Table of content

-

BPO Company Registration in Nepal through FDI Route

01. Background for establishment of BPO Company in Nepal Through FDI Route

Business Process Outsourcing (BPO) refers to the delegation of specific business operations such as customer service, IT support, payroll processing, human resource management, finance, and accounting to external service providers. By outsourcing these non-core functions, companies can improve operational efficiency, reduce overhead costs, and concentrate on their primary business objectives.

In recent years, Nepal has emerged as a promising destination for BPO investment, particularly in the Information Technology (IT) and IT-enabled services sectors. This growth is largely driven by a combination of policy reforms, economic advantages, and an increasingly skilled workforce.

A key policy reform was introduced in the Fiscal Year 2023/24, when the Government of Nepal removed the minimum threshold requirement for Foreign Direct Investment (FDI) in the IT sector. This makes Nepal’s IT sector uniquely accessible, as the minimum investment requirement of NPR 20 million still applies to other sectors. Furthermore, FDI in the IT sector now qualifies for automatic approval, making investment faster and more accessible.

Nepal also offers cost-effective labor, which is a major attraction for foreign companies looking to outsource business functions. In addition to affordable labor, the government provides various tax incentives and favorable regulatory conditions, making the BPO sector more competitive and investor-friendly. These factors together position Nepal as a strategic and cost-efficient location for establishing BPO operations, particularly for companies seeking to expand in South Asia.

Foreign investors can enter Nepal’s BPO sector by establishing local subsidiary, investing in an existing company, or establishing a branch office with approval from the Ministry of Information, Communication and Technology. However, branch offices face challenges in repatriating funds if they invoice Nepali clients. Therefore, establishing a local subsidiary is the most practical and preferred option.

02. Establishment of the BPO Company through foreign direct investment in Nepal.

2.1 Governing laws:

The matters relating to the establishment of B.P.O. Business in Nepal by foreign investors are governed by

| S.N. | Act | Year |

|---|---|---|

| 1 | Foreign Investment and Technology Transfer Act | 2019 |

| 2 | Industrial Enterprise Act | 2020 |

| 3 | Foreign Exchange (Regulation) Act | 1962 |

| 4 | The Companies Act | 2006 |

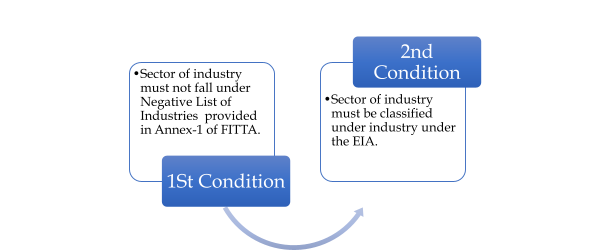

2.2 Permissibility

A foreign company desirous to invest in Nepal must invest in a permitted sector of “industry” in Nepal. The permissibility of foreign investment in Nepal is subject to the fulfillment of the following two conditions:

List and the Foreign Investment Act does not include it under the Negative List. Thus, the investor can apply for foreign investment approval to establish a company with the objective to operate BPO business with 100% foreign ownership in equity shares of the company or in Joint Venture (JV) with Nepalese/foreign investors.

03. Minimum Capital Requirement

Previously, a minimum capital of NPR 20 million (approximately USD 150,000) was required for each foreign investor to establish a company through foreign investment. However, as Business Process Outsourcing (BPO) is categorized under Information Technology Industries by the Industrial Enterprises Act, 2076, this requirement no longer applies. According to the Nepal Gazette published on 2 October 2023, there is no minimum capital requirement for companies operating in the IT sector.

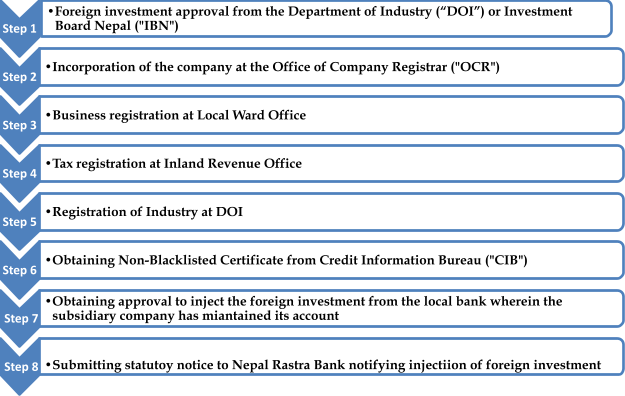

04. Registration process of BPO Company in Nepal through FDI

BPO Company Registration Process Step:

