Table of content

-

How to start a company in Nepal by foreign investor?

01. Introduction

This article provides a quick overview of the detailed procedure for starting a company in Nepal by the Foreign Investor.

02. Permissibility of Business

Foreign Investment is not permitted in all sectors of Nepal. Therefore, before starting a business, a foreign investor must first determine whether the proposed business activity is open to foreign investment.

For a business to be eligible for foreign investment in Nepal, the following two conditions must be satisfied:

1st Condition: Exclusion from Negative List

The proposed activity must not fall under the restricted sectors listed in the Foreign Investment and Technology Transfer Act, 2019 (FITTA). The restricted Industries include:

1. Poultry farming, fisheries, bee-keeping, fruits, vegetables, oil seeds, pulse seeds, milk industry and other sectors of primary agro-production,

2. Cottage and small industries,

3. Personal service business (hair cutting, tailoring, driving etc.),

4. Industries manufacturing arms, ammunition, bullets and shell, gunpowder or explosives, and nuclear, biological and chemical (N.B.C.) weapons; industries producing atomic energy and radio-active materials,

5. Real estate business (excluding construction industries), retail business, internal courier service, local catering service, moneychanger, remittance service,

6. Travel agency, guide involved in tourism, trekking and mountaineering guide, rural tourism including homestay,

7. Business of mass communication media (newspaper, radio, television and online news) and motion picture of national language,

8. Management, account, engineering, legal consultancy service and language training, music training, computer training, and

9. Consultancy services having foreign investment of more than fifty-one percent

10. Ride sharing having foreign investment of more than Seventy percent.

2nd Condition: Classification as an "Industry" (Positive List)

The proposed business activity must be qualified as an "industry" under the Industrial Enterprises Act, 2020.

03. Minimum investment amount

Before making an investment in Nepal, foreign investor should also take consideration of the minimum investment requirement. The minimum investment threshold for foreign investment company is NPR 2,00,00,000 ( 20 Million Nepalese Rupees, approximately USD 145,000.

However, pursuant to the Nepal Gazette notification dated October 2, 2023, the minimum investment threshold has been waived for companies operating in Information Technology (IT) Sector.

04. Capping of Foreign Investment

Foreign investors can invest 100% of ownership in local subsidiary companies. However, for few sectors, the domestic law restricts investment through investment capping which are as mentioned:

| Sector | Investment Percentage / Ratio |

|---|---|

| Telecommunication | 80% |

| Banking and Financial Institution | Minimum 20% and Maximum 85% |

| Insurance Companies | 80% |

| Consultancy Business | 51% |

| Ride Sharing Business | 70% |

| International Air Services | 80% |

| Domestic Air Services | 49% |

| Training Institutions (aviation-related) | 95% |

| Maintenance Institutions | 95% |

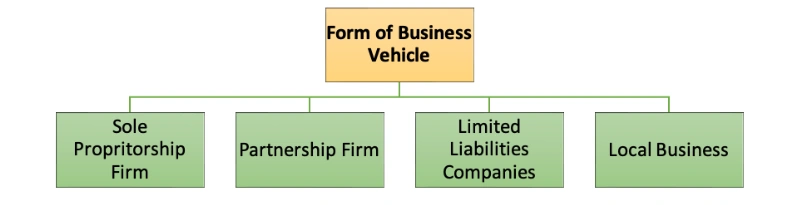

05. Determination of the appropriate business vehicles

There are different forms of business vehicles through which business can be established in Nepal. The major forms of business vehicles are as mentioned.

For foreign direct investment (FDI) companies, registration is restricted to Limited Liability Companies, primarily Private Limited Companies. The Department of Industry (DOI) does not permit FDI companies to choose any other form of business vehicle.

06. Prerequisites for formation of the FDI company in Nepal

6.1 Confirmation of Company Name

Before registering a company, the applicant must first obtain approval for the proposed company name. The name must consist of two or more words and must not be identical to that of an existing company. Therefore, the applicant should select a unique and appropriate name before proceeding with registration.

