Table of content

-

Foreign Loan Approval Process in Nepal: Key Legal Highlights

01. Background of Foreign Loan in Nepal

This article covers details regarding the applicable law and procedure related to obtaining foreign loans in Nepal.

02. Governing Law

Pursuant to Section 12 of the Foreign Exchange (Regulation) Act 1962 (2019) (“FERA 1962”), the Nepal Rastra Bank (“NRB”) is empowered to issue directives, bylaws, or notices to implement the provisions of the Act. Exercising this authority in accordance with Sections 10A, 10B, and 10C of FERA 1962, the Central Bank has issued “Foreign Investment and Loan Management Bylaws 2021 to regulate the foreign loan in Nepal.

03. Governing Authority

Nepal Rastra Bank the central bank of Nepal, is the governing authority that provides the approval of foreign loans in Nepal.

04. Obtaining the Foreign Loan in Nepal

Nepali individuals, companies, banks, financial institutions, and other organized entities must obtain prior approval from Nepal Rastra Bank before taking foreign loans, unless exempted by law. The loan must not be for industries restricted to foreign investment under the Foreign Investment and Technology Transfer Act, 2019.

The application for the foreign lone along with the required documents has to be submitted before the NRB, upon the review NRB shall decide and respond within 15 working days.

05. Eligibility of Borrower and Lender for Foreign Loan (Applicable for Entities)

The eligibility and details required for the foreign loan approval for entities of Nepal is mentioned below:

| S.N. | Eligible Borrower | Eligible Foreign Lender | Terms and Conditions of Foreign Loan | Loan Application to be Submitted to |

|---|---|---|---|---|

| 1 | Firm, company, industry or institution (except licensed bank and financial institution) | Foreign banks and financial institutions, Government/Inter-Government owned Development Finance Institutions (DFIs) | Interest rate: - Up to 1 Year Benchmark Interest Rate + 6% p.a. From India in INR: - MCLR + 2% p.a. - If eligible: MCLR + 2% p.a. or average MCLR + 2% p.a. From China in CNY: Up to 1 Year LPR + 2% p.a. | Department |

| 2 | Firm, company, institution, and Nepali citizen | Relatives abroad, other individual, non-resident Nepali or association/institution | Limit: Up to 1 million USD / 100 million INR Interest rate: - Benchmark Interest Rate + 2% p.a. - From India: Avg. One Year MCLR - From China: Up to One Year LPR Repayment period: 1 year minimum Purpose: Sector not prohibited by law (not real estate or securities trading). | Department |

| 3 | Industry/company with foreign investment | Foreign investor of the company/industry (including the parent company/group of companies) | Limit: Up to 2 times paid-up capital; up to 5 times if: Loan from parent/group is outstanding (avg. interest applies). Max interest rate: Not exceed 50% of premium rate without benchmark. Interest: - Free or Benchmark + 3.5% p.a. - From India: Avg. One Year MCLR - From China: Up to One Year LPR Purpose: For designated sector Approval of foreign investment authority Certified loan source | Unit |

| 4 | Industry/company with foreign investment (except licensed bank and financial institution) | Foreign Financial Institution, Government/Inter-Government owned Development Finance Institutions (DFIs) | Purpose: Project loan or financing. Recommendation from Government of Nepal Interest Rate: As mentioned in S.N. 1 | Unit |

| 5 | Infrastructure Development | Parent company/group of companies | Interest rate: Non-interest bearing | Department |

| 6 | "A", "B", "C" and "D" class bank and financial institution, and infrastructure development bank | Indian bank and financial institution, Government/Inter-Government owned Development Finance Institutions (DFIs) | Limit: Up to 100% of core capital Interest: One Year MCLR + 0.5% p.a. Repayment: 6 months to 15 years Purpose: Energy, tourism, infrastructure, etc. (excluding real estate) Collateral: No collateral or bank guarantee allowed | Department |

| 7 | "A", "B", "C" and "D" class bank and financial institution, and infrastructure development bank | Foreign banks and financial institutions, foreign pension funds, hedge funds, Government/Inter-Government owned DFIs | Limit: Up to 100% of core capital Interest: - Benchmark Rate + 4.5% p.a. - From China: LPR + 1% p.a. Repayment: 6 months to 15 years Purpose: Energy, infrastructure, tourism, etc. (excluding real estate) Collateral: No collateral or bank guarantee allowed | Department |

| 8 | Public limited company incorporated in Nepal or organized institution authorized to issue securities | Foreign purchasers of foreign capital market (as per section 11 of Foreign Investment and Technology Transfer Act, 2019) | Through issuance of bonds, debentures or other securities. Recommendation of Securities Board. | Unit |

Note:

Kindly note that “Unit” defined above means the Foreign Exchange Facilitation Unit under the Foreign Exchange Management Department of the Nepal Rastra Bank at One Stop Services Center established as per the Section 37 of the Industrial Enterprises Act, 2020., whereas “Department” means Nepal Rastra Bank, Foreign Exchange Management Department.

