Table of content

-

How To Start A Company In Nepal By Nepalese Investor?

01. Introduction

This article provides a quick overview of the detailed procedure for starting a company in Nepal by the Nepalese Investor.

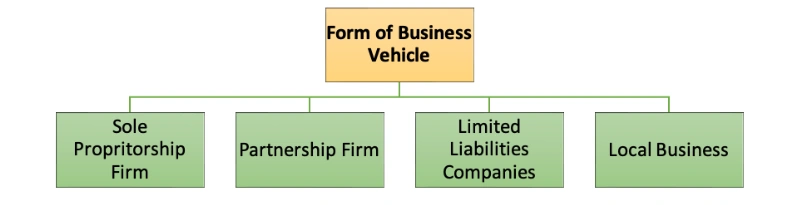

02. Determination of the appropriate business vehicles

There are different forms of business vehicles through which business can be established in Nepal. The major forms of business vehicles are as mentioned:

2.1 Sole Proprietorship Firms:

The Private Firm Registration Act, 1958 (2014) is the governing law to register the sole proprietorship firm in Nepal.

The sole proprietorship firms do not have a separate legal personality, and the liability of the individual is unlimited. It is mostly used by individuals undertaking trading activities, operating small retailer shops, restaurants, etc., and professional service providers such as accountants and lawyers.

The advantages and drawbacks of sole proprietorship firms are as mentioned:

| Advantages | Drawbacks |

|---|---|

| Easy to establish, control, and dissolve | Unlimited liability |

| Prompt and flexible in decision making | Requires periodical renewal |

| Comparatively fewer corporate compliances | No separate legal personality |

2. 2 Partnership Firms:

Another major form of business vehicle is a partnership firm that can be established under the Partnership Act, 1964 (2020) ). Similar to the private firm, a partnership firm does not have a separate corporate personality, and the liability of partners is unlimited. Partnership firms are mostly used for trading activities and professional services. The minimum number of individuals required to open a partnership form is two, and the maximum is unlimited. Nepalese law has not made any restriction on the maximum number of partners in this type of business vehicle.

The advantages and drawbacks of partnership firm are as mentioned:

| Advantages | Drawbacks |

|---|---|

| Easy to establish, control, and dissolve | Liability is unlimited |

| Comparatively fewer corporate compliances | Requires periodical renewal |

| Flexibility in decision making as compared to limited companies | No separate legal personality |

2.3. Limited Liability Companies:

Limited liability company are the most common form of business vehicle that investor incorporates in Nepal. The same is applicable for the foreign investors who want to register the business in Nepal. Limited liability and separate personality are the main features of this business vehicle. Private Limited Company and Public Limited Company are two types of limited liability company in Nepal .

Limited liability companies are incorporated under the Company Act 2006(2063) and it is registered by Office of Company Registrar (“OCR”).

The advantages and drawbacks of limited liability Companies are as mentioned:

| Advantages | Drawbacks |

|---|---|

| Limited Liability | Expensive to manage and difficult to establish, control, and dissolve |

| Separate Legal Personality | Fulfilment of a high level of legal compliance |

| Perpetual Succession |

2.4 Local Business:

Individuals also can operate business by registering the business at the local level government that is ward office. Small business such as retail shop, grocery stores, tea shop etc. are directly registered on as the local business and are governed by local municipality law.

Suggestion

Among the various business vehicles, we recommend establishing a limited liability company, as it offers several advantages, including limited liability, a separate legal personality, and perpetual succession.

03. Prerequisites for formation of the company

There are several prerequisites that must be confirmed before the registration of a Limited Liability Company which are mentioned below:

3.1 Confirmation of Company Name

Before registering a company, the applicant must first obtain approval for the proposed company name. The name must consist of two or more words and must not be identical to that of an existing company. Therefore, the applicant should select a unique and appropriate name before proceeding with registration.

Before finalizing the name of the company, investors should also verify the availability of the corresponding domain name, as most shareholders prefer to develop the company’s website under the same name. It is equally important to conduct a trademark search with the Department of Industry (DOI) to ensure that the proposed name or logo has not already been registered by another entity. Taking these precautionary steps will help secure the company’s brand identity and prevent potential legal disputes or reputational risks in the future.