Before finalizing the name of the company, investors should also verify the availability of the corresponding domain name, as most shareholders prefer to develop the company’s website under the same name. It is equally important to conduct a trademark search with the Department of Industry (DOI) to ensure that the proposed name or logo has not already been registered by another entity. Taking these precautionary steps will help secure the company’s brand identity and prevent potential legal disputes or reputational risks in the future.

6.2 Confirmation on Company Registered Address

The applicant must determine and confirm the company’s official address prior to registration, as this address is required to be incorporated in both the Memorandum of Association (MOA) and Articles of Association (AOA). The chosen address serves as the company’s principal place of business and will be used for all official correspondence and regulatory communications. Furthermore, the company must be registered with the local government authority (i.e., the respective ward office) based on this address, followed by obtaining a tax registration certificate from the Inland Revenue Department (IRD) corresponding to the same jurisdiction. It is advisable to select a stable and accessible location for the company’s registered office, as any subsequent change in address will necessitate a formal amendment to the corporate documents and notification to the concerned authorities

6.3 Determination of Objective of Company

For a foreign direct investment (FDI) company, the Department of Industry (DOI) permits only a single business objective. Multiple objectives are not allowed for FDI companies and the proposed objective must strictly align with the sector approved for investment.

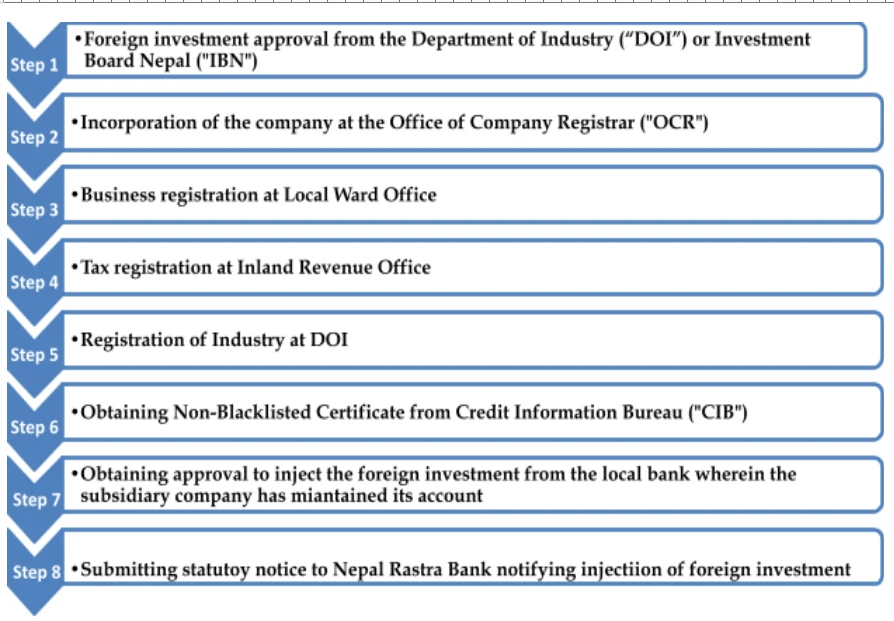

07. Process and timeline of establishment of FDI company

The process for establishing an FDI company in Nepal involves the following steps:

Step 1: Foreign investment approval from the Department of Industry (“DOI”)

The first step for establishing Foreign Direct Investment (FDI) Company in Nepal is to obtain approval from DOI. For this purpose, following documents and information are required depending on whether the investor is a legal entity or an individual:

a. Legal Entity as an Investor

-

Notarized Copy of Company Registration Certificate, Memorandum of Association, and Article of Association

-

Notarized Copy of Passport of Director and Shareholders of Company

-

Signed Company Profile of the investing company

-

Notarized Copy of passport/citizenship of investor’s authorized representative

-

Proposed Name of company and address of company in Nepal

-

Proposed Investment Amount

-

Project Report for the operation of a local subsidiary company

-

Financial Credibility Certificate (FCC) of Investor issued by a local bank in the home country

