Table of content

-

IPOs Regulations in Nepal: Key Legal Insights

01. Background

For any growing company in Nepal, the decision to go public is a monumental leap. An Initial Public Offering (“IPO”) is not just limited to raising capital but it is also a transformation into a publicly accountable entity with access to the capital market. However, this process is governed by a stringent legal and regulatory framework designed to protect investors and ensure market integrity. This article provides a comprehensive overview of the key highlights of the IPO process in Nepalese market.

02. Introduction to IPO in Nepal

An IPO is when a private company sells its shares to the public for the very first time. Think of it as the moment a company "goes public" and invites investors to become part-owners. In addition, under Securities Act 2063 (2007) (“Securities Act”), if the Company is to issue shares to more than fifty (50) persons at a time, then it should be issuing IPO by fulfilling the necessary procedures.

03. Governing Laws of IPO in Nepal

Following are the primary law regulating IPO in Nepal:

| S.N. | STATUTES | SCOPE |

|---|---|---|

| 1 | Securities Act, 2063 (2007) | This is the principal legislation that governs the issuance, management, and transaction of securities. It sets out the foundation for the capital market. |

| 2 | Securities Registration and Issue Regulation, 2080 (2023) (“Securities Regulation”) | This is the key regulation that details the entire process for issuing securities, including IPOs. It specifies eligibility criteria, application procedures, allotment mechanisms, and post-issue compliance. |

| 3 | Companies Act, 2063 (2006) | This act governs the incorporation, management, and operation of companies. A public company must comply with its provisions regarding share capital, director duties, and general meetings. |

04. Governing Authority

Following are the principal authority regulating the IPO in Nepal:

| S.N. | AUTHORITY | SCOPE OF WORK |

|---|---|---|

| 1 | Securities Board of Nepal (SEBON) | It is the autonomous statutory authority responsible for regulating the entire securities market in Nepal. Its key functions include registering all securities before they can be publicly issued, regulating the entire process of issuance and sale, and licensing all intermediaries involved. Ultimately, SEBON's oversight ensures that IPOs are conducted in a fair, transparent, and systematic manner to safeguard investor interests. |

| 2 | Nepal Stock Exchange (NEPSE) | NEPSE is the only stock exchange in Nepal where approved securities are listed and traded. |

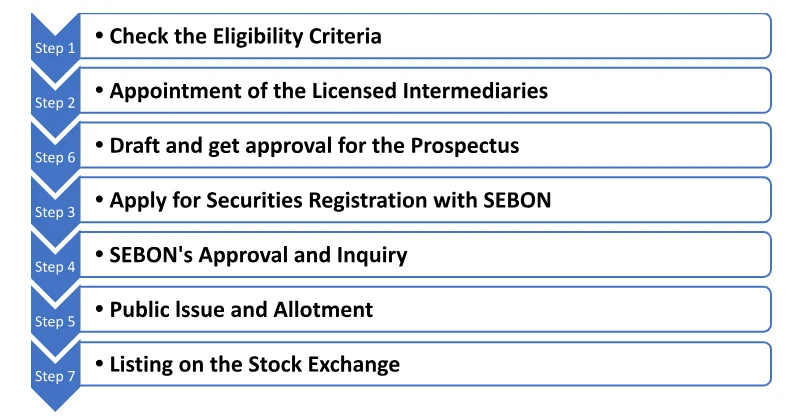

05. Process of Issuing IPO in Nepal

Process of Issuing the IPO are as mentioned:

Step 1: Eligibility criteria and Corporate Restructuring:

Only the public limited companies are competent to issue IPO under the Securities Act of Nepal. This implies the requirement of restructuring and converting itself to public limited company in the case of Private Limited Company. Similarly, the Securities Regulation, mandates strict eligibility criteria, including:

a. Minimum paid-up capital NPR 100 million for manufacturing firms; NPR 50 million for others as prescribed by SEBON for respective industry

b. Must have earned a net profit in at least three of the immediately preceding five years

c. Companies in sectors like finance, insurance, and telecommunications must obtain a credit rating from a SEBON-approved rating agency.

d. The company’s Article of Association (AOA) must permit the issuance of shares to the public.

e. The company must have its accounts audited by a registered auditor in accordance with Nepal Financial Reporting Standards (NFRS).

f. The company, its promoters, and directors must not be disqualified by any court of law or SEBON

In addition, subject to the latest Seventh (7th) amendment to the Securities Regulation, if a company's business license is due to expire in less than 10 years then, it cannot apply to sell shares to the public (unless it's in a business that regularly renews its license, like banks).

Step 2: Appointment of Licensed Intermediaries

The company must appoint SEBON-licensed intermediaries to manage the issue, most crucially:

- Manager: A merchant banker who acts as the lead coordinator for the entire IPO process.

- Depository: To hold demat shares and manages investor accounts

- Credit Rating Agency: To obtain a rating for the company (mandatory for certain entities).

- Underwriter: To underwrite and guarantee the subscription of the issue.

- Auditor: To audit financial statements for the prospectus

- Legal Advisor: To ensure legal compliances

Step 3: Draft and Get Approval for the Prospectus

- A prospectus is like a detailed sales brochure for a company that wants to sell its shares to the public for the first time. It is a legal document as well as an official fact sheet of a company that helps investors make an informed decision about investing their money. The company must therefore, prepare detailed Prospectus as required under Section 30, 31 and 32 of the Securities Act including the following information, and submit to SEBON for approval before publishing.

-

Capital structure and information about the issuer.

-

Main functions of the company.

-

Information on legal actions, economic condition, and management.

-

Financial statements (assets, liabilities, profit/loss).

-

Details of the experts preparing the prospectus.

-

Any other prescribed matters.

Step 4: Apply for Securities Registration with SEBON

Section 27 of the Securities Act mandates the companies to register the securities to be issued with the SEBON prior to the issuance. For this, the Company should submit the following documents:

-

Application in the prescribed format.

-

Memorandum of Association (MOA) and Articles of Association (AOA) of the company.

-

The Draft Prospectus

-

All other "documents related with such securities" as required by SEBON (e.g., auditor's reports, valuation reports, etc.).

-

Prescribed registration fees.

Step 5: SEBON’s Inquiry and Approval

Under Section 27 (3) of the Securities Act, SEBON will make necessary inquiry into the matter and if satisfied, register the securities and issue a Securities Registration Certificate to the company. This certificate is the primary approval to proceed with the public issue.

Step 6: Public Issue and Allotment

The company through its Issue Manager, opens the IPO for public subscription for a period as prescribed by SEBON regulation. The prospectus must be published for public information while doing so. After the issuance of the shares and application, the allotment of shares must be done according to the provisions prescribed by SEBON. In addition, the Company should give the details of the allotment to the SEBON within seven days of allotting such securities. The laws have also specified the allocation to percentage of these companies: 10% of the shares are to be publicly issued to Foreign Employment. 10% of equity shares are to be distributed to the project affected local people and upto 2 to 5% to the employees of the company depending on the number of the employees.

Step 7: Listing on the Stock Exchange

Following the successful completion of the public issue and allotment of shares, the final mandatory step for the company is to secure a formal listing on the Nepal Stock Exchange (NEPSE). This process requires the company to formally apply to NEPSE and demonstrate full compliance with its specific listing regulations and bye-laws. Only after fulfilling all of NEPSE's requirements and finalizing the listing process can the company's shares be officially admitted for trading, allowing them to be freely bought and sold by the public on the open market.

05. Special Regulations for Hydropower Companies

Currently, hydropower companies that have completed at least 65 percent of their physical construction are eligible to issue IPOs. This existing provision has faced criticism in recent years, with concerns that it exposes the public to financial risk if the projects encounter delays or fail to complete construction. Thus, 'Economic Reform Implementation Action Plan-2082, based on recommendations from the High-Level Economic Reform Recommendation Commission, has made provision that restricts hydropower companies to issue IPO shares until they start production.

06. Conditions of Issuing Premium

As per the (7th) amendment to the Securities Regulation, a company has an immediate option to issue primary shares at a premium right after their conversion to a public company upon fulfilling two strict criteria:

-

Large Paid-up Capital: The company must already have a paid-up capital of at least Rs. 1 Arba (1,00,00,00,000 or 1 billion Nepali Rupees).

-

Proven Profitability: The company must have made a net profit in the two financial years immediately before it wants to issue the shares.

If the company’s capital falls below the one-billion-rupee mark, the three-year waiting period remains before they are allowed to issue shares at premium. This rule is designed to protect investors. The details on the process of the calculation of the premium is provided under the Securities Regulation, that later needs to be certified by underwriter.

07. Post-Registration Compliance

The compliance obligations do not end after a successful IPO. Becoming a public company brings ongoing transparency and reporting responsibilities such as:

a. Continuous Disclosure: The company must promptly disclose any price-sensitive information (e.g., financial results, major contracts, litigation, acquisition/merger plans) to SEBON and NEPSE to ensure an informed market.

b. Financial Reporting: Mandatory submission of quarterly and annual financial reports to SEBON and NEPSE within the stipulated timeframe.

c. Corporate Governance: Adherence to higher standards of corporate governance, including forming board committees (e.g., Audit Committee), holding Annual General Meetings (AGMs) on time, and ensuring fair treatment of all shareholders.

d. SEBON and NEPSE Directives: Compliance with all circulars, directives, and guidelines issued by SEBON and NEPSE from time to time.

e. Lock- up Period: The lock-up period for promoter shares is typically one year from the date of allotment. During this period, promoters cannot sell their shares. This restriction aims to align promoter interests with those of public shareholders and maintain market stability post-IPO.

07. Green Bond

The Seventh (7th) amendment to the Securities Regulation has made provision for the issuance of ‘green bonds’ by the company following the approval of SEBON. "Green bond" means a bond issued by an incorporated entity to fund environmentally friendly projects, and the term also includes bonds issued for investments in projects aimed at mitigating the adverse effects of climate change through sustainable development. These bonds and debentures are also available for investment by foreign investors, in compliance with applicable laws.

09. Conclusion

In conclusion, the process of conducting an IPO in Nepal is a complex and highly regulated procedure governed by SEBON and a detailed legal framework, designed to ensure market stability and protect investors. Given the intricate and evolving nature of these regulations, any company considering this significant step is strongly advised to seek detailed guidance from legal and financial

Date of Publication: 8 November 2025

Disclaimer: This article published on our website is just for information purpose only. It shall not be taken as the legal advice, advertisement, personal communication, solicitation or inducement. Bhandari Law and Partners or any of the team members of the firm shall not be liable for the consequence arising of the information provided. As the factual situation may be different on your case, thereof if you need further legal advice on the subject matter, please Contact Us.

Related Professionals:

Frequently Asked Question

For quick legal assistance:

You can directly call to our legal expert: +977-9808811027

Even can call or drop a text through What’s app , Viber, Telegram and We Chat at the same number.

Also can do email on : info@lawbhandari.com

contact us

Phone :,

,Connect with our professional lawyers in Nepal :

Follow Our Law Firm on Social Media :