Table of content

-

Merger and Acquisition in Nepal: Key Legal Insights

01. Introduction

Mergers and Acquisitions (M&A) are strategic tools for corporate restructuring and growth, allowing companies to expand operations, achieve economies of scale, diversify business, or gain market share. In Nepal, M&A activities have gained significant traction, particularly in the banking and financial sector, driven by regulatory pushes for consolidation and increased competition. This article provides a detailed insight into the legal framework, process and key considerations for M&A in Nepal. The case is handled by merger and acquisition lawyer in Nepal

02. Governing Law

Merger and acquisition activities in Nepal are primarily governed by the following laws and bylaws:

-

Company Act, 2063 (2006): This is the foundational law governing corporate mergers, acquisitions and restructuring procedures for all types of companies.

-

Merger Bylaws, 2068: Specifically deals with merger procedures.

-

Acquisition Bylaws, 2070: Specifically deals with acquisition procedures.

-

Bank and Financial Institutions Merger and Acquisition Bylaws, 2073: Further elaborates on the provisions.

-

Bank and Financial Institutions Act (BAFIA), 2073 (2017): Crucial for M&A involving banks and financial institutions, along with directives from Nepal Rastra Bank (NRB).

-

Securities Act, 2063 (2007): Regulates public company transactions and disclosure requirements, especially for listed companies.

-

Foreign Investment and Technology Transfer Act (FITTA), 2075 (2019): Governs foreign investment aspects in M&A transactions.

-

Competition Promotion and Market Protection Act, 2063 (2007): Addresses anti-competitive practices arising from M&A.

-

Income Tax Act, 2058 (2002): Deals with the tax implications on M&A.

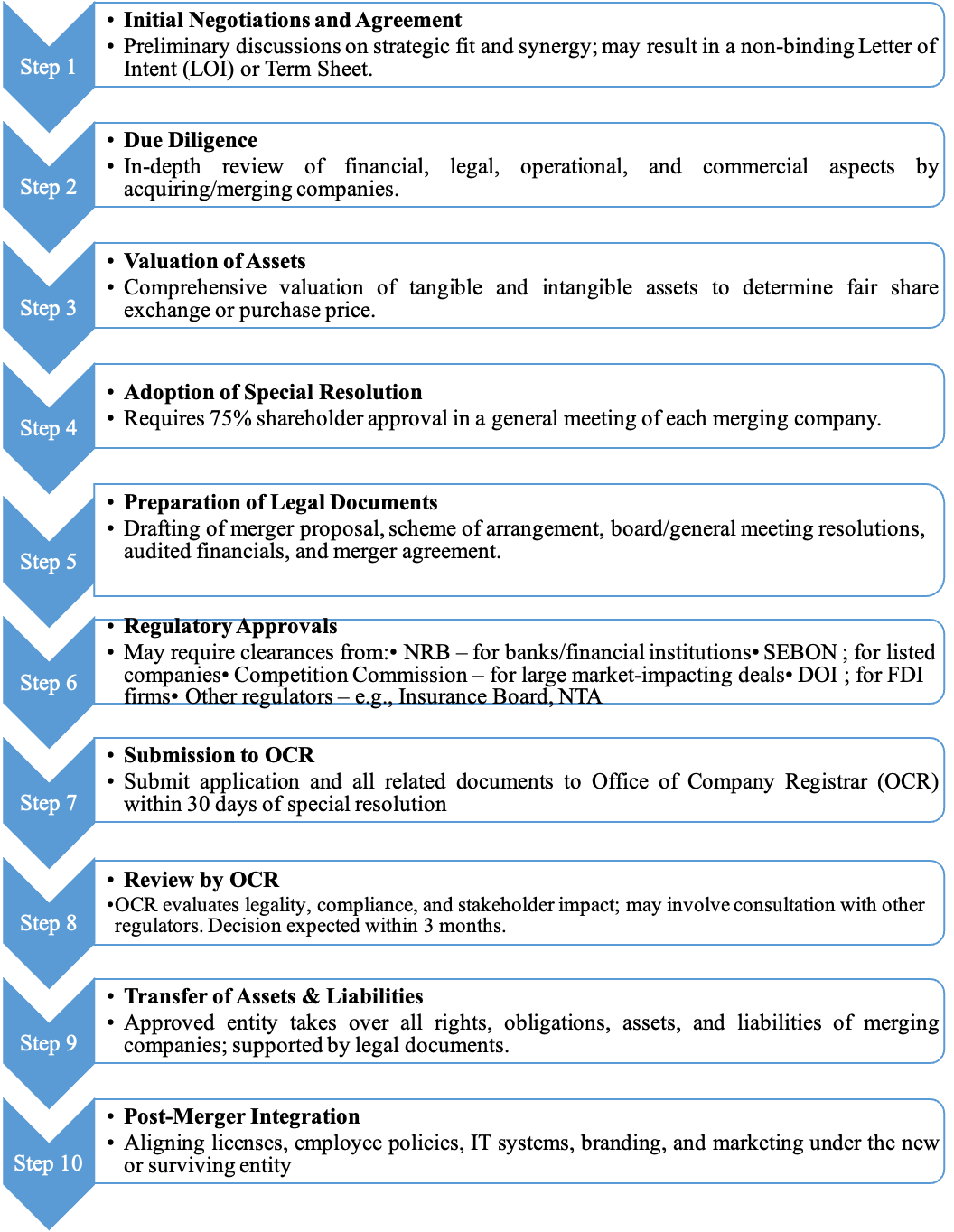

03. Process of Merger in Nepal

The process of a merger in Nepal, particularly for public companies, involves several key steps:

04. Timeline

The timeline for M&A in Nepal can vary significantly depending on the size and complexity of the companies involved, the thoroughness of due diligence and the number of regulatory approvals required. Generally, the process can take several months to over a year.

