Table of content

-

Private Equity and Venture Capital Law in Nepal : Key Highlights

01. Background Private Equity and Venture Capital in Nepal

The emergence of Private Equity and Venture Capital in Nepal offers a fresh approach to financing, providing alternatives to traditional bank loans that pose significant barriers for local businesses. Private Equity and Venture Capital is newly introduced alternative Financing model in Nepal. Business Oxygen Pvt. Limited, was established in 2012 as Nepal’s first onshore Private Equity fund with Foreign Investment. However, at present there are several offshore and onshore (with and without FDI) funds in Nepal.

This article examines the legal framework required and describes processes for establishment of Private Equity (“PE”), Venture Capital (“VC”), Hedge Fund or any other fund that comes within the ambit of Specialized Investment Funds (“Funds”) in Nepal.

02. Governing Law Related to Private Equity and Venture Capital in Nepal

Securities Board of Nepal (“SEBON”) introduced the Specialized Investment Fund Rules, 2019 (2075) (“SIF Rule”) on March 6, 2019 (2075/11/22) to regulate activities related to Private Equity (“PE”) , Venture Capital (“VC”), hedge fund or any other fund that comes within the ambit of Specialized Investment Funds in Nepal.

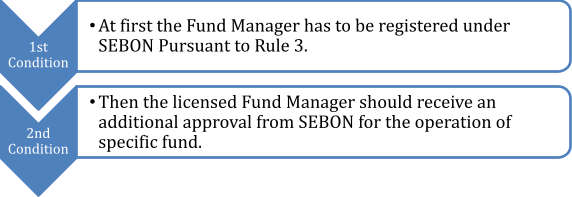

The SIF Rule addresses various aspects of Funds including the legal definition of PE , VC, Hedge Funds, the establishment process, the setup and approval of fund managers, fund registration, the provision of minimum standards and rejection criteria, the appointment of CEOs and board members, investment agreements, miscellaneous provisions, and scheduling requirements. Pursuant to SIF Rule two conditions has to be fulfilled for the operation of Fund including PE and VC in Nepal:

1st Condition: At first the Fund Manager has to be registered under SEBON Pursuant to Rule 3 of SIF Rule.

2nd Condition: Then the licensed Fund Manager should receive an additional approval from SEBON for the operation of specific fund.

Additionally, Funds originating from foreign sources are governed by the Foreign Investment and Technology Transfer Act, 2019 ("Foreign Investment Act"). Foreign Investment Approval should be taken for the incorporation of Company in Nepal.

03. Governing Authority

In Nepal, SEBON is the primary authority governing Funds including Private Equity and Venture Capital activities, that is responsible for licensing and renewal of fund managers, enforcing regulations, and protecting investor interests.

04. Registration of Fund Manager

Prior to formation of any Funds including PE and PV, it is mandatory for such fund manager to receive the approval from SEBON. Pursuant to Rule Number 4 of SIF Rule, SEBON has obligation to grant certificate of registration of Fund Manager within 35 days of submission of the application. But as a matter of practice SEBON at first grant a Letter of Intent(“LOI”) and SEBON shall Grant the Certificate of Fund Manager Registration upon inspecting the infrastructure, human resource and detail policy of the applicant.

4.1 Qualification of the Fund Manager

Following are the qualification that the Fund Manager should have for getting the approval from SEBON:

The entity must be a corporate body incorporated in accordance with the prevailing laws;

-

The function of the fund manager must be included in the objectives of the Memorandum of Association and Articles of Association;

-

The paid-up capital must be at least NPR 2,00,00,000;

-

The fund manager, its board of director, its chief executive must not have been convicted of crimes involving cheating or embezzlement or crimes involving moral turpitude. and

-

The fund manager, CEO, Board of Directors must not be listed in a blacklist maintained by the Credit Information Bureau.

4.2 Document to be submitted for Registration of the Fund Manager

- A copy of registration certificate of a body corporate;

- A copy of memorandum of association and articles of association;

- A copy of audited financial statement of the preceding fiscal year prepared in a format as prescribed by the prevailing law and accounting standards and a copy of annual report, (a copy of periodic financial report in the case of not completing fiscal year following its incorporation);

- A copy of the decision made by board of directors regarding approval;

-

Details regarding any action taken against board of directors or chief executive officer of a proposed fund manager in accordance with the securities related law or the prevailing law, if any;

-

Details about the shares hold by promoters and amounts paid therefor;

-

Name, full address and contact number of shareholders holding five percent or more shares out of the paid-up capital and ownership of shareholding;

-

Details about organizational structure and working procedure of a body corporate;

-

Details about office location and area of office, office equipment and communication devices and human resources;

-

Details about ownership in other companies or a body corporate, if any, and

-

Other documents and particulars as the Board deems necessary.