3.2 Confirmation on Company Registered Address

The applicant must determine and confirm the company’s official address prior to registration, as this address is required to be incorporated in both the Memorandum of Association (MOA) and Articles of Association (AOA). The chosen address serves as the company’s principal place of business and will be used for all official correspondence and regulatory communications. Furthermore, the company must be registered with the local government authority (i.e., the respective ward office) based on this address, followed by obtaining a tax registration certificate from the Inland Revenue Department (IRD) corresponding to the same jurisdiction. It is advisable to select a stable and accessible location for the company’s registered office, as any subsequent change in address will necessitate a formal amendment to the corporate documents and notification to the concerned authorities.

3.3 Capital Requirement of Company

The applicant must also determine the amount of capital to be invested in the company prior to its registration. The proposed capital should reflect the estimated operational and administrative costs of the company and ensure adequate funding for its initial business activities. Accordingly, the shareholders shall contribute capital proportionate to their shareholding, representing their financial commitment to the company.

Private Limited Company Minimum Capital Requirement: While there is no statutory minimum capital requirement for a private limited company under the prevailing laws of Nepal, it is generally customary to register such companies with a minimum paid-up capital of NPR 100,000. However, depending on the size, nature, and scope of the business, a higher capital amount may be advisable to ensure sufficient liquidity and credibility in commercial dealings.

Public Limited Company Minimum Capital Requirement: In contrast, a public limited company must have a minimum paid-up capital of NPR 10,000,000 (ten million) as prescribed by law.

3.4 Determination of Objective of Company

A company may have multiple objectives; however, these objectives must be interrelated and fall within the same or similar scope of business activities. The objectives define the operational boundaries of the company and are incorporated into its Memorandum of Association (MOA). For instance, an information technology (IT) company may engage in software development, IT consulting, or digital services, but it cannot include unrelated activities such as agriculture or manufacturing under the same corporate entity. Maintaining a coherent set of objectives ensures regulatory compliance and clarity in business operations.

04. Required documents for the registration of the company

The following documents are required for the company registration process:

| S.N. | Documents |

|---|---|

| 1 | Application for the registration in the standard format |

| 2 | Memorandum of Association and Article of Association |

| 3 | National Identity Card (NID), Citizenship Certificate/Passport, PAN of Investor in case of individual |

| 4 | Copy of certificate of registration and other registration documents (memorandum of association, articles of association) of corporate entity in case a corporate entity wants to invest in the company |

| 5 | Resolution of the corporate entity for incorporating entity in case a corporate entity wants to invest in the company |

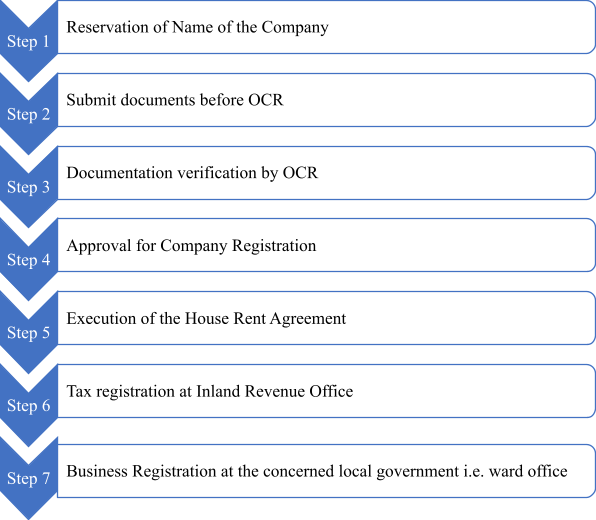

05. Company registration process in Nepal

Company Registration Process is explained in below table:

Step 1: Reservation of Name of the company

Before initiating the company registration process, the applicant must reserve the proposed company name with the Office of the Company Registrar (OCR). The proposed name is submitted to the OCR for approval through the prescribed online or physical application process. Upon submission, the OCR reviews the proposed name to ensure that it is distinct, not misleading, and not identical or similar to any existing registered company or trademark.

If the proposed name satisfies the regulatory requirements, the OCR will approve and reserve it for a limited period—typically 35 days—within which the applicant must complete the company registration. The name reservation process typically takes around 3 to 5 working days.

Step 2: Submit documents before OCR

Once the company name has been reserved, the applicant must execute Application for Company Registration, Memorandum of Association (MOA), Articles of Association (AOA) and other necessary document and upload the same at the online portal of OCR.