-

Notarized latest audit report of Investor Company

-

Resolution of the Investor for investing in Nepal

-

Power of attorney authorizing individuals to complete the approval and registration process on behalf of the Investor

-

Notarized Joint Venture Agreement in case of two or more than two investor

-

Additionally, if the investor company is owned by another company, then the documents of the ultimate beneficiary company are also required

b. For Individual as an Investor

-

Notarized Copy of Passport of Individual Investor/s

-

Bio Data in case of an Individual Investor/s

-

Proposed Name of Company and address of company in Nepal

-

Proposed Investment Amount

-

Project Report for the operation of a local subsidiary company

-

Financial Credibility Certificate (FCC) of Investor issued by a local bank in the home country

-

Power of attorney authorizing individuals to complete the approval and registration process on behalf of the Investor

-

Notarized Joint Venture Agreement in case of two or more than two investor

Based on the provided documents, the project report and other necessary filings are drafted and shared with the client by email for execution. The client is required to print, execute, and notarize the necessary documents and courier the originals to Nepal. Upon receipt of the executed documents, the FDI application is filed with the Department of Industry (DOI). For certain industries, approval is granted through the Automatic Route, which allows for expedited processing once the application and required documents are filed online.

Timeline for FDI Approval:

-

Automatic Route Industries (e.g., Energy Based Industries, Infrastructure Based Industries, Tourism Industries, ICT Industries, Service Based Industries and Manufacturing Industries): Approval is typically granted within 1-2 days working days of filing the complete application.

-

Non-Automatic Route Industries: Approval is generally granted within 10-15 working days.

Step 2: Incorporation of the company at the Office of Company Registrar ("OCR")

After the Foreign Investment is approved, the company can be registered with the Office of Company Registrar (OCR) as a private limited under the Companies Act, 2006. The required documents MOA, AOA and the application shall be drafted during the time of incorporation and can be executed remotely (no need to courier the original documents). The executed document along with the application must be uploaded at the online portal of OCR. The OCR approves the company’s registration upon verifying the submitted documents and payment of the prescribed government fees.

Rate of Government fee for incorporation of FDI Company in Nepal:

| S.N. | Particulars | Rate of Government Fee |

|---|---|---|

| 1 | Government fee for Company Registration at the Office of the Company Registrar | Depends upon the authorized capital of the company. The following fees must be paid before OCR registration: 1. For authorized capital of Rs. 1,00,001/- to Rs. 5,00,000/- → USD 34 2. For authorized capital of Rs. 5,00,001/- to Rs. 25,00,000/- → USD 72 3. For authorized capital of Rs. 25,00,001/- to Rs. 1,00,00,000/- → USD 120 4. For authorized capital of Rs. 1,00,00,001/- to Rs. 2,00,00,000/- → USD 142 and so on... |

| 2 | Business Registration at Ward Office | USD 100–120 (Fees vary by local level and may change each fiscal year.) |

| 3 | House Rent Tax (6-Month Advance Payment Required) | 10% of monthly house rent amount |

| 4 | Guarantee amount to be deposited at the Department of Industry at the time of issuance of foreign investment approval | USD 180 |

Timeline: The company incorporation process may take approximately 15- 20 working days.

Step 3: Business registration at Local Ward Office

Once a company is incorporated at Office of Company Registrar, it must also be registered as a business at the local level government, i.e., ward office corresponding to the company’s registered address. To complete these registrations, the company must furnish proof of its registered office address, which is typically established through a House Rent Agreement or Lease Agreement executed between the company and the property owner.

Timeline: 2-3 working days.

Step 4: Tax registration at Inland Revenue Office and Opening bank account

Once the company is registered at the local level, it must be registered at the Inland Revenue Office (IRO) corresponding to its registered address to obtain a Permanent Account Number (PAN) or, where applicable, a Value Added Tax (VAT) registration certificate.