4.3 Government Fee To be Paid for Registration of Fund Manager

Government fee to be paid for registration of Fund Manager is as mentioned:

| S.N. | Fee | Fee Amount in NPR |

|---|---|---|

| 01 | Fund Manager Registration Annual Fee | NPR. 3,00,000 (One Time Fee) |

| 02 | Fund Manager Registration Annual Fee | NPR. 1,50,000 (Need to be Paid Annually) |

4.4 Power and Duties of Fund Manager

-

To work in the interest of unit holders as per notices, circulars, directives, or directions issued restricting to get undue advantage by a fund manager itself or any other person affiliated thereto;

-

To carry out fund related transactions in a free and fair manner;

-

To ensure that a fund manager, board of director, chief executive officer, employee, and member of investments committee has no any kind of financial interest in an organization to be invested in. Provided that if there appears any kind of financial interest, a resolution along with all information regarding investment shall be passed by annual general meetings of unit holders. A notice to that effect shall be communicated to the Board within seven days following the passage of the said resolution;

-

To ensure the customer's identification and other necessary documents;

-

To provide information about risks and profits to unit holders;

-

To make procedure pertaining to investment and fund management and implement or cause to be implemented the same;

-

To make its employees’ code of conduct and implement or cause to be implemented the same;

-

To ensure that investment has been made in the interest of unit holders;

-

To maintain records of accounts, reports, documents and particulars pertaining to investments,

-

To provide reasonable time to eligible investors to make payments by providing a two-week prior written notice while calling capital from the eligible investors;

-

To prepare financial details of a fund as per the accounting standards within six months following the end of each fiscal year of the fund manager and the fund and

-

To conduct annual general meetings of unit holders within six months following the end of each fiscal year.

05. Registration of Fund in Nepal

5.1 Registration Process of Fund including Private Equity and Venture Capital in Nepal

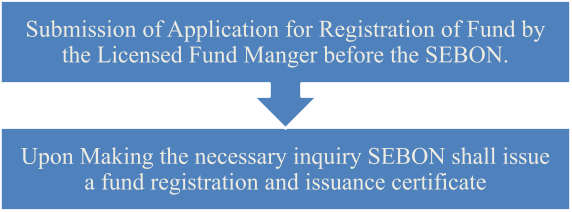

License Fund Manager willing to operate the Fund specified by the SIF Rule shall receive the additional certificate from the SEBON to Operate the Fund. The Process of registration of Fund is mentioned below:

-

Step 1: Submission of Application for Registration of Fund by the Licensed Fund Manger before the SEBON

-

Step 2: Upon Making the necessary inquiry SEBON shall issue a fund registration and issuance certificate

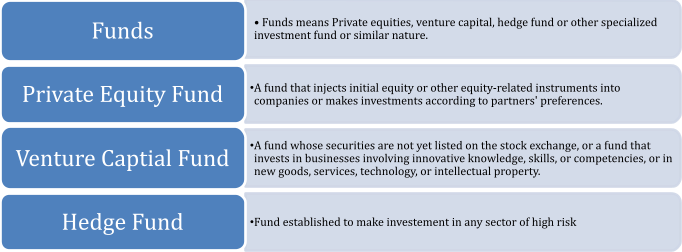

5.2 Different form of Funds and Definition

SIF Rule has defined different from of Funds which are defined below:

5.3 Minimum requirements to be made for the registration of the Fund

-

The Fund’s capital must be at least 15 Crores (150 million) Nepalese Rupees;

-

The fund manager must hold at least 2% units of the fund and the held units must stand continually (however, this shall not be applicable in the case of investments made by bilateral or multilateral international agencies);

-

The unit holders’ number shall not exceed two hundred;

-

The Fund must be close-ended in nature;

-

The Fund must provide only cash dividend to the unit holders and

-

Each unit holder shall purchase units up to at least fifty lakh Nepalese Rupees.

