Table of content

-

Direct Selling License Obtaining Procedure in Nepal: Quick Guide

01. Background of Direct Selling License in Nepal

Direct selling is a method of selling products and services directly to consumers, bypassing traditional retail stores and intermediaries. Direct Sales of Goods (Management and Regulation) Act, 2074 defined, "Direct sale or distribution of goods" as the act of the licensee selling or distributing the goods available from a manufacturing company or distribution company directly to the consumer.

02. Governing Law of Direct Selling in Nepal

Following are the governing laws for direct selling license in Nepal:

a. Direct Sales of Goods (Management and Regulation) Act, 2017 (2074) (the “Direct Selling Act”)

b. Direct Sales of Goods (Management and Regulation) Regulations, 2019 (2076) (“Direct Selling Regulation”)

c. Directive Governing Direct Selling Business, 2022 (2078) (“Direct Selling Directive”)

03. Governing Authority

The Department of Commerce, Supplies and Consumer Protection (the "DCSCP") is the governing authority for Direct Selling business in Nepal.

04. Process of obtaining Direct Selling License in Nepal

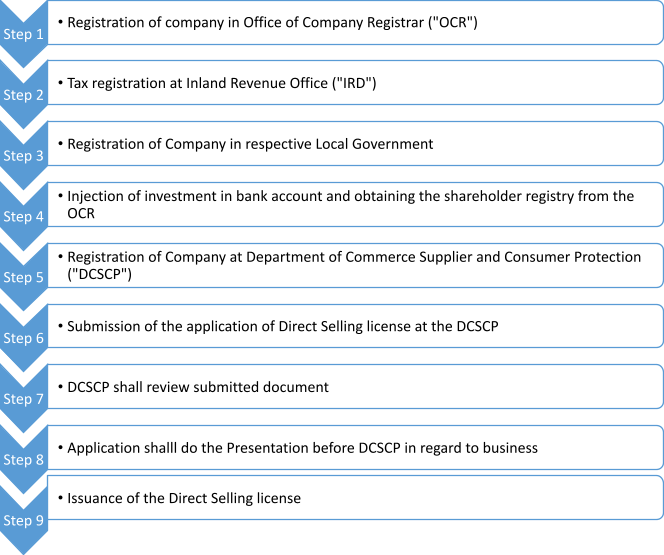

Following steps should be followed to obtain Direct Selling License in Nepal :

Step 1: Registration of company in Office of Company Registrar ("OCR")

Step 2: Tax registration at Inland Revenue Office ("IRD")

Step 3: Registration of Company in respective Local Government

Step 4: Injection of investment in bank account and obtaining the shareholder registry from the Step 4 OCR

Step 5: Registration of Company at Department of Commerce Supplier and Consumer Protection Step 5 ("DCSCP")

Step 6: Submission of the application of Direct Selling license at the DCSCP

Step 7: DCSCP shall review submitted document

Step 8: Application shalll do the Presentation before DCSCP in regard to business

Step 9: Issuance of the Direct Selling license

05. Applicable fee and bank guarantee

The applicable government fees that need to pe provided while obtaining the license is as mentioned:

| S.N. | Government fee applicable for the Direct Selling License | Rate (NPR) |

|---|---|---|

| 1 | Direct Selling License fee | 0.2% of the Paid Up Capital |

| 2 | Bank guarantee while obtaining license | 50% of the Paid Up Capital |

| 3 | License renewal Fee | 0.1% of the Paid Up Capital |

06. Documents required for obtaining direct selling license in Nepal

Following document are required to be submitted to the DCSCP for obtaining the Direct Selling License in Nepal:

| SN | DOCUMENTS |

|---|---|

| 1 | Application, Power of Attorney and Board resolutions |

| 2 | Detailed Proposed Project Report and board resolution regarding the approval of the such report |

| 3 | Copy of certificate of Nepalese citizenship of the director |

| 4 | Copy of company registration certificate, Memorandum and Articles of Association of Company |

| 5 | Share Registry and OCR updated letter of the Company |

| 6 | VAT registration Certificate, latest audit report and tax clearance certificate |

| 7 | Detailed action plan related to direct sale of goods, dividend, commission distribution plan |

| 8 | Detail price of product (both foreign and domestic product) to be sold through direct selling |

| 9 | In terms of goods that can be produced in Nepal or not, the quality assurance certificate from respective regulatory body |

| 10 | Trademark of the Products to be sold through direct selling |

| 11 | A self-declaration of not being blacklisted by the directors |

| 12 | Number of Seller and Distributors |

| 13 | Exim Code Certificate (If company does imports of products from foreign jurisdiction) |

| 14 | Code of conduct of staff of company (HR policy) |

| 15 | Clear |

| 16 | Commitment and agreement letter from the company, or firm producing the goods to supply the products for sale |

| 17 | Citizenship Copy of shareholder and directors |

| 18 | Copy of agreement between distributors and the Company as per the Schedule 4 of the Direct Selling Directives |

| 19 | Approval letter from Inland Revenue office for software billing |

| 20 | Software Details used for the billing of invoice |

07. Validity and renewal of the of the Direct Selling License in Nepal

Validity:

The Validity of the Direct Selling License is for (2) two years.

Renew:

60 days prior to the expiry of the license. If applied at least 15 days before the expiry of the license, renewal can be done with double the renewal fee.

08. Commission or Bonus:

The commission and bonuses for the direct seller or distributor must be determined in such a way that it does not exceed a maximum of forty-two percent of the selling price of the product. Here the "selling price" mean the price determined not exceeding the maximum retail price.

09. Products prohibited for the Direct Selling

Following products are prohibited to sell through the Direct Selling:

a. Medicines that are to be sold only upon a doctor's prescription as per prevailing laws,

b. Alcohol, tobacco products, and other items that may adversely affect consumer health,

c. Items claimed to be supernatural or imaginary, such as those related to witchcraft or similar unverified practices,

d. Products without a registered trademark,

e. Any other products restricted by prevailing laws or prohibited by the Government of Nepal through a notice published in the Nepal Gazette for export, import, or direct sale or distribution.

10. Requirements to obtain the Direct Selling License in Nepal

Basic Requirements before applying for a direct selling license are as follows:

a. Minimum paid-up capital of NPR 1 crore,

b. Business software or website must be developed,

c. At least 50% of domestic produced products must be sold,

d. Billing Software must be IRD-approved with backups in two separate locations in Nepal,

e. Trademark registration of each products intending to sell,

f. Commitment letter from product manufacturers for the regular supply,

g. Business must be insured,

h. Affiliation with the Social Security Fund (SSF).

Date of Publication: May 27, 2025

Disclaimer: This article published on website of the law firm is just for information purpose only. It shall not be taken as the legal advice, advertisement, personal communication, solicitation or inducement. Bhandari Law and Partners or any of the team members of the firm shall not be liable for the consequence arising of the information provided. As the factual situation may be different on your case, thereof if you need further legal advice on the subject matter, please Contact Us.

Related Professionals:

Frequently Asked Question

For quick legal assistance:

You can directly call to our legal expert: +977-9808811027

Even can call or drop a text through What’s app , Viber, Telegram and We Chat at the same number.

Also can do email on : info@lawbhandari.com

contact us

Phone :,

,Connect with our professional lawyers in Nepal :

Follow Our Law Firm on Social Media :