Step 1: Foreign investment approval from the Department of Industry (“DOI”) or Investment Board Nepal ("IBN")

Step 2: Incorporation of the company at the Office of Company Registrar ("OCR")

Step 3: Business registration at Local Ward Office

Step 4 : Tax registration at Inland Revenue Office

Step 5: Registration of Industry at DOI

Step 6: Obtaining Non-Blacklisted Certificate from Credit Information Bureau ("CIB")

Step 7: Obtaining approval to inject the foreign investment from the local bank wherein the subsidiary company has maintained its account

Step 8: Submitting statutory notice to Nepal Rastra Bank notifying injection of foreign investment

05. Tentative Time line for incorporation of Subsidiary BPO Company

The tentative timeline for the registration of FDI Company in Nepal shall takes about two to three (2 to 3) months from the date of submission.

06. Timeline for injection of Foreign Investment Amount

Foreign investors are required to bring following percentage of the FDI amount within 1 (one) year from the date of DOI approval.

| S.N. | FDI Approval Based on Investment Amount | % of Capital Injection |

|---|---|---|

| 1 | NPR. 20 million (approx. USD 150,000) | 25% |

| 2 | NPR. 20 million to NPR. 250 million (approx. USD 150,000 to USD 1.8 million) | 15% |

| 3 | NPR. 250 million to NPR. 1 billion (approx. USD 1.8 million to USD 8.5 million) | 10% |

| 4 | Above NPR. 1 billion (approx. USD 8.5 million) | 5% |

Notwithstanding the above, FITTA Regulation requires investors to bring in 70% of the total FDI amount before commercial operation of the company, and the remaining 30% within 2 (two) years thereafter.

07.

The lists of documents required for foreign investor are as follows:

| S.N. | Documents |

|---|---|

| 1 | Company incorporation certificate (if the company is an investor) |

| 2 | Memorandum of Association |

| 3 | Article of Association |

| 4 | Copy of passports of all the directors and shareholders of an investor |

| 5 | Copy of passport or citizenship of an investor's authorized representative |

| 6 | Project Report and schedule for investment |

| 7 | Financial Credibility Certificate ("FCC") |

| 8 | Latest financial statement |

| 9 | Board Resolution of the investor company (if the company is an investor) |

| 10 | Profile of the company or biodata of an individual investor |

| 11 | Power of attorney |

08. Tentative Government Fee

The tentative Government fee required for the establishment of BPO Company are as follows:

| S.N. | Particulars | Rate of Government Fee |

|---|---|---|

| 1 | Amount to be deposited at the Department of Industry while FDI approval | NPR. 20,000 (Approx. USD 150) |

| 2 | Government fee for the establishment of the Company | Depends upon the authorized capital of the company: - NPR 5,00,001 to 25,00,000 = NPR 9,500 - NPR 25,00,001 to 1,00,00,000 = NPR 16,000 - NPR 1,00,00,001 to 2,00,00,000 = NPR 19,000 - NPR 2,00,00,001 to 3,00,00,000 = NPR 22,000 - NPR 3,00,00,001 to 4,00,00,000 = NPR 25,000 - ...and so on |

| 3 | Business Registration at Ward Office (Local Government) | Approx. NPR 10,000 to NPR 20,000 (USD 75 to 150) (Subject to local government rates and annual revisions) |

| 4 | House Rent Tax (6 Month Advance Amount has to be paid) | 10% of House Rent Amount per month |

09. Tax Incentive for IT Company

Income Tax Act of Nepal has given some tax incentives for the IT businesses. The general rate of Income tax is Nepal is 25 %. The incentives are normally in the form of rebates in income tax rates.