As per Rule 6 of the Value Added Tax (VAT) Rules, 2053, VAT registration is mandatory for the following businesses:

-

Businesses dealing in goods with an annual turnover exceeding NPR 5 million.

-

Businesses engaged in services or mixed supply of goods and services with an annual turnover exceeding NPR 2 million.

-

Businesses dealing in specific goods and services prescribed by law, irrespective of turnover.

If the investor is an individual, they must personally visit the Inland Revenue Office (IRO) to obtain personal PAN and for biometric verification. An individual investor cannot authorize another person to complete this process on their behalf.

-

In the case of a corporate entity as an investor, the company may appoint one of its directors to be physically present at the IRO to complete the required procedures.

Once the business tax certificate is obtained, the company becomes eligible to open a bank account in Nepal.

Timelines:

-

Tax Registration: 1-2 working days.

-

Bank account opening: 3-4 working days

Step 5: Registration of Industry at Department of Industry (DOI)

For the registration of the company as an Industry under the Industrial Enterprise Act, 2020, an application must be submitted to the Department of Industry (DOI) along with all the required documents. Upon verification of the documents and completion of the approval process at various stages, the DOI requires the company to deposit NPR 20,000 as the bank guarantee. Following final verification, the DOI issues Industry registration Certificate

Timeline: 4-5 weeks

Step 6: Obtaining Non-Blacklisted Certificate from Credit Information Bureau ("CIB")

As per the legal requirement DOI and NRB check whether such investor is blacklisted in Nepal or not. For the same it is necessary to apply for the non blacklist certificate from the Credit Information Bureau (CIB).

Timeline: It shall take timeline of 2 to 3 workings days for receiving the certificate.

Step 7: Submitting statutory notice to Nepal Rastra Bank (NRB) notifying injection of foreign investment

Before injecting the investment amount, a statutory notice must be submitted to NRB stating that the Company is bringing in FDI, along with the company incorporation documents. Based on the submitted documents, the authorities will issue a certified letter acknowledging the notification. This step is crucial because without notifying NRB prior to injection of investment amount, the amount will not get recognized as investment amount.

Key Requirements for transfer of investment amount:

-

Funds must be transferred via SWIFT from the investor’s personal bank account maintained outside Nepal

-

The SWIFT transfer message (remark) must clearly state: “Foreign Investment”

Timeline: 3-4 working days.

Total Time period for the entire process of establishment of FDI Company

The incorporation of a company through foreign investment typically takes tentative 2 to 3 months after submitting the required documents.

08. Sector Approval

Certain regulated businesses are also subject to additional business specific approvals or licenses for the commencement of their business activities even after getting FDI approval. Licensing/Approval requirement depends on the nature of business of company. Following are some business which requires additional specific approval before commencement of business activities:

| S.N. | Business | License Authority |

|---|---|---|

| 1 | Banking and Financial Institutions | Nepal Rastra Bank (NRB) |

| 2 | Insurance Companies | Insurance Board |

| 3 | Tourism and Trekking Companies | Department of Tourism (DOT) |

| 4 | Hydropower Company | Department of Electricity Development (DoED) |

| 5 | Pharmaceutical Companies | Department of Drug Administration (DDA) |

| 6 | Seeds and Fertilizer Importing Company | Ministry of Agriculture and Livestock Development |

| 7 | Data Centers and Cloud Service Company | Department of Information and Technology (DoIT) |

| 8 | Business Related to Telecom | Nepal Telecommunications Authority |

09. Post registration compliance

a. Initial Compliance at OCR

After the company is incorporated by the Office of the Company Registrar (OCR), the company within the first three month of incorporation shall provide the information of address, appointment of the auditors and the formation of the Board of Directors in accordance with section 92 and section 184 of the Company Act, 2063 (2006).

b. Inflow Certificate from the Bank

Once the company submits the statutory notice to the Nepal Rastra Bank (NRB) the investors can inject the investment amount to the local bank in company’s bank account. After the Investment amount is injected in the company’s bank account, the bank request for the required documents for the issuance of the Inflow Certificate.