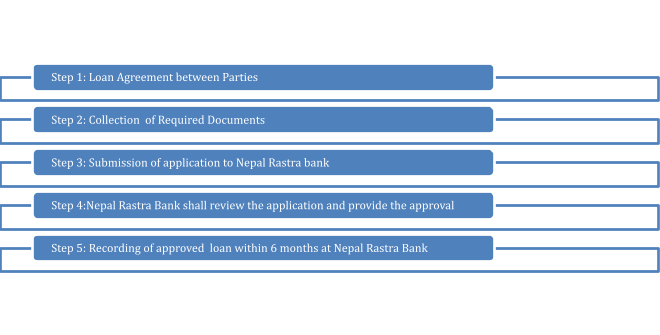

06. Procedure for Obtaining the Foreign Loan in Nepal

Following procedure has to be followed for obtaining the foreign loan in Nepal:

- Step 1: Loan Agreement between Parties

- Step 2: Collection of Required Documents

- Step 3: Submission of application to Nepal Rastra Bank

- Step 4: Nepal Rastra Bank shall review the application and provide the approval

- Step 5: Recording of approved loan within 6 months

07. Tentative Timeline for Foreign Loan Approval

Once all the required documents are collected and the application is submitted to NRB, the entire foreign loan approval process typically takes around 20 to 30 days.

08. Documents Required for Foreign Loan Approval

The Document required for foreign loan approval can be categorized into 3 (three) types based on parties involved.

Document required for both contracting parties of Loan Agreement

Document required for Lender

Document required for Borrower

A. Document required for both contracting parties of Loan Agreement

| S.No. | Documents |

|---|---|

| 1 | Certified copy of the loan agreement between the lender and the borrower |

| 2 | Commitment letter regarding inflow of the approved loan through banking system |

| 3 | Document stating the need for the loan from abroad and the plan for loan utilization |

| 4 | Document showing the basis for loan repayment including exchange risk |

| 5 | Timeline schedule for loan disbursement and repayment |

| 6 | A self-declaration of no foreign currency misappropriation and compliance with anti-money laundering, anti-terrorism financing, and applicable laws |

| 7 | Other necessary documents as specified by the Nepal Rastra Bank |

B. Document required for Lender

| S.No. | Documents related to lender (Institution) | Remarks |

|---|---|---|

| 1 | Certified copy of the institution's registration certificate | Notary |

| 2 | Certified documents disclosing the beneficial owner | Notary |

| 3 | Certified copy of the decision of the board of directors or authorized personnel regarding loan disbursement | Notary |

| 4 | Certified copy of the latest audited financials | Notary (applicable only if investment amount is less than or equal to USD 1 million or its equivalent in foreign currency) |

| 5 | Certified copy of documents related to the source of the foreign loan | Notary |

C. Document required for Borrower

| S.No. | Documents related to borrower | Remarks |

|---|---|---|

| 1 | Copy of institution's registration certificate | |

| 2 | Copy of business operation license (if applicable) | |

| 3 | Copy of permanent account number certificate | |

| 4 | Copy of memorandum of association and articles of association | Not required for institutions listed in the stock market |

| 5 | A copy of the decision of the Board of Directors or the authorized personnel to avail loan | |

| 6 | Copy of the latest audited financials | Not required for institution listed in stock market |

| 7 | Copy of the latest tax clearance certificate/submission of tax returns | Not required for institution listed in stock market |

| 8 | Evidence of not being in the blacklist of the Credit Information Bureau | Without elapse of six months while submission of the application with all documents |

09. Recording of foreign Loan

To record the amount of a foreign loan remitted into Nepal, the borrower must submit an application to NRB within 6 (six) months of the remittance, along with the necessary documents and prescribed form.

| S.N. | Documents |

|---|---|

| 1. | Certified copy of the loan agreement between the lender and the borrower |

| 2. | Commitment letter regarding inflow of the approved loan through banking system. |

| 3. | Document stating the need for the loan from abroad and the plan for loan utilization. |

| 4. | Document showing the basis for loan repayment including exchange risk |

| 5. | Timeline schedule for loan disbursement and repayment. |

| 6. | A self-declaration of no foreign currency misappropriation and compliance with anti-money laundering, anti-terrorism financing, and applicable laws. |

| 7. | Other necessary documents as specified by the Nepal Rastra Bank. |

10. Foreign Currency Conversion Facility for Repayment of Foreign Loans

For foreign loans approved and recorded by NRB along with an approved repayment schedule, borrowers can obtain foreign currency exchange from banks and financial institutions to repay principal and interest without requiring additional NRB approval. To access this facility, borrowers must submit an application with documents. The bank must respond in writing within seven working days. Repayment must be made to the same foreign lender and country from which the loan was received, ensuring the funds are deposited into the lender’s bank account.

Date of Publication: May 26, 2025

Disclaimer: Bhandari Law and Partners is one of the leading law firm in Nepal with team of best professional lawyers in Nepal. This article published on website of the law firm is just for information purpose only. It shall not be taken as the legal advice, advertisement, personal communication, solicitation or inducement. Bhandari Law and Partners or any of the team members of the firm shall not be liable for the consequence arising of the information provided. As the factual situation may be different on your case, thereof if you need further legal advice on the subject matter, please Contact Us.

Related Professionals:

Frequently Asked Question

For quick legal assistance:

You can directly call to our legal expert: +977-9808811027

Even can call or drop a text through What’s app , Viber, Telegram and We Chat at the same number.

Also can do email on : info@lawbhandari.com

contact us

Phone :,

,Connect with our professional lawyers in Nepal :

Follow Our Law Firm on Social Media :