| S.N. | Particulars | Effective Income Tax Rate |

|---|---|---|

| 1 | IT business providing direct employment to 100 or more Nepali citizens throughout the year | 22.5% |

| 2 | IT business providing direct employment to 300 or more Nepali citizens throughout the year | 20% |

| 3 | IT business providing direct employment to 500 or more Nepali citizens throughout the year | 18.75% |

| 4 | IT business providing direct employment to 1,000 or more Nepali citizens throughout the year | 17.5% |

| 5 | IT business providing direct employment to 100 or more Nepali citizens, with at least one-third women, dalits, or incapacitated | 20.25% |

| 6 | IT business providing direct employment to 300 or more Nepali citizens, with at least one-third women, dalits, or incapacitated | 18% |

| 7 | IT business providing direct employment to 500 or more Nepali citizens, with at least one-third women, dalits, or incapacitated | 16.875% |

| 8 | IT business providing direct employment to 1,000 or more Nepali citizens, with at least one-third women, dalits, or incapacitated | 15.75% |

| 9 | Export income earned in foreign currency from BPO, software programming, cloud services, etc. | 50% tax exemption on applicable income tax rate up to NFY 2084/85 (2027/28 AD) |

10. Post Investment Compliances for FDI Company

Following are the main compliances that FDI Company has to do after the FDI approval process:

a. Submission of 3 months compliance document before OCR,

b. Recording of investment at NRB,

c. Submit Annual Compliance Document at OCR,

d. Compliance with Companies Act, Labor Act, Tax Law and other applicable law of Nepal during the operation of the local subsidiary company.

11. Facilities Provided To Foreign Investors In Nepal

The following facilities are provided under for the foreign investor in Nepal

| S.N. | Particulars | Details |

|---|---|---|

| 1 | Land Ownership | Companies having foreign investment are considered local companies and can own private land in Nepal. |

| 2 | Business Visa for Individual Investors | Foreign individual investors can obtain a business visa as long as the investment is retained in Nepal. |

| 3 | Business Visa for Company Representatives | Representatives of foreign investor companies and their family members are eligible for business visas as long as the investment is retained. |

| 4 | Residential Visa | Provided to foreign investors and their family members who invest USD 1 million or more at once, valid as long as the investment is retained in Nepal. |

| 5 | Foreign Currency Accounts | Foreign investment companies and investors are allowed to open and operate foreign currency accounts and conduct foreign currency transactions. |

| 6 | Employment of Foreign Nationals | Allowed in highly technical or managerial roles if suitable Nepali citizens are not available. |

| 7 | Repatriation of Investment | Foreign investors have the right to repatriate their investment and earnings in convertible foreign currency. |

12. Protection Of Foreign Investment In Nepal

Nepal has signed six bilateral investment treaties (BIT) with the India, Finland, Mauritius, United Kingdom, Germany and France. Among which only four BITs are already in implementation. Nepal's BIT with India and Mauritius have not yet come into force.

BITs have incorporated the following principles: (i) National Treatment, (ii) MFN Treatment and (iii) Fair and Equitable Treatment for the protection of foreign investment. Same principle has also been recognized by FITTA.

13. Repatriation

A foreign investor is allowed to repatriate the following:

a. Earnings through dividend or through sale proceeds against investment in shares,

b. Compensation and Indemnity,

c. Sale Proceeds upon Share Transfer,

d. Returns of Capital at the Time of Liquidation,

e. Technology transfer fees, royalty and license fees that have been earned through technology transfer and

f. Lease rent under lease financing.

The investor has obligation to show that all local subsidiary company have complied all the laws, obtained all the necessary approval, pay tax and compiled with all the obligation before repatriation. Approval from DOI or IBN and NRB approval is required before repatriation. Investor can repatriate the investment and earning in the same currency or in other convertible foreign currency.

Date of Publication: 24 April 2025

Disclaimer: This article published on website is just for information purpose only. It shall not be taken as the legal advice, advertisement, personal communication, solicitation or inducement. Bhandari Law and Partners or any of the team members of the firm shall not be liable for the consequence arising of the information provided. As the factual situation may be different on your case, thereof if you need further legal advice on the subject matter, please Contact Us.

Related Professionals:

Frequently Asked Question

For quick legal assistance:

You can directly call to our legal expert: +977-9808811027

Even can call or drop a text through What’s app , Viber, Telegram and We Chat at the same number.

Also can do email on : info@lawbhandari.com

contact us

Phone :,

,Connect with our professional lawyers in Nepal :

Follow Our Law Firm on Social Media :