c. Share distribution and Shareholder’s Registry

After the bank provides the inflow certificate, we can distribute the company share to the shareholders and submit the documents to the Office of the Company Registrar (OCR). The OCR issues certified the Share Registry. Share Registry is provided by the OCR as certification to the shares owned by the shareholders.

d. Recording of the Foreign Investment at the NRB

Additionally, after the above compliance are fulfilled is completed, recording must be done of the Foreign Investment amount along with submission of the required documents like Inflow Certificate, Share Registry and other company details. Nepal’s Foreign Investment and Technology Transfer Act requires foreign investments to be registered with the NRB to ensure they adhere to legal and regulatory frameworks. This helps maintain transparency and accountability.

e. Annual OCR Compliance

Companies are required to convene their first AGM within one year of incorporation, submitting the following documents to the OCR:

-

Details of the AGM, confirming adherence to the Companies Act.

-

Audited financial statements and an audit report for the fiscal year.

From the second year onward, AGMs must be held annually, with annual reports submitted to the OCR within six months of the fiscal year-end (typically June or July).

f. Labour Law Compliance

Compliance with Nepal’s labor laws requires the preparation of a company handbook and the execution of employment agreements with staff to ensure adherence to employment regulations. The Company further need to be enrolled in Social Security Fund which is contribution based social security scheme.

g. Industry Operation and Extension

FDI companies must commence operations within one year of industry registration with the Department of Industry. Prior to commencing operations, at least 70% of the authorized capital must be injected. The issuance of the first invoice marks the start of operations, and companies must notify the Department of Industry within 30 days of this event. Non-compliance may result in fines.

If operations cannot commence within one year, companies must apply for an extension at least one month prior to the expiry of the industry registration. And Industry Operation Annual Report has to be submitted every year after the industry commencement fiscal year.

10. Timeline for injecting the foreign investment amount in Nepal

FERA has categorized 3 stages of timeline to inject the foreign investment amount. The schedule of investment as mentioned:

| Stages | Details | Percentage of Injection of Investment |

|---|---|---|

| Stage I | Within 1 year of receiving the investment approval (depends on the amount of investment) | |

| Minimum investment amount i.e. NPR 20 million | 25% | |

| 20 to 250 million NPR | 15% | |

| 250 million to 1000 million NPR | 10% | |

| 1000 million NPR and more | 5% | |

| Stage II | When the company starts production or begins commercial transactions | Up to 70% of the investment amount |

| Stage III | After 2 years of production or commencement of transactions | Remaining 30% of the investment amount |

10. Repatriation of foreign investment in Nepal

A foreign investor is allowed to repatriate the following:

-

earnings through dividend or through sale proceeds against investment in shares,

-

Compensation and Indemnity,

-

Sale Proceeds upon Share Transfer,

-

Returns of Capital at the Time of Liquidation,

-

Technology transfer fees, royalty and license fees that have been earned through technology transfer and

-

Lease rent under lease financing.

The investor has obligation to show that all local subsidiary company have complied all the laws, obtained all the necessary approval, pay tax and compiled with all the obligations before repatriation. Approval from DOI or IBN and NRB approval is required before repatriation. Investor can repatriate the investment and earning in the same currency or in other convertible foreign currency.

Date of Publication: October 29, 2025

Disclaimer: . This article published on website of the law firm is just for information purpose only. It shall not be taken as the legal advice, advertisement, personal communication, solicitation or inducement. Bhandari Law and Partners or any of the team members of the firm shall not be liable for the consequence arising of the information provided. As the factual situation may be different on your case, thereof if you need further legal advice on the subject matter, please Contact Us.

Related Professionals:

Frequently Asked Question

For quick legal assistance:

You can directly call to our legal expert: +977-9808811027

Even can call or drop a text through What’s app , Viber, Telegram and We Chat at the same number.

Also can do email on : info@lawbhandari.com

contact us

Phone :,

,Connect with our professional lawyers in Nepal :

Follow Our Law Firm on Social Media :