05. Taxation of Mergers and Acquisitions in Nepal

The taxation regime governing mergers and acquisitions (M&A) in Nepal is primarily derived from the Income Tax Act, 2058 (2002) and the Income Tax Rules, 2059 (2003). Although these laws do not provide an explicit definition of “merger” or “acquisition,” they address such transactions through provisions on share transfers, asset disposals and changes in control, particularly under Section 57 of the Act. This section plays a critical role in determining the tax implications arising from corporate restructuring, ensuring that gains derived from the transfer of ownership or reorganization of business entities fall within Nepal’s tax net.

Capital gains tax is a significant consideration during M&A transactions in Nepal. The tax treatment depends on various factors such as the status of the shareholder (resident or non-resident), type of shares (listed or unlisted) and period of ownership. Under Section 57, a “deemed disposal” occurs if there is a change of 50 percent or more in the underlying ownership of a company within three consecutive income years. In such cases, the company is considered to have disposed of all its assets and liabilities at market value, triggering potential tax liabilities. This provision extends to both direct and indirect changes in ownership, thereby capturing complex corporate structures and cross-border share transfers.

Despite these provisions, Nepal’s tax law also offers certain relief mechanisms for legitimate business reorganizations. Sections 45 and 46 of the Income Tax Act provide tax neutrality or deferral in cases of mergers, demergers, share swaps, or transfers among associated persons, provided continuity of ownership is maintained. However, these reliefs may not apply if the ownership threshold under Section 57 is breached. The law also interacts with Double Taxation Avoidance Agreements (DTAAs), under which treaty benefits may be denied if beneficial ownership conditions are not satisfied. Consequently, the structuring and valuation of M&A transactions require careful planning to ensure compliance, minimize tax exposure and achieve legitimate business objectives within Nepal’s evolving corporate tax framework.

06. Merger and Acquisition through the Perspective of Competition Law

The Competition Promotion and Market Protection Act, 2063 (2007) is crucial in assessing M&A transactions in Nepal, particularly those that might lead to a significant reduction in market competition. The Act aims to promote fair competition and prevent monopolistic or restrictive trade practices.

-

Prohibition of Anticompetitive Mergers: The Act prohibits mergers, acquisitions, or amalgamations that result in the combined entity having more than 40% market share in Nepal. This threshold is a key determinant for regulatory scrutiny. There is generally no room for exception to this provision if the market share exceeds this limit.

-

Abuse of Dominance: Even if a merger doesn't directly create a monopoly, the Competition Act also prohibits the abuse of a dominant position. If a merged entity, post-merger, holds a dominant position and engages in practices that restrict competition (e.g., predatory pricing, limiting output), it could face legal action.

-

Review by Competition Commission: For large mergers, especially those that approach or exceed the 40% market share threshold, the Competition Commission may review the transaction to assess its potential impact on market competition. They may require detailed impact assessments and public consultations.

-

Exemptions: The Act provides certain exemptions, for instance, for small cottage industries, agricultural production and cooperatives and activities related to research and development.

-

Importance of Compliance: Companies undertaking M&A, particularly those in concentrated markets, must carefully assess the competition law implications and ensure compliance to avoid penalties and legal challenges. This involves conducting a thorough competition law analysis as part of the due diligence process.

07. Conclusion

Mergers and acquisitions have emerged as pivotal mechanisms for corporate growth, market consolidation and economic transformation in Nepal. With the gradual evolution of its legal and regulatory framework, Nepal is witnessing an increasing number of M&A activities, particularly in the banking, financial and corporate sectors. The growing emphasis on compliance, transparency and governance reflects a maturing business environment that is aligning with international standards.

Nevertheless, the success of any M&A transaction in Nepal hinges on meticulous legal and financial due diligence, strategic structuring and adherence to multiple regulatory requirements under company, tax, competition and sector-specific laws. Stakeholders must carefully assess potential risks, including tax exposure, ownership continuity and competition law implications, to ensure smooth execution and post-merger integration.

As Nepal continues to liberalize its investment climate and harmonize its corporate laws with global practices, M&A transactions are set to play a central role in driving corporate consolidation, attracting foreign investment and enhancing overall economic competitiveness. Properly executed, mergers and acquisitions will not only strengthen individual businesses but also contribute significantly to Nepal’s long-term economic resilience and growth.

Date of Publication: 2. November 2025

Disclaimer: This article published on our website is just for information purpose only. It shall not be taken as the legal advice, advertisement, personal communication, solicitation or inducement. Bhandari Law and Partners or any of the team members of the firm shall not be liable for the consequence arising of the information provided. As the factual situation may be different on your case, thereof if you need further legal advice on the subject matter, please Contact Us.

Related Professionals:

Frequently Asked Question

For quick legal assistance:

You can directly call to our legal expert: +977-9808811027

Even can call or drop a text through What’s app , Viber, Telegram and We Chat at the same number.

Also can do email on : info@lawbhandari.com

contact us

Phone :,

,Connect with our professional lawyers in Nepal :

Follow Our Law Firm on Social Media :