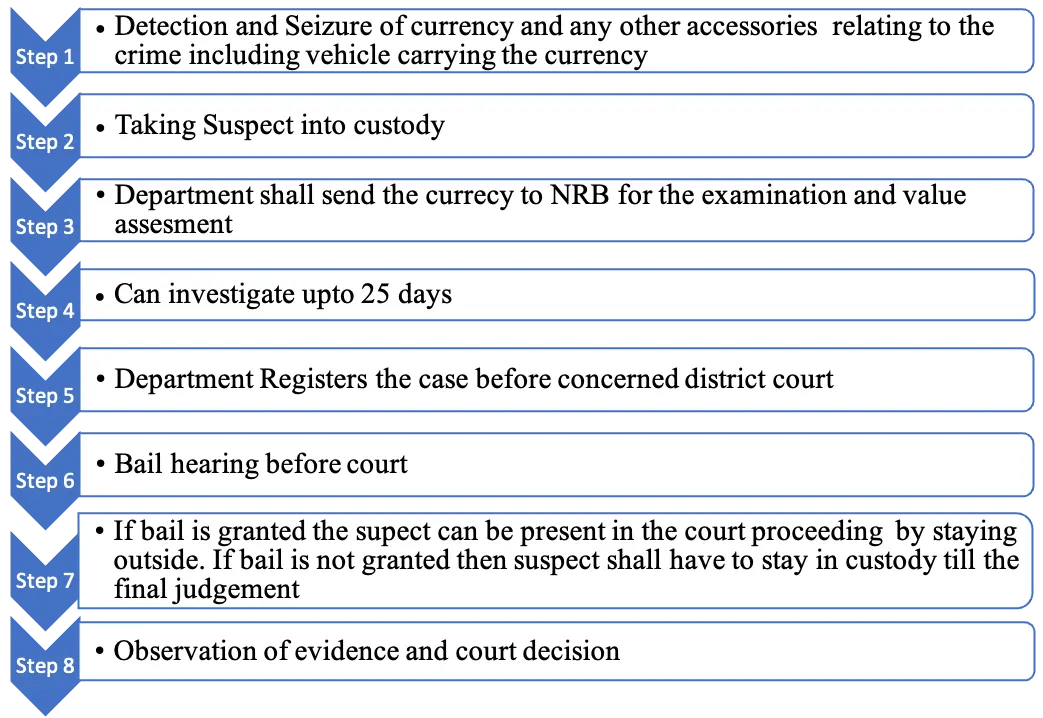

Summary of investigation and prosecution process are:

Step 1- Detection and seizure

Step 2 -Taking into custody

Step 3 - Forensic analysis (e.g., fake notes)

Step 4 - Foreign currency value assessment (via NRB)

Step 5 - Initial hearing: Bail or remand hearing.

Step 6 - If bail is granted can stay out of custody by paying the guaranteed amount

Step 7 - If bail is not granted have to stay on custody until the case is finalized

Step 8 - Observation of evidence and court decision

05. Tentative time frame for completion of the case

a. It shall take 25 working days for the investigation (custody) before the filing of case. It is extendable up to 90- days if organized crime is involved.

b. Shall take up to 8 to 12 months tentatively for trial and adjudication of case.

06. Punishment

| S.N. | Punishment | Details |

|---|---|---|

| 1 | Confiscation | Confiscation of currency and assets. |

| 2 | Fine | A fine equivalent to the value of the seized currency to fine triple the amount involved. |

| 3 | Imprisonment | Up to 4 years imprisonment if unable to pay the fine amount. Additional 3 years of imprisonment if the value of seized currency is 1 crore Nepalese Rupees or more. |

Please note that there will be double of punishment if done by any member of constitutional body or position of political appointment. If a company or institution is involved, the person responsible (e.g., director or manager) is held liable and the license of the company may be suspended or canceled.

08. Involvement of additional investigation institution

| S.N. | Agency | Role/Details |

|---|---|---|

| 1 | Central Investigation Bureau (CIB) | Investigates cases of serious gravity (depending on the nature). |

| 2 | Financial Information Unit (FIU-Nepal) under Nepal Rastra Bank (NRB) | Observes suspicious transactions and assists in tracking illegal currency flow. |

| 3 | Department of Money Laundering Investigation (DMLI) | Investigates laundering cases and coordinates with FIU/DRI. |

| 4 | Customs Department (under MoF) | Handles border seizure, initial questioning, and coordination with DRI. |

09. Recent trends

Even though the Foreign Exchange (Regulation) Act of 2019 B.S. clearly prohibits it, currency smuggling attempts are still being carried out by individuals and networks. The number of cases involving foreign currency seems to be increasing lately as Nepal is being used as a route for illegal foreign exchange smuggling.

Recently, a case against a foreign Indian National was initiated by the District Attorney’s Office, Kathmandu for smuggling currency, after making an arrest at the Tribhuvan International Airport (TIA) when twenty-five thousand US dollar is found while inspecting his baggage. The accused was charged under the foreign exchange regulation act, 1962, section 17 and thus was fined by Kathmandu district court with double the amount of currency following the confiscation of same.

The seizure of NPR 250 million worth of foreign currency including US dollar and Euro from a truck on route to the China border in March 2025 is another recent case where the investigation by Revenue investigation department (DRI) is going on.

In another currency smuggling case, the absconding accused, who was convicted for illegal foreign currency smuggling and was fined around Rs. 1.2 million by Gorkha District Court, under the foreign currency exchange regulation act 1962, has been arrested after 4 years on 24 April, 2025 by special decision-implementation team formed by the District Police Office to arrest him. He was reportedly presented before the Gorkha District Court to pay the fine, and since he was unable to pay the fine, he was sentenced to 10 years in prison and sent to prison to pay.

10. Conclusion

The analysis of cases relating to illegal foreign currency clearly demonstrates that there is a strict practice of not only investigation and prosecution but also implementation of court decision in cases involving foreign currency. One must obtain license to conduct any transaction of foreign currency and must declare before the custom office if is in possession of the currency above the limit set by the law. Any activities involving foreign currency which contravenes the law is strictly forbidden.

Date of Publication : May 11, 2025

Disclaimer: Bhandari Law and Partners is one of the leading law firm in Nepal with team of best professional lawyers in Nepal. This article published on website of the law firm is just for information purpose only. It shall not be taken as the legal advice, advertisement, personal communication, solicitation or inducement. Bhandari Law and Partners or any of the team members of the firm shall not be liable for the consequence arising of the information provided. As the factual situation may be different on your case, thereof if you need further legal advice on the subject matter, please Contact Us.

Related Professionals:

Frequently Asked Question

For quick legal assistance:

You can directly call to our legal expert: +977-9808811027

Even can call or drop a text through What’s app , Viber, Telegram and We Chat at the same number.

Also can do email on : info@lawbhandari.com

contact us

Phone :,

,Connect with our professional lawyers in Nepal :

Follow Our Law Firm on Social Media :