5.4 Government Fee To be Paid for Registration of Fund

In addition to payment of government fee for registration of Fund Manager, Separate Fee has to be paid for registration of Fund before SEBON which is mentioned below:

| S.N. | Fee | Fee Amount in NPR |

|---|---|---|

| 01. |

Application Fee for Fund Registration | NPR. 50,000 (One Time Fee) |

| 02. |

Fund Registration Fee (Depends on amount of Capital of Fund:

|

|

5.5 Minimum Provision under the Constitution of the Fund

Following provision shall be mentioned in the constitution of the Fund:

-

Name of a fund;

-

Types of the fund (private equity, venture capital fund, hedge fund, or any other);

-

Size of and period of the fund;

-

Details of investors making commitments to invest at least ten percent money for the promotion of the fund;

-

Provision regarding the operation of fund, records keeping and audit;

-

Details regarding targeted areas of the Fund and investment procedures;

-

Provision regarding projected profits to be accrued in the investments;

-

Provision regarding repatriation of investments;

-

Provision regarding dispute resolution procedure;

-

Provision regarding hurdle rates;

-

Provision regarding fund management fees;

-

Provision regarding fund's winding up and

-

Other particulars to be prescribed by the Board from time to time.

5.6 Eligible Investors for Funds

The Following entity or individual can make investment in Fund:

-

Bank and financial institutions;

-

Insurance companies;

-

Funds such as pension fund, welfare fund, provident fund, Citizen investment fund as recognized by the prevailing law;

-

Bilateral or multilateral international organizations;

-

Foreign citizen or foreign firm, company or foreign organized investor or fund registered abroad or foreign fund manager or any other similar organized entity;

-

A body corporate with an objective of making investments established in Nepal pursuant to the prevailing law Nepali citizen or non-resident Nepali and

-

Other entities or individuals as prescribed by SEBON from time to time.

5.7 Fund Manager Must Execute the Investment Agreement

- A fund manager shall enter into investment agreement with eligible investors regarding the investment. The investment agreement shall include the following subject matter:

-

Amount and period to be invested;

-

Projected profit on investments;

-

Procedures regarding reimbursement;

-

Provision of hurdle rate;

-

Details regarding fund management fees;

-

Expenditure headings of the fund;

-

Provision regarding issuance of units and phase of collection of money therefor;

-

Provision regarding settlement of all liabilities of the fund and distribute the remaining amounts to unit holders by converting all types of property into cash following its winding up.

5.8 Period of Fund and Termination

A period of the fund shall be from five to fifteen years and shall be terminated on following grounds:

-

If a period given by the Board has been completed;

-

If approval given by the Board to operate Fund has been cancelled and

-

If Board has issued directions to wind up the fund being satisfied that it cannot be operated further owing to arising unavoidable circumstances or financial crisis.

06. Annual Compliance to be Made by Fund Manager

- Fund Manager shall have to submit the annual report to SEBON compromising its audited financial statement and the activities carried out in each year within six months from the end of preceding fiscal year.

- Summary of Financial Statement shall be provided to unit holders

- Fund Manager shall convey AGM of unit holders in each fiscal year and such AGM report should be provide to SEBON within 30 days from the date of the general meeting.

7. Investment through Foreign Fund and Fund Manager

Foreign Fund or fund manager can operate the fund or function as fund manage in Nepal through partial or full ownership. For the same it must establish the local subsidiary company in Nepal through Investment Approval. While acquiring the approval from SEBON it must submit the required document and same fee as like the Nepali Fund Manager.

Date of Publication: 18 October 2024

Disclaimer

This article published on our website is just for information purpose only. It shall not be taken as the legal advice, advertisement, personal communication, solicitation or inducement. Bhandari Law and Partners or any of the team members of the firm shall not be liable for the consequence arising of the information provided. As the factual situation may be different on your case, thereof if you need further legal advice on the subject matter, please Contact Us.

Related Professionals:

Frequently Asked Question

For quick legal assistance:

You can directly call to our legal expert: +977-9808811027

Even can call or drop a text through What’s app , Viber, Telegram and We Chat at the same number.

Also can do email on : info@lawbhandari.com

contact us

Phone :,

,Connect with our professional lawyers in Nepal :

Follow Our Law Firm on Social Media :