Step 3: Documentation verification by OCR

After the required documents are submitted Office of the Company Registrar (OCR) verifies the documents submitted for the registration of the company.

Step 4: Approval of Company Registration

The Office of the Company Registrar (OCR) approves the company’s registration upon verifying the submitted documents and payment of the prescribed government fee. Once the fee has been paid, the company is successfully registered at the Office of the Company Registrar (OCR) which then issues the signed Memorandum of Association (MOA), signed Articles of Association (AOA), the company registration certificate, and other relevant document through online.

Step 5: Execution of the House Rent Agreement

Upon completion of company registration at the Office of the Company Registrar (OCR), the next step involves registering the business with the Inland Revenue Department (IRD) for tax purposes and with the concerned local government authority (ward office). To complete these registrations, the company must furnish proof of its registered office address, which is typically established through a House Rent Agreement or Lease Agreement executed between the company and the property owner.

Step 6: Tax registration at Inland Revenue Office

Once the rental agreement has been executed, the business may proceed with registration at the Inland Revenue Office. For tax registration, at least one shareholder must be physically present at the Tax Office to provide their biometric purpose.

Step 7: Business Registration at the concerned local government i.e. ward office

After completing business registration at the Tax Office, the business must also be registered with the relevant local authority (i.e., the ward office). At the ward office, the company is required to pay:

-

Business Registration Tax – an annual fee determined by the local government (tentatively NPR 10,000–15,000), which may vary depending on the nature of the company.

-

House Rental Tax – a monthly tax on the rental property, with a tentative rate of 7–10%.

Please note that both the business registration tax and rental tax may vary from municipality to municipality and are subject to change based on updates to the MUNICIPALITY’S FISCAL POLICIES.

06. Timeline for company registration

It shall take around 10 to 15 working days for the company registration process.

07. Licensing requirement

After the company registration process is completed, certain companies must obtain a license from the relevant licensing authority before commencing operations. The types of companies that require a license and their respective licensing bodies are listed on below table:

| S.N. | Business | License Authority |

|---|---|---|

| 1 | Banking and Financial Institutions | Nepal Rastra Bank (NRB) |

| 2 | Insurance Companies | Insurance Board |

| 3 | Tourism and Trekking Companies | Department of Tourism (DOT) |

| 4 | Hydropower Company | Department of Electricity Development (DoED) |

| 5 | Pharmaceutical Companies | Department of Drug Administration (DDA) |

| 6 | Seeds and Fertilizer Importing Company | Ministry of Agriculture and Livestock Development |

| 7 | Data Centers and Cloud Service Company | Department of Information and Technology (DoIT) |

| 8 | Business Related to Telecom | Nepal Telecom Authority |

08. Government fee

The government fee for company registration must be paid at the Office of the Company Registrar (OCR) based on the company’s authorized capital.

8.1 Government fee for the registration of the Private Limited Company

The government fee for the registration of the Private Company is enlisted below:

| S.N. | Authorized Capital | Government Fee |

|---|---|---|

| 1 | Upto NPR 1,00,000/- | NPR 1,000/- |

| 2 | From NPR 1,00,001/- to NPR 5,00,000/- | NPR 4,500/- |

| 3 | From NPR 5,00,001/- to NPR 25,00,000/- | NPR 9,500/- |

| 4 | From NPR 25,00,001/- to NPR 1,00,00,000/- | NPR 16,000/- |

| 5 | From NPR 1,00,00,001/- to NPR 2,00,00,000/- | NPR 19,000/- |

| 6 | From NPR 2,00,00,001/- to NPR 3,00,00,000/- | NPR 22,000/- |

| 7 | From NPR 3,00,00,001/- to NPR 4,00,00,000/- | NPR 25,000/- |

| 8 | From NPR 4,00,00,001/- to NPR 5,00,00,000/- | NPR 28,000/- |

| 9 | From NPR 5,00,00,001/- to NPR 6,00,00,000/- | NPR 31,000/- |

| 10 | From NPR 6,00,00,001/- to NPR 7,00,00,000/- | NPR 34,000/- |

| 11 | From NPR 7,00,00,001/- to NPR 8,00,00,000/- | NPR 37,000/- |

| 12 | From NPR 8,00,00,001/- to NPR 9,00,00,000/- | NPR 40,000/- |

| 13 | From NPR 9,00,00,001/- to NPR 10,00,00,000/- | NPR 43,000/- |

| 14 | Above NPR 10,00,00,000/- | NPR 30/- per 1 lakh capital |

8.2 Government fee for the registration of the Public Company

The government fee for the registration of the Public Company is enlisted below:

| S.N. | Authorized Capital | Government Fee |

|---|---|---|

| 1 | Upto NPR 1,00,00,000/- | NPR 15,000/- |

| 2 | From NPR 1,00,00,001/- to NPR 10,00,00,000/- | NPR 40,000/- |

| 3 | From NPR 10,00,00,001/- to NPR 20,00,00,000/- | NPR 70,000/- |

| 4 | From NPR 20,00,00,001/- to NPR 30,00,00,000/- | NPR 1,00,000/- |

| 5 | From NPR 30,00,00,001/- to NPR 40,00,00,000/- | NPR 1,30,000/- |

| 6 | From NPR 40,00,00,001/- to NPR 50,00,00,000/- | NPR 1,60,000/- |

| 7 | Above NPR 50,00,00,000/- | NPR 1,000/- per 1 crore capital |

09. Post-compliance

There are few compliances that needs to be completed after the incorporation of the company which are as follows:

9.1 Bank account opening

After the company is registered at Office of Company Registrar (OCR), local authority (ward office) and the Tax Office, the company can open the company bank account at any preferred bank for the financial transactions of the company.

9.2 Obtaining the Shareholder Registry

After the shareholder injects the capital into the company’s bank account, the company must submit the bank statement to the Office of the Company Registrar (OCR) to obtain the shareholder registry. Please note that the shareholder registry serves as the official shareholder certificate of the company.

9.3 Initial Three-Month Compliance at OCR

The following tasks must be completed within three months of incorporation of company to ensure compliance with the Companies Act of Nepal.

a. Registration of Office Address

Under Section 184 of the Companies Act, private companies, including FDI entities, are required to register their office address with the OCR within three months of incorporation. This submission must include contact details such as telephone, fax, and email. Any subsequent changes to the registered address must be promptly notified to the OCR to maintain accurate records.

b. Formation of the Board of Directors

Section 86 of the Companies Act mandates that private companies establish a Board of Directors in accordance with their Articles of Association (AOA) within three months of incorporation. Section 97 further stipulates that the AOA governs the procedures for board meetings. The appointment of directors must be documented in meeting minutes, which should be retained as part of the company’s official records.

c. Appointment of an Auditor

As per Section 110 of the Companies Act, every private company must appoint an auditor. Section 111 specifies that the auditor is selected based on the Memorandum of Association (MOA), AOA, or a shareholder consensus. In the absence of such an agreement, the auditor is appointed at a general meeting. The OCR must be notified of the auditor’s appointment within 15 days, and the initial auditor serves until the company’s first Annual General Meeting (AGM).

9.4 Annual Compliances

Companies are required to convene their first AGM within one year of incorporation, submitting the following documents to the OCR:

Details of the AGM, confirming adherence to the Companies Act.

-

Audited financial statements and an audit report for the fiscal year.

-

From the second year onward, AGMs must be held annually, with annual reports submitted to the OCR within six months of the fiscal year-end (typically June or July).

10. Protection of brand of company

Although the company name is reserved with the Office of the Company Registrar (OCR), this does not provide full protection. To obtain exclusive rights to the brand or company name, applicants can apply for trademark registration at the Department of Industry (DOI).

Further details on trademark registration can be found at the following link:

Trademark Registration in Nepal

Date of Publication: October 29 , 2025

Disclaimer: . This article published on website of the law firm is just for information purpose only. It shall not be taken as the legal advice, advertisement, personal communication, solicitation or inducement. Bhandari Law and Partners or any of the team members of the firm shall not be liable for the consequence arising of the information provided. As the factual situation may be different on your case, thereof if you need further legal advice on the subject matter, please Contact Us.

Related Professionals:

Frequently Asked Question

For quick legal assistance:

You can directly call to our legal expert: +977-9808811027

Even can call or drop a text through What’s app , Viber, Telegram and We Chat at the same number.

Also can do email on : info@lawbhandari.com

contact us

Phone :,

,Connect with our professional lawyers in Nepal :

Follow Our Law Firm